Game Theory and Exchange Economies: A New Model for Pure Exchange and Transferable Payoff

Table of Links

Abstract and 1. Introduction

-

A free and fair economy: definition, existence and uniqueness

2.1 A free economy

2.2 A free and fair economy

-

Equilibrium existence in a free and fair economy

3.1 A free and fair economy as a strategic form game

3.2 Existence of an equilibrium

-

Equilibrium efficiency in a free and fair economy

-

A free economy with social justice and inclusion

5.1 Equilibrium existence and efficiency in a free economy with social justice

5.2 Choosing a reference point to achieve equilibrium efficiency

-

Some applications

6.1 Teamwork: surplus distribution in a firm

6.2 Contagion and self-enforcing lockdown in a networked economy

6.3 Bias in academic publishing

6.4 Exchange economies

-

Contributions to the closely related literature

-

Conclusion and References

Appendix

6.4 Exchange economies

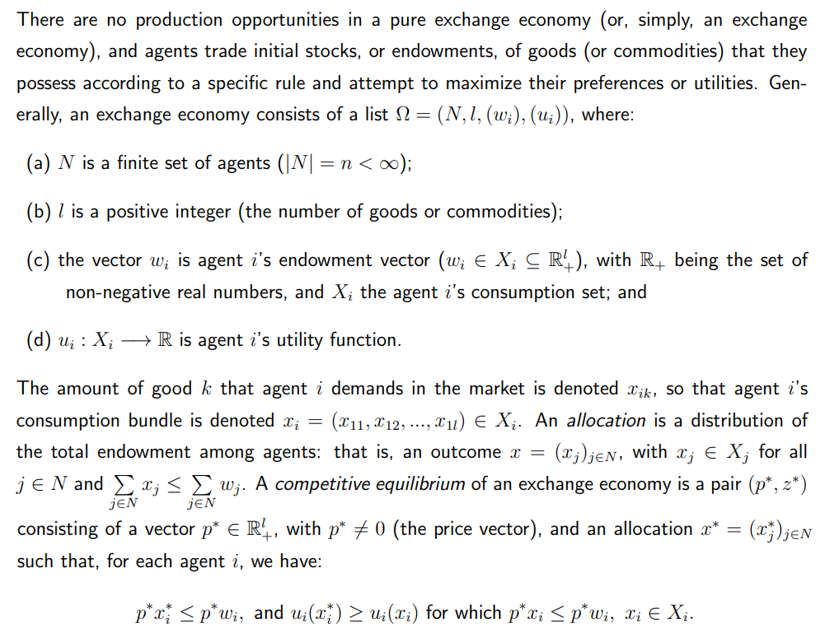

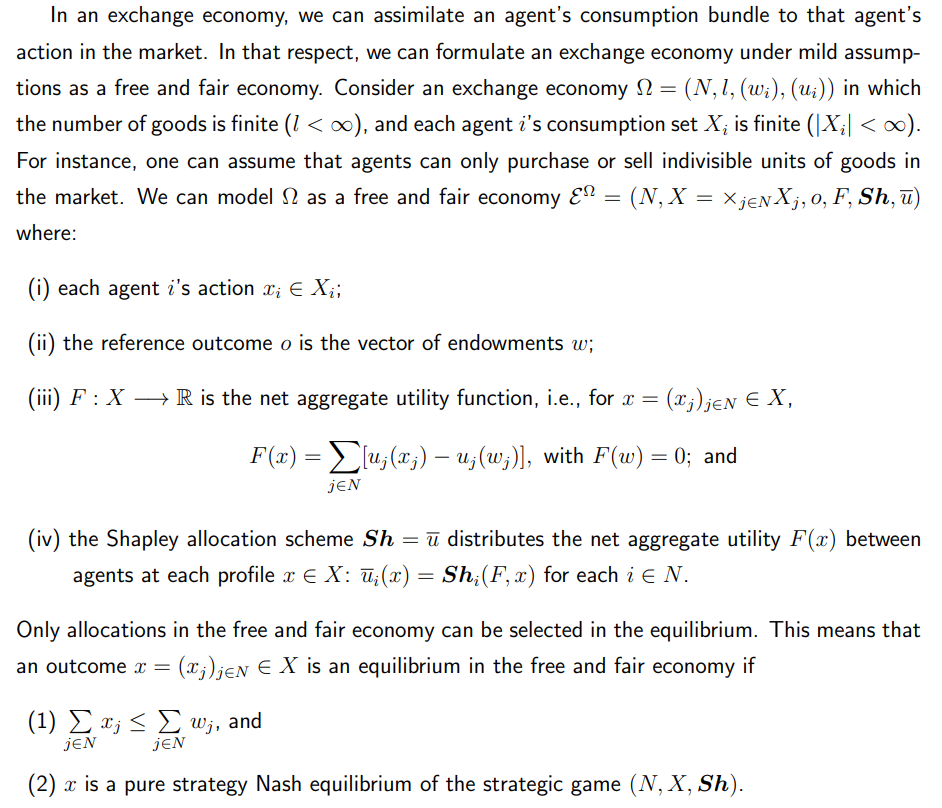

In this section, we apply our theory to pure exchange economies (Section 6.4.1) and markets with transferable payoff (Section 6.4.2).

\ 6.4.1 Pure exchange economies

\

\

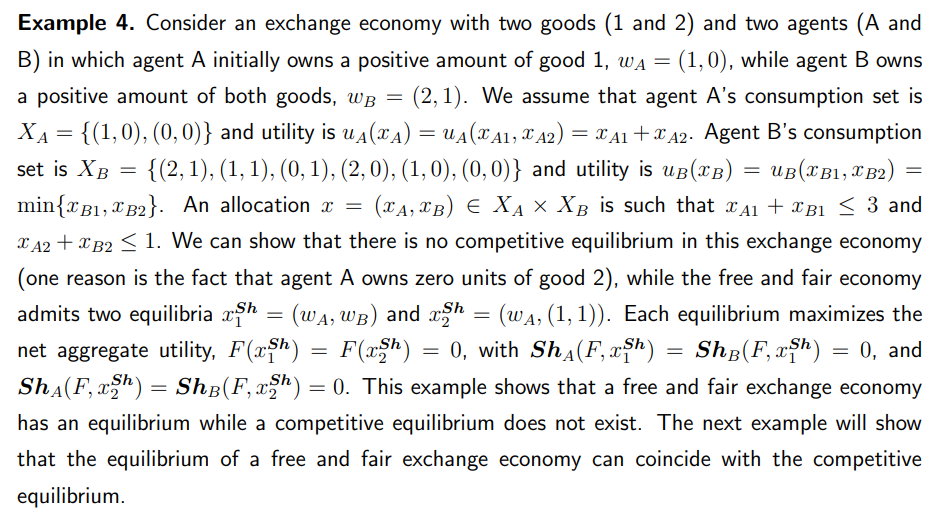

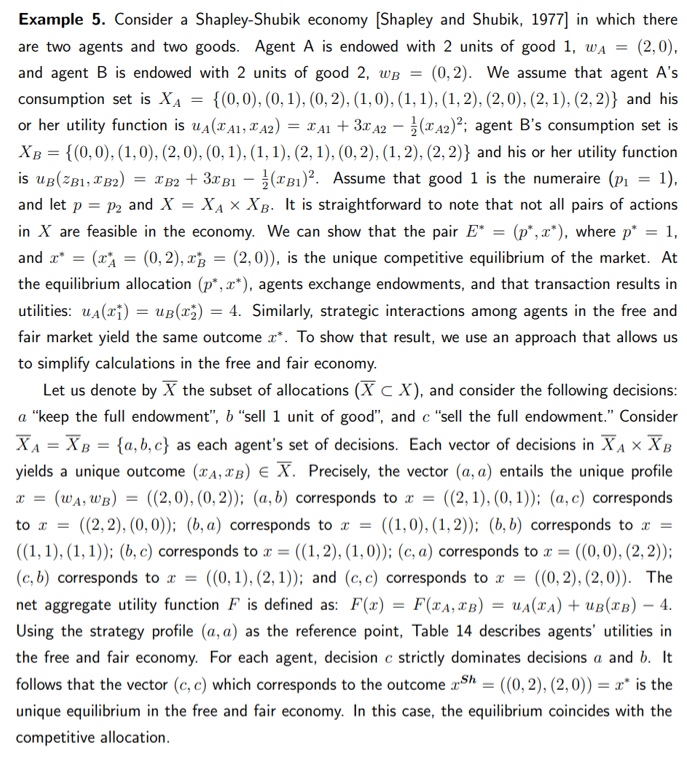

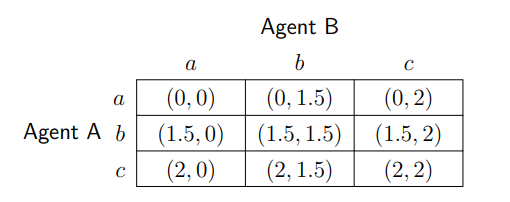

\ Our model differs from the exchange economy in at least two important respects. First, the incentive mechanism is different. Second, the equilibrium prediction from free exchanges between agents in both economies is different in general. A competitive equilibrium exists in an exchange economy when some assumptions exist on agents’ utilities and endowments. For instance, when utilities are continuous, strictly increasing, and quasi-concave and each agent initially owns a positive amount of each good in the market, a competitive equilibrium exists, and many equilibria might arise. However, under such assumptions on agents’ utilities, the net aggregate utility function F is strictly increasing, and thanks to Theorem 2, the free and fair economy admits a unique equilibrium. Additionally, it is not necessary to impose any assumptions on utilities and endowments to guarantee the existence of an equilibrium in a free and fair economy. We illustrate these points in the following examples.

\

\

\

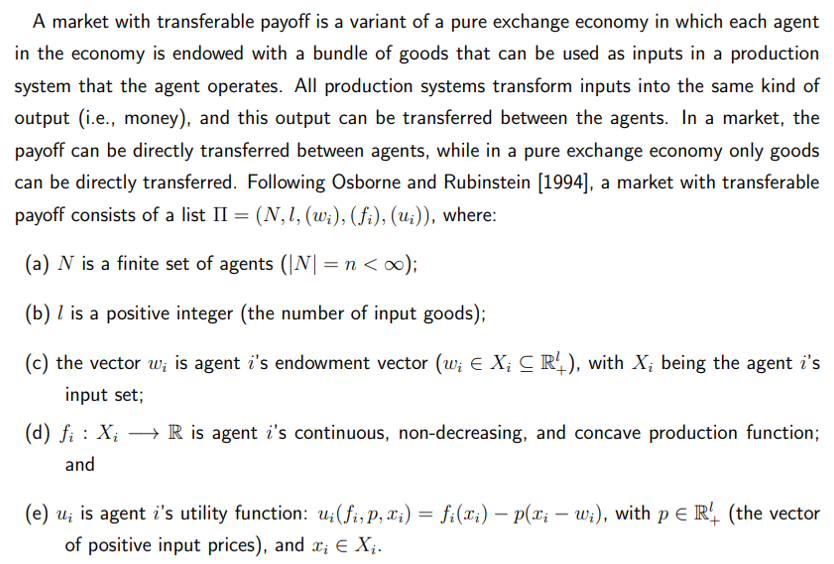

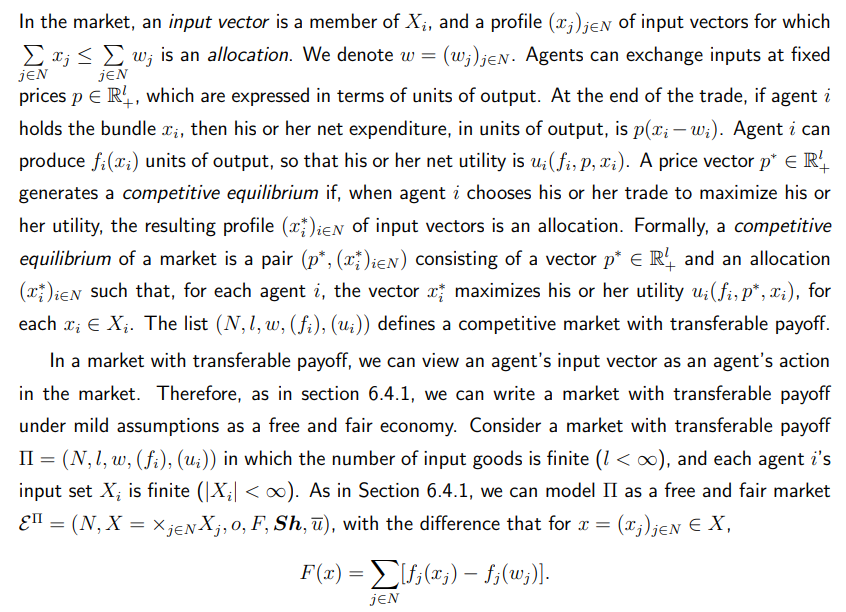

\ 6.4.2 Markets with transferable payoff

\

\

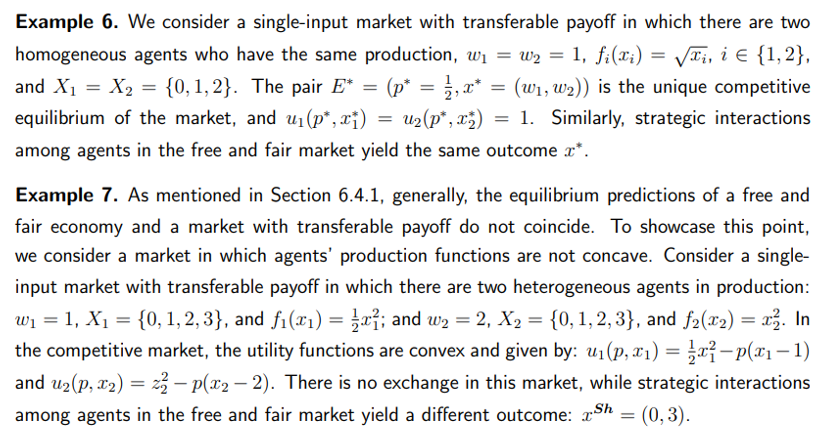

\ As in the analysis in section 6.4.1 below, we provide examples that show similarities (Example 6) and differences (Example 7) between the predictions of free and fair markets and markets with transferable payoff.

\

\

:::info Authors:

(1) Ghislain H. Demeze-Jouatsa, Center for Mathematical Economics, University of Bielefeld (demeze jouatsa@uni-bielefeld.de);

(2) Roland Pongou, Department of Economics, University of Ottawa (rpongou@uottawa.ca);

(3) Jean-Baptiste Tondji, Department of Economics and Finance, The University of Texas Rio Grande Valley (jeanbaptiste.tondji@utrgv.edu).

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

You May Also Like

No Longer Just a Token: Pi Network Is Quietly Building a Massive Digital Economy

Zoomex & UR Debut Transparent Multi-Currency Virtual Card