FinteqHub’s Hidden Rails: How SoftSwiss’s Gateway Allegedly Funnels Casino Payments Through Spoynt, Decta, Rapyd and Rastpay

A new whistleblower leak adds technical detail to FinteqHub’s role in the SoftSwiss & Dream Finance (dba CoinsPaid, CryptoProcessing) ecosystem: card and Apple Pay transactions at the Lucky Dreams casino are allegedly cascaded through a stack of third‑party processors, raising acute transparency and AML concerns for regulators and banks dealing with these rails.

Key findings

- FinteqHub markets itself as a PCI DSS‑certified “payment orchestration” platform with 50+ integrated providers and smart routing for card and alternative payments.

- A whistleblower claims that at LuckyDreams casino, card payments flow via FinteqHub through:

- pay.spoynt.com (Spoynt gateway),

- transactions.decta.com (Decta),

- rapyd.net (Rapyd),

and that Cardaq may also be involved (as discussed on Casinoguru).

- Separate sources confirm Spoynt (Estonia‑based), Decta (global card acquirer), Rapyd (major cross‑border payments/Wallets provider) and Rastpay (Apple Pay‑capable PSP) as active payment providers that can be integrated by orchestration layers like FinteqHub.

- The previous FinTelegram investigation already showed:

- FinteqHub is a SoftSwiss‑built gateway product.

- Its EU trademark and IP sit in Dream Transaction Lda, Madeira, whose shareholders are Pavel Kashuba, PrimeFuture Ltd and Bitcapital Ltd, all linked to the Dream Finance / SoftSwiss circle.

- Dream Finance entities in Lithuania, Poland and El Salvador have been suspended or liquidated in regulatory context and amid money‑laundering allegations.

- The whistleblower’s network‑trace narrative (FinteqHub → Spoynt → Decta → Rapyd, with Rastpay for Apple Pay) is technically plausible for a stacked orchestration model, but cannot yet be independently verified for LuckyDreams without direct log evidence or traffic captures.

Read our initial FINTEQHUB report here.

Interpretive analysis

FinteqHub’s own sales pitch is that it is a “payment orchestration” hub sitting between merchants (including iGaming) and dozens of PSPs, acquirers and wallets via a unified API and smart routing engine.

This architecture naturally supports cascading flows of the type described by the whistleblower: initial card request at the casino front‑end, then redirect or API hand‑off to FinteqHub, which in turn routes the transaction to connected gateways such as Spoynt, Decta, Rapyd or others depending on risk and approval‑rate logic.

Spoynt markets transaction cascading and multi‑gateway routing specifically to improve approval ratios and support high‑risk merchants. Decta and Rapyd provide card acquiring, wallets and cross‑border settlement capabilities that are widely used by gaming and high‑risk e‑commerce. Rastpay positions itself as a gateway offering card and mobile‑wallet payments, including Apple Pay, and is available as a pluggable provider via integration platforms like Corefy. In other words, each of the PSPs cited by the whistleblower does operate in a way that is technically compatible with being nested under a top‑level orchestrator such as FinteqHub.

When this technical picture is overlaid on yesterday’s structural findings, the risk profile becomes sharper:

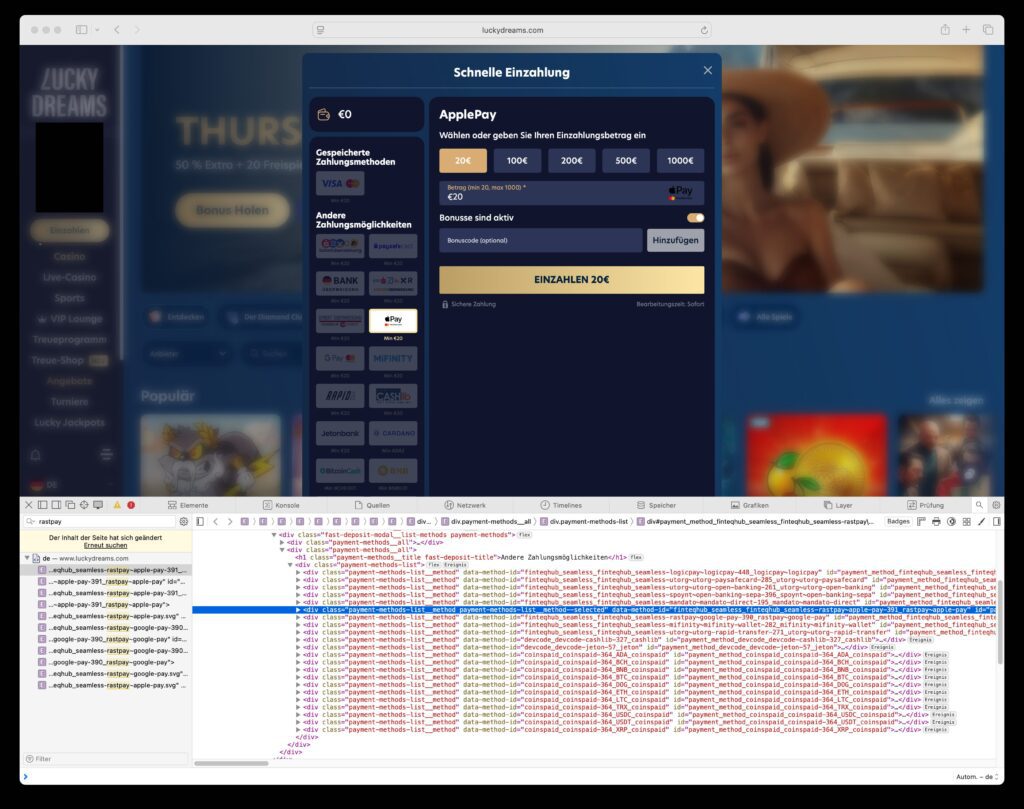

Screenshota screenshot of the source code of the deposit page on Lucky Dreams listing various payment methods, including Spoynt and Rastpay – each with a direct link to Finteqhub.

Screenshota screenshot of the source code of the deposit page on Lucky Dreams listing various payment methods, including Spoynt and Rastpay – each with a direct link to Finteqhub.

- The ownership and control of FinteqHub are rooted in the Dream Finance / SoftSwiss group via Dream Transaction Lda and Cyprus shareholders tied to Ivan Montik and Pavel Kashuba.

- The regulatory perimeter around Dream Finance has already been breached: MiCA‑driven suspension in Lithuania, liquidation of Poland and El Salvador entities, and allegations of casino‑driven laundering and tax evasion.

- the involved third‑party providers may be unknowingly servicing high‑risk SoftSwiss casinos through an intermediate gateway, complicating their own KYC/KYB and merchant‑of‑record assessments.

At this stage, FinTelegram cannot publicly state as fact that LuckyDreams payments follow the exact sequence described in the whistleblower’s message; that would require corroboration via payment‑page code analysis, network captures, or PSP‑side documentation. However, the combination of:

- FinteqHub’s documented orchestration model,

- Spoynt’s and Rapyd’s own positioning as cascading / multi‑method gateways,

- and the known SoftSwiss / Dream Finance control over FinteqHub,

makes the whistleblower’s description credible and consistent with how this stack is likely configured for iGaming merchants.

Summarizing Table

Here is a concise summary table of the alleged FINTEQHUB rails, the processors involved, and their roles in the stack:

| Layer in flow (alleged) | Domain / Entity | Role in the stack (function) | Public profile / capabilities relevant here |

|---|---|---|---|

| 1. Frontend casino | for example: luckydreams.com | Online casino front‑end where player initiates card or Apple Pay deposit; integrates with FinteqHub API/checkout (alleged). | SoftSwiss‑style iGaming brand; uses third‑party gateways for payments (not independently confirmed for FinteqHub). |

| 2. Orchestration layer | FinteqHub | Payment orchestration and routing engine; receives requests from casino, selects downstream PSP/acquirer based on rules, risk, and approval rates. | Positions itself as a “payment gateway & orchestration platform” with 50+ providers, smart routing, PCI DSS, focus on iGaming. |

| 3. Gateway / PSP | pay.spoynt.com (Spoynt) | Card gateway / PSP endpoint allegedly called by FinteqHub; handles checkout, tokenisation, and forwarding to acquirer(s). | Spoynt markets a full payment gateway with multi‑acquirer routing and high‑risk merchant support. |

| 4. Acquirer / processor | transactions.decta.com (Decta) | Card acquiring and processing; authorisation, clearing and settlement between card schemes, issuing banks and merchant accounts. | Decta is a Visa/Mastercard acquirer and certified processor offering gateway + acquiring + issuing; full card‑scheme connection. |

| 5. Global PSP / network | rapyd.net (Rapyd) | Global card acquiring and alternative methods; may serve as another route or fallback for cross‑border card and wallet payments. | Rapyd provides global card acquiring and 100+ country payment methods via one platform, widely used in iGaming/online services. |

| 6. Additional card PSP | Cardaq (alleged) | Possible additional card gateway/acquirer in the chain, e.g. for specific corridors or merchant IDs (mentioned on CasinoGuru per whistleblower). | Cardaq is an EMI‑licensed payment and card‑issuing provider, PCI DSS‑certified; public complaints allege involvement in miscoding casino transactions. |

| 7. Apple Pay PSP | Rastpay (rastpay.com) | Dedicated PSP for Apple Pay and possibly cards; FinteqHub allegedly routes Apple Pay deposits to Rastpay for tokenisation and processing. | Rastpay advertises itself as a secure payment gateway offering cards and mobile wallets like Apple Pay, and is integrated as a provider on platforms such as Corefy. |

This table is built from the whistleblower’s account (for the specific routing and LuckyDreams use) combined with public information on each processor’s general role and capabilities; the exact sequence and merchant‑of‑record relationships for LuckyDreams remain alleged and are not yet independently verified.

Call to players, insiders and PSP staff

FinTelegram is continuing to map the payment stack behind FinteqHub and the SoftSwiss / Dream Finance Group, including the role of Spoynt, Decta, Rapyd, Rastpay, Cardaq and other processors in handling casino deposits and withdrawals for brands such as LuckyDreams.

We urgently invite:

- Players who used card, Apple Pay or alternative methods at LuckyDreams or other SoftSwiss‑powered casinos,

- Current and former employees of FinteqHub, SoftSwiss, Dream Finance, Spoynt, Decta, Rapyd, Rastpay or Cardaq,

- Bank and PSP compliance officers who have seen unusual traffic patterns or onboarding documents involving these entities,

to submit screenshots, bank statements, payment URLs, technical logs, routing diagrams, contracts or internal communications through our secure whistleblower platform Whistle42.

Your evidence can help regulators and financial institutions understand how this layered orchestration is used to disguise merchant identities, circumvent gambling restrictions, or facilitate suspicious flows, and will be handled with strict source‑protection standards.

Ayrıca Şunları da Beğenebilirsiniz

Rizz Network Lands $5M Capital Commitment from Nimbus Capital to Drive Next-Generation AI-DePIN Rizz Wireless Rollout

Paris Saint-Germain Embraces BTC for Treasury Strategy