Research: Performance of Coin Listings of Top Five Exchanges, including Binance and OKX, in the First Three Quarters

By Animoca Digital Research

Compiled by: Felix, PANews.

Animoca Digital Research released a research report that analyzed the listing status of the five major exchanges, Binance, OKX, Bitget, KuCoin and Bybit, from a data perspective. The report details are as follows:

Listed Coin Performance Overview

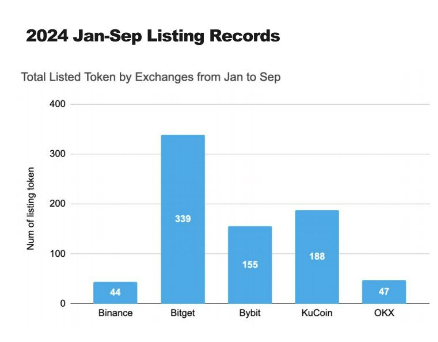

This year, leading exchanges have adopted different coin listing strategies.

Binance and OKX have been more selective among the major exchanges, listing only 44 and 47 tokens respectively so far this year.

In sharp contrast, Bitget has adopted a more aggressive listing strategy, with 339 listed tokens, far exceeding its competitors and significantly increasing its market share in 2024.

So far this year, both KuCoin and Bybit have listed more than 150 tokens.

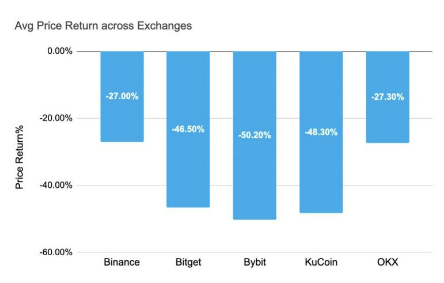

Average return rate of each exchange

Year-to-date, most exchanges have seen negative average returns, with Bybit seeing the largest drop in average returns at -50.20%.

KuCoin followed closely behind with an average return of -48.30%, while Bitget’s average return was -46.50%.

In contrast, Binance and OKX performed relatively well, with average returns of -27.00% and -27.30% respectively. This suggests that Binance and OKX implemented a more effective selective listing strategy, and token prices performed relatively well in the challenging altcoin market environment.

List the number of coins listed by month

Given the favorable market conditions at the beginning of the year, March and April became the peak months for listings on various exchanges, especially Bitget, Bybit, and KuCoin, where the number of listings surged significantly. In April, the total number of listings reached a peak of 133, while August had the lowest number of listings, with only 44. Since April, the number of listings on most exchanges has been steadily declining until August.

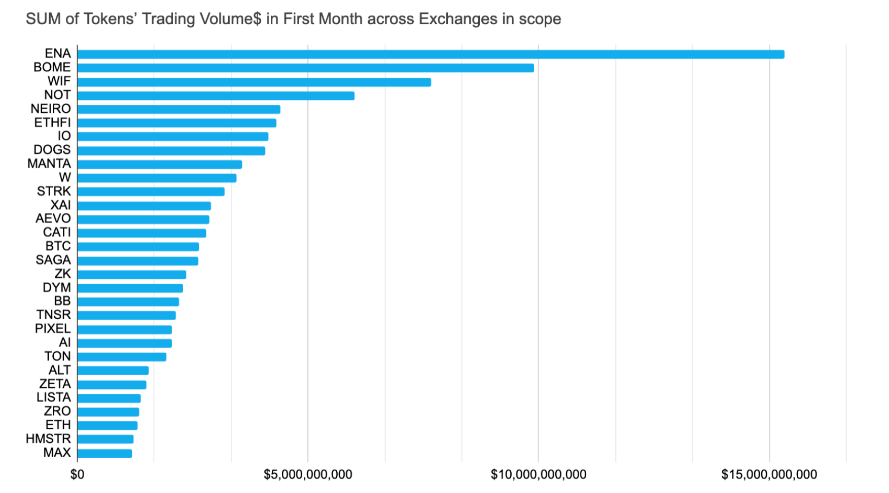

Total token trading volume in the first month of launch

The above chart shows the 30 most traded tokens so far this year. ENA leads the pack with over $15 billion in trading volume in the first month. Among the popular meme tokens, BOME, NElRO, and WIF have seen significant increases in trading activity, while tokens such as ZRO, TON, and lO have seen trading volumes ranging from $1 billion to $5 billion in the first month.

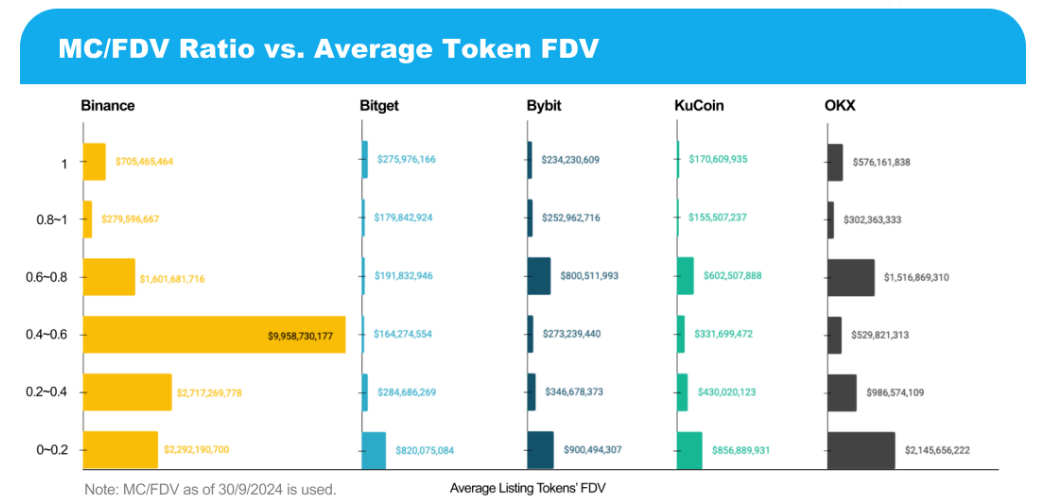

MC/FDV Ratio vs. Average Token FDV

MC/FDV (market capitalization to fully diluted valuation) is a key metric for evaluating a token’s floating market capitalization relative to its total valuation. Analysis of the rankings shows that projects with lower circulation ratios tend to push up their valuations.

For Binance, tokens in the 0.4 to 0.6 range account for the largest share of fully diluted valuations. This is mainly due to the recent launches of TON, BANANA, and XAl. Meanwhile, tokens in the 0 to 0.4 range, such as TAO, JUP, ENA, and ZRO, also made significant contributions to the overall FDV.

OKX has a higher concentration of tokens in the 0.6 to 0.8 and 0 to 0.2 ranges. Notable high FDV listings so far this year include JUP, ONDO, ZRO, STRK, and ZK.

The remaining three exchanges have listed tokens with lower FDVs, reflecting the diversification of their token selection strategies, and may also be due to the lag of Binance and OKX in listing high FDV tokens.

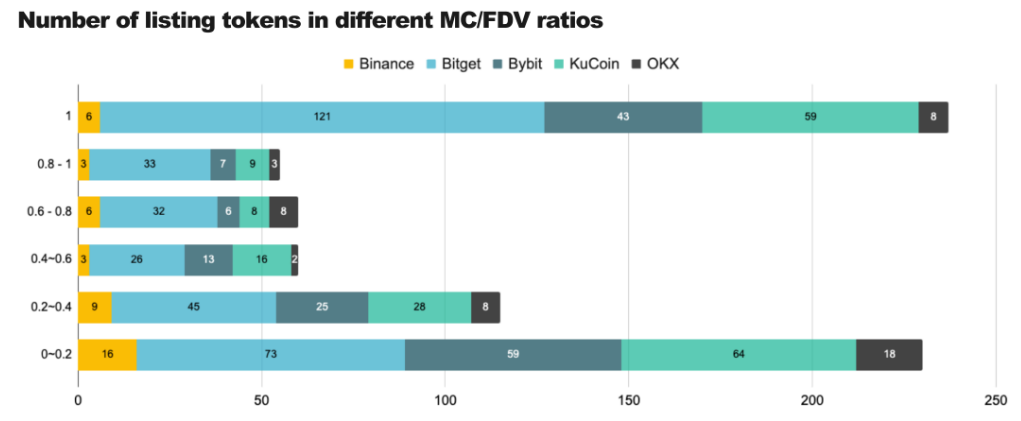

Number of tokens listed at different MC/FDV ratios

When analyzing the distribution of tokens with different MC/FDV ratios, a noteworthy trend emerges: most tokens tend to cluster at extremely high or low MC/FDV ratios, and the same is true for the circulation percentage.

Interestingly, the highest valued tokens are those in the middle of the MC/FDV range. This suggests that tokens that demonstrate both established market presence and growth potential tend to attract greater interest from investors.

Trading volume by exchange and launch month

Trading volume trends in the last 24 hours (by exchange and listing month)

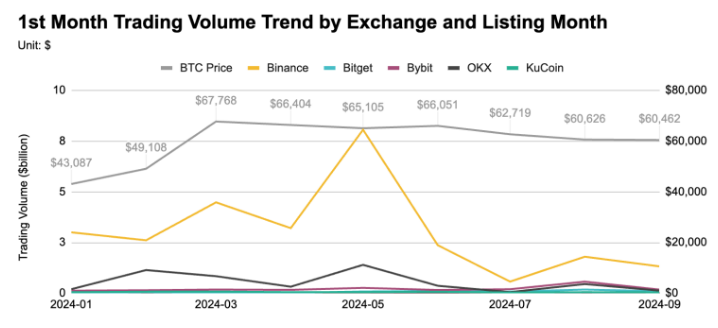

First month trading volume trends (by exchange and launch month)

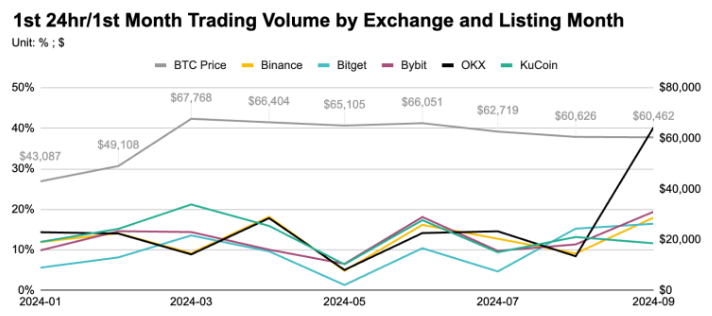

First 24- hour / first month trading volume by exchange and launch month

First day trading activity:

After going live, the first 24 hours of trading volume typically accounted for 5-20% of the first month’s volume, depending on the exchange. OKX was recorded as an outlier in September, with 40% of its activity driven by CATl and HMSTR tokens, while KuCoin showed stronger participation in the first few months.

Volume:

Among the five exchanges, Binance leads the market in both first 24 hours and first month average volume, followed by OKX. For Binance, April was the peak for average first day volume, while May was the peak for first month volume. Both volume metrics reached their lowest point in July and partially recovered in August and September. A similar decline and recovery trend can be observed in OKX.

First day closing price and ATH price (by exchange and listing month)

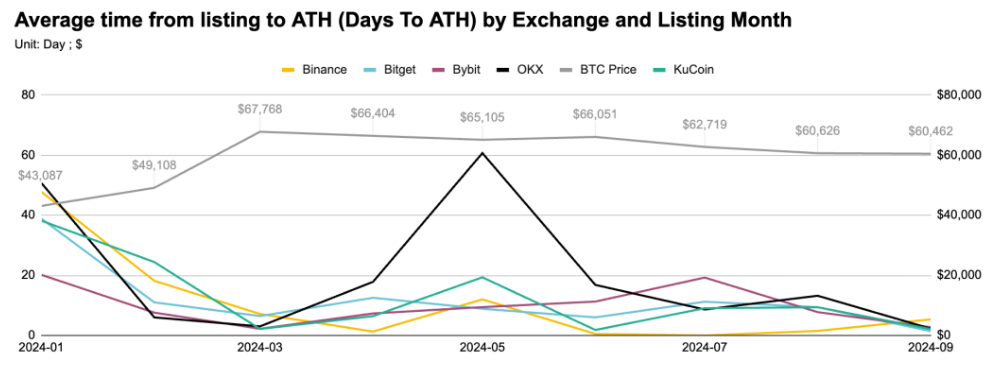

Average time from launch to ATH (by exchange and launch month)

Average number of days it takes for a newly listed token to reach its all-time high (ATH) after listing

Average ATH ROl by exchange and launch month

ATH ROI % (average percentage change between ATH and previous price)

Online performance:

Based on the ratio of ATH price to first-day price, Bybit and Bitget had the highest average ATH ROL between April and July. Meanwhile, Binance was the fastest of the five exchanges to reach a new all-time high (ATH) between January and March, a period when Bitcoin’s price fluctuated significantly.

The shift in market greed:

When BTC price surges, the number of days reaching ATH decreases, likely due to increased investor interest in newly listed tokens between January and March, during which BTC experienced significant price volatility.

Related reading: CZ's first public sharing after his return: prison life, market views and future plans

Ayrıca Şunları da Beğenebilirsiniz

Elon Musk’s net worth hits record $749B after legal win restores massive Tesla compensation