The Blockchain Center Abu Dhabi And Binance Report Highlights UAE’s Transition From Experimentation To National Blockchain Execution

The Blockchain Center Abu Dhabi has published a comprehensive report examining the United Arab Emirates’ progression from initial blockchain experimentation to large-scale, regulated implementation across finance, governance, and public-sector services.

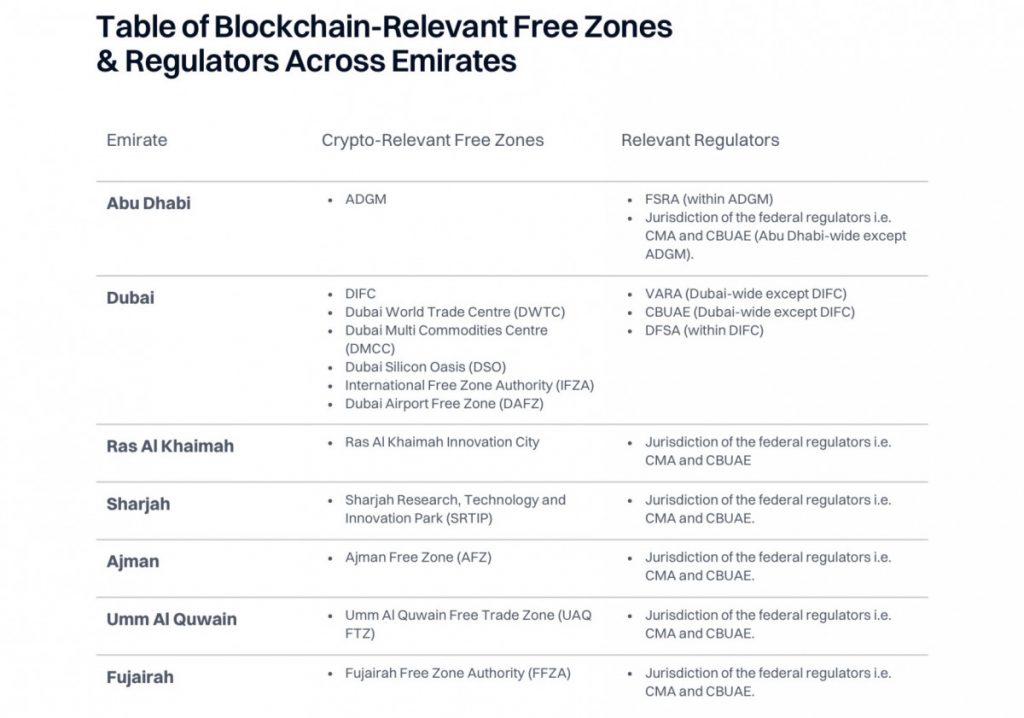

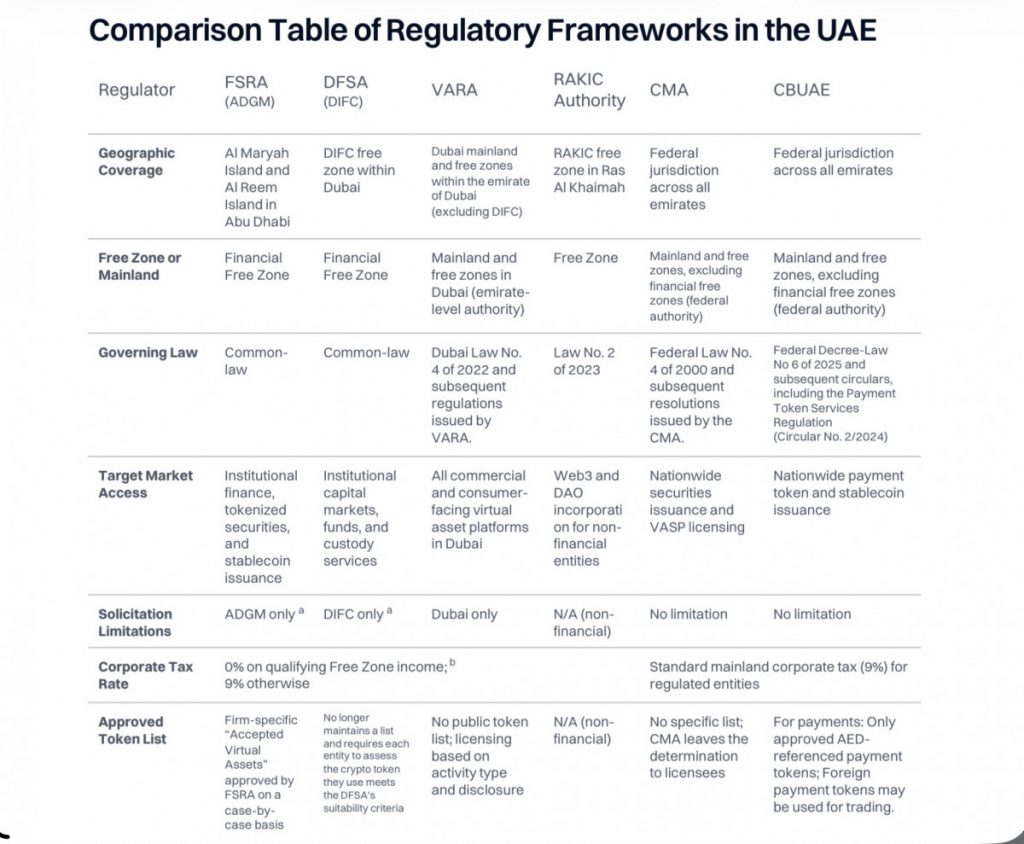

The report attributes the country’s institutional adoption of blockchain in payments, tokenization, custody, and market infrastructure to its layered regulatory framework, which has established blockchain as a foundational component of the national economy.

The study was co-authored with Binance, recognizing the company’s transition from a global cryptocurrency exchange to a provider of institutional-grade digital asset infrastructure both globally and within the UAE’s regulatory environment.

UAE Blockchain Ecosystem Matures: Participants Drive Institutional-Scale Adoption, Regulatory Clarity, And Multi-Billion-Dollar Deployments

The report notes that the UAE has entered a phase of execution defined by scale, regulatory clarity, and institutional deployment. Evidence of adoption is reflected in operational, regulated initiatives, including a national digital identity system serving 11 million users, multiple DFSA- and FSRA-approved stablecoins, a central bank digital currency in pilot with initial transactions completed, and real-world asset tokenization projects exceeding $4 billion in real estate alone.

These deployments are integrated into a payments and remittance ecosystem of significant scale, with domestic payment systems processing over AED 20 trillion in transfers during the first ten months of 2025, and the UAE ranking among the world’s largest sources of outbound remittances.

The research further highlights a structural transformation within the UAE’s blockchain ecosystem, shifting from early-stage startups to an institutional landscape that now includes regulated exchanges, custodians, payment providers, tokenization platforms, infrastructure vendors, enterprise solutions, banks, and multinational technology firms.

In the report blockchain is framed as critical national economic infrastructure, comparable to transformative technologies such as telecommunications and railways. Key live implementations include real-world asset tokenization, stablecoins and AED-backed tokenized deposits, payments and wholesale settlement platforms, as well as blockchain-based trade, logistics, and government services.

The UAE Pass digital identity system supports 11 million users with over 2.5 billion authentications, while sovereign and quasi-sovereign capital exceeding USD 2.5 trillion contributes to the scaling and compliance of blockchain initiatives.

Binance’s integration within the UAE’s institutional framework, as an ADGM FSRA-regulated entity, reflects the country’s emphasis on compliant, large-scale digital asset infrastructure. The 2025 USD 2 billion investment by MGX into Binance, conducted using regulated stablecoin infrastructure, further demonstrates the UAE’s commitment to institutional blockchain infrastructure.

The Blockchain Center Abu Dhabi And Binance Highlight UAE As A Global Leader Iin Institutional Blockchain Infrastructure

“Binance chose to partner on this research because we share the UAE’s vision of blockchain as a critical pillar of future economic infrastructure,” said Tarik Erk, Regional Head for MENAT and Senior Executive Officer, Abu Dhabi at Binance, to MPost.

“The country’s clear regulatory framework and focus on institutional-grade deployment align perfectly with our commitment to building secure, compliant, and scalable digital asset solutions. Collaborating with The Blockchain Center Abu Dhabi allows us to contribute meaningfully to the UAE’s transition from blockchain experimentation to execution at scale, reinforcing our dedication to supporting real-world use cases within a trusted, regulated environment,” he added.

The Blockchain Center Abu Dhabi and Binance report positions the UAE as a global reference point for institutional blockchain infrastructure, emphasizing how coordinated regulatory design and ecosystem alignment have enabled blockchain to function as production-grade infrastructure rather than a speculative technology.

The post The Blockchain Center Abu Dhabi And Binance Report Highlights UAE’s Transition From Experimentation To National Blockchain Execution appeared first on Metaverse Post.

Ayrıca Şunları da Beğenebilirsiniz

JPMorgan Chase: Circle faces "intense" competition from Tether, Hyperliquid, and fintech firms

Vàng Cán Mốc Lịch Sử 5.000 USD: Khi Dự Báo Của CEO Bitget Gracy Chen Trở Thành Hiện Thực Và Tầm Nhìn Về Đích Đến 5.400 USD