Uniswap (UNI) Volume Soars 500%, Will the Recent Spike Turn Into a Breakout?

- Uniswap currently trades in the $3 range.

- The trading volume is up by over 500%.

With a 0.45% spike in the market, some of the crypto assets are charted in green. The bearish dominance has erased all the recent gains, keeping the broader sentiment in extreme fear. The largest asset, Bitcoin (BTC), trades around $66.9K, while Ethereum (ETH), the largest altcoin, hovers at $1.9K. Among other altcoins, Uniswap (UNI) lit green on the chart with a 5.23% gain.

The asset opened the day trading at a bottom level of $3.23, and the entry of bulls was lightning-fast, resulting in the UNI price climbing to a high range of $4.37. According to CMC data, at press time, Uniswap traded at $3.39, with its market cap resting at $2.12 billion. Notably, the daily trading volume has increased by over 568% touched the $1.05 billion zone.

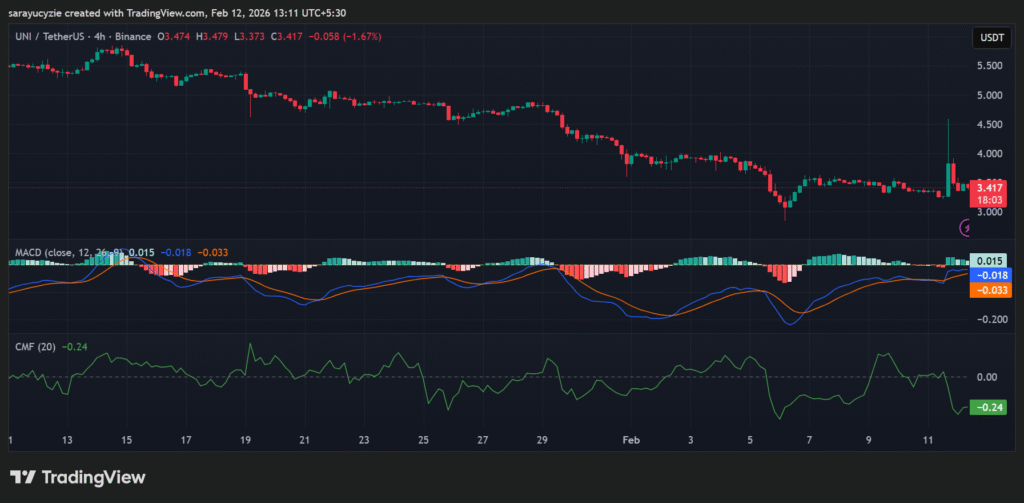

Uniswap’s 4-hour trading pattern reveals the negative outlook, and the price could slip to the key support at around $3.31. Assuming the downside correction intensifies, the asset’s price may steadily fall toward $3.23 or even lower. On the flip side, if the UNI bulls reclaimed power against the pressure, the price movement might rise to a retest of the $3.47 resistance. As the token continues to move upward, it will climb high toward the $3.55 range.

Uniswap Faces Bearish Correction on the Charts

When both the Moving Average Convergence Divergence (MACD) and the signal lines of Uniswap are below the zero line, displaying its bearish mood. As the downward momentum dominates, the broader trend is negative. Only a bullish move above zero can rescue the asset.

UNI chart (Source: TradingView)

UNI chart (Source: TradingView)

In addition, the Chaikin Money Flow (CMF) indicator is located at -0.24, pointing to a strong selling pressure in the UNI market. There is a significant amount of capital outflows, and if the negative reading persists, it likely supports the downside momentum to continue.

Uniswap’s daily Relative Strength Index (RSI) is found at 48.19 suggests neutral momentum. It is neither overbought nor oversold, hovering near the midpoint of 50, and a move above it hints at strengthening bullish pressure, while a drop below 40 may signal growing weakness.

Furthermore, the Bull Bear Power (BBP) reading of -0.036 indicates slight bearish dominance. With the negative value, the sellers have a marginal edge. Also, as the magnitude is very small, the ongoing market momentum of UNI is weak rather than strongly bearish.

Top Updated Crypto News

73% Price Jump and 404% Volume Boom: Can Berachain (BERA) Power Higher?

Ayrıca Şunları da Beğenebilirsiniz

UAE Launches First Regulated Stablecoin as ADI Trends Higher

The Ultimate Guide to Professional Dog Grooming: Choosing the Right Tools for a Salon-Finish at Home