Ric Edelman Says $500,000 Bitcoin Is ‘Simple Arithmetic’ By 2030

Ric Edelman says Bitcoin can reach $500,000 by the end of the decade and, unlike many headline-grabbing forecasts, he’s putting a simple allocation math behind it.

In a Feb. 15 interview with Altcoin Daily, the longtime financial adviser and founder of Edelman Financial (now managing roughly $330 billion, by his account) framed his target as the “conservative” case in a range of increasingly aggressive calls circulating in crypto. “I believe that Bitcoin can reach $500,000 by the end of the decade,” Edelman said. “And there are other predictions that are even more bold than mine… many are predicting a million. Others are predicting as much as two to 5 million in pricing.”

Why Edelman Calls $500,000 Bitcoin ‘Conservative’ By 2030

What he objects to, he said, is not optimism, it’s the lack of disclosed assumptions. “The problem I have with a lot of the predictions is that they are opaque. They haven’t explained why they believe what they’re saying,” Edelman said. “So I’ll be transparent and tell you how I get to 500,000 by 2030… this is not a straight line… it’s going to be very bumpy along the way.”

Edelman’s case rests on a broad-based shift in global portfolio construction, not a single catalyst. He argues Bitcoin still isn’t owned by the “average investor” worldwide but that adoption can expand through sovereign and institutional channels over time. He listed potential buyers across the capital stack: “government holdings, sovereign wealth funds and institutional holdings, endowments, pension funds, hedge funds, insurance companies, banks, brokerages, etc.”

From there, Edelman zooms out to the size of the global asset pool. He estimated the combined value of global stocks, bonds, real estate, gold, and cash at roughly $750 trillion. The key step is the portfolio slice: if diversified investors ultimately assign just 1% to Bitcoin, that implies about $7.5 trillion of inflows, which he says would translate into roughly $500,000 per coin when combined with Bitcoin’s existing value.

“It’s simple arithmetic,” Edelman said. “If you take the attitude… that everybody who owns a diversified portfolio ends up owning just 1% of their portfolio in Bitcoin — that’s inflows of $7.5 trillion… That plus the current value of Bitcoin translates to about $500,000 per coin. It’s really that simple.”

He added two reinforcing observations: that allocations are already happening, and that when they happen they may be larger than 1%. “We’re beginning to discover… more and more people are allocating,” he said. “And… they’re allocating closer to 5% of assets.”

While Edelman emphasized Bitcoin’s long-term adoption curve, he also argued the broader crypto stack matters, particularly Ethereum, which he tied to stablecoin growth. He called it “funny” that investors can be bearish on crypto prices while simultaneously bullish on stablecoins, given where much of that activity settles today.

“If you believe stablecoins are the winner, how can you not be a supporter of Ethereum? Because almost all the stablecoins are trading on Ethereum,” Edelman said. Pressed for a number, he suggested Ethereum could reach “between $4,000 and $10,000,” adding that a doubling would be “very easy to suggest” in his view.

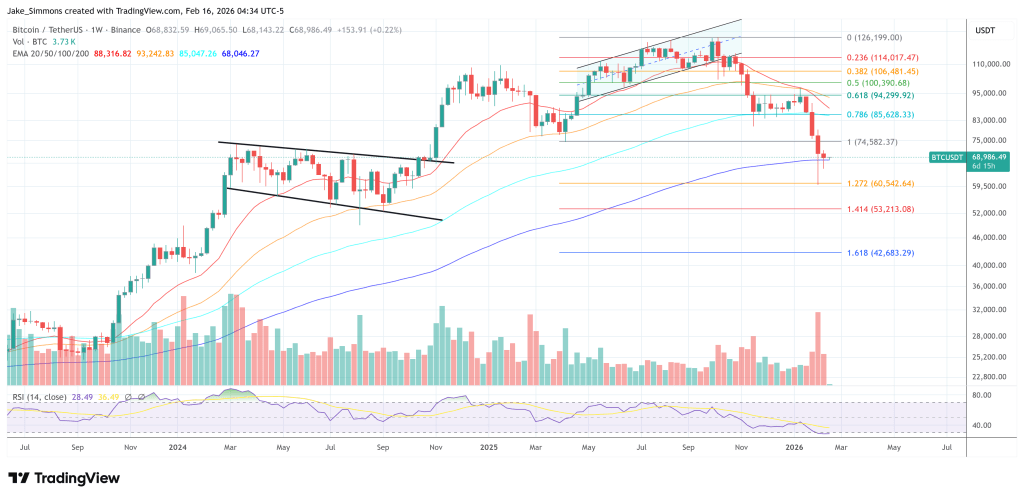

At press time, BTC traded at $68,986.

Ayrıca Şunları da Beğenebilirsiniz

Strive and Semler Scientific to Merge in All-Stock Deal, Creating Bitcoin Treasury Powerhouse

Milyar Dolarları Yöneten Şirket, Onchain Verilerine Göre Bu Altcoini Topluyor Olabilir!