XRP Price Prediction: Tokentus Investment Head Sees XRP Reaching $9 Soon

The post XRP Price Prediction: Tokentus Investment Head Sees XRP Reaching $9 Soon appeared first on Coinpedia Fintech News

XRP, the fourth-largest cryptocurrency in the world, is back in focus after a bold XRP price prediction from Michel Oliver, head of Tokentus Investment AG. He said XRP could reach between $7 and $9 in the next bull market.

This comes as the XRP price shows solid recovery and growing institutional interest, despite recent price pressure.

Michel Oliver XRP Price Prediction $9

Speaking in a recent interview on the German financial media platform Der Aktionär TV, Michel Oliver said XRP could climb as high as $9 in the next major crypto bull cycle.

One of the main reasons behind the Michel Oliver XRP price prediction is the steady growth in XRP institutional adoption. Also growing partnerships with banks, fintech companies, and payment providers across Europe, Asia, and the Middle East.

Many institutions are using XRP and Ripple’s technology to improve cross-border payments by reducing transaction time and costs. He also pointed out that improving regulatory clarity in several regions has helped improve trust among large investors.

Oliver believes the next bull cycle will reward projects with real-world use cases. If institutional adoption continues and payment integration expands, XRP could benefit from stronger long-term demand.

XRP Outperforming Bitcoin and Ethereum

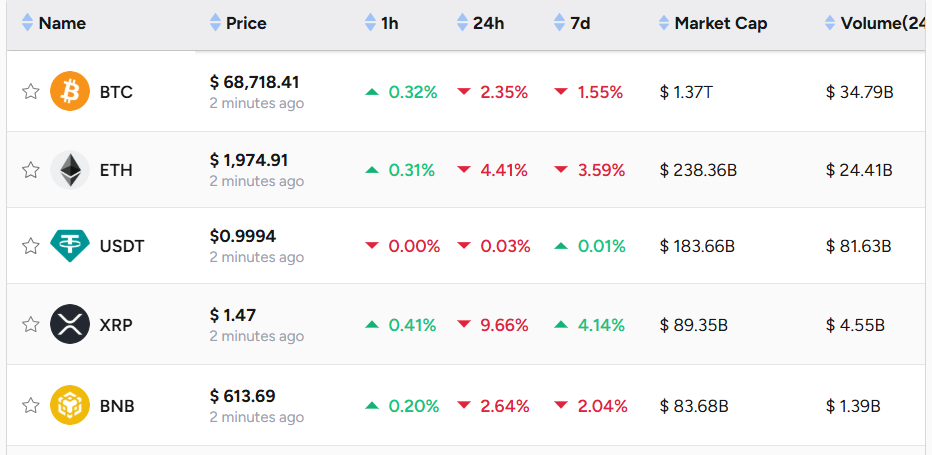

Another key reason behind the Michel Oliver XRP price prediction is XRP’s strong recovery performance. Since the February market downturn, XRP has recovered nearly 19%, outperforming Bitcoin and Ethereum, which recovered only around 6%.

On a weekly basis, XRP is up nearly 4%, while Bitcoin and Ethereum are down about 1.5% and 3.2%, respectively.

This recovery shows strong investor interest and rising XRP demand during market uncertainty. As more institutions and investors adopt XRP, the overall demand is expected to increase further.

XRP Price Prediction

As of now, the XRP price is trading around $1.46, down nearly 11% today. On the weekly chart, XRP remains in a corrective phase after completing a five-wave impulsive move to the upside.

The marked (1) to (5) structure signals the end of a full bullish cycle, with wave (5) peaking near the $3.50 region. Since that top, XRP has formed lower highs and lower lows, reflecting sustained medium-term bearish pressure.

Currently, the key support zone sits around $1.40. If buyers manage to defend this level, a relief rally toward the $2.50–$3.00 range could unfold. However, for a confirmed trend reversal, XRP must reclaim the $2.10 level with strong buying volume.

Meanwhile, the weekly RSI is hovering in the mid-30s. This indicates weak momentum but also suggests that selling pressure may be gradually slowing down.

Ayrıca Şunları da Beğenebilirsiniz

Strategy vergroot BTC voorraad: MSTR aandeel stijgt ondanks druk op Bitcoin koers

RBNZ guidance to support richer NZD – BNY