Opendoor (OPEN) Stock: Is It a Buy Right Now?

TLDR

- Opendoor hired Kaz Nejatian from Shopify as new CEO and brought back co-founders Keith Rabois and Eric Wu to the board

- Stock surged nearly 500% year-to-date but remains below its SPAC debut price at around $9.55

- Company achieved brief profitability with $23 million adjusted EBITDA in Q2 2025 after years of losses

- Third quarter guidance projects revenue decline to $800-875 million with return to negative EBITDA

- Management plans cost cuts and expansion into new services like mortgages and title work

Opendoor Technologies made waves in September with a dramatic leadership overhaul. The real estate platform named Kaz Nejatian, former Shopify COO, as its new CEO.

The company also brought back co-founders Keith Rabois and Eric Wu to the board. Rabois takes the chairman role while Wu returns as a director.

This marks a return to what the company calls “founder mode.” The leadership reset comes after ousting previous CEO Carrie Wheeler in August.

Nejatian brings strong technology credentials from his time at Shopify. The e-commerce giant has been a major winner for shareholders over the years.

The new CEO plans to eliminate the work-from-home strategy to boost innovation. He wants to apply similar tactics that worked at Shopify.

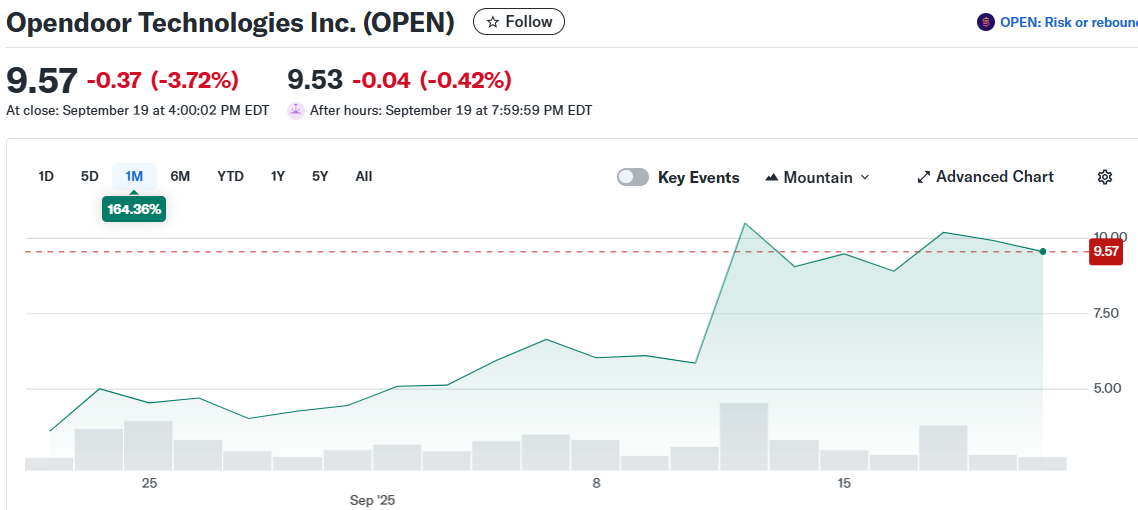

Stock performance tells a wild story this year. Shares jumped nearly 500% year-to-date from extreme lows.

Opendoor Technologies Inc. (OPEN)

Opendoor Technologies Inc. (OPEN)

The stock hit bottom around $0.51 in June before the massive rally began. Large investors and retail traders started buying shares in mass during the third quarter.

Despite the huge gains, Opendoor still trades below its SPAC debut price. The stock currently sits around $9.55 with a $7 billion market cap.

Financial Performance Shows Mixed Results

Recent quarterly results reveal both progress and ongoing challenges. Second quarter revenue reached $1.6 billion, up modestly from the prior year.

The company sold 4,299 homes during the period. More importantly, it achieved $23 million in adjusted EBITDA.

This marked the first positive adjusted EBITDA quarter since 2022. Gross profit margins remain thin at just 8.2% due to the nature of home flipping.

From gross profit of $128 million, the company spent heavily on operations. Marketing costs hit $86 million while general overhead reached $28 million.

Product development expenses totaled $21 million for the quarter. Interest expense added another $36 million drag on profitability.

The brief return to profitability didn’t last long in guidance. Third quarter projections show revenue dropping to $800-875 million range.

Turnaround Strategy Takes Shape

Management highlighted several headwinds facing the business. High mortgage rates continue suppressing buyer demand across housing markets.

More listings are coming off the market as sellers wait for better conditions. This creates a challenging environment for Opendoor’s core model.

The company also faces margin pressure from older inventory. Lower acquisition volumes mean a worse mix of homes in the pipeline.

Rabois indicated major cost cuts are coming to eliminate what he calls employee bloat. The company plans to focus on core operations and innovation.

Beyond cost reduction, Opendoor aims to expand into new revenue streams. Potential areas include title services, mortgages, and real estate agent partnerships.

These services could reduce reliance on the capital-intensive home buying business. The goal is making transactions smoother for buyers and sellers.

Nejatian’s equity-heavy compensation package aligns his interests with shareholders. His success depends on turning around the company’s financial performance.

The new leadership team faces high expectations given the stock’s massive run. Trading at 20 times trailing gross profit represents a premium valuation.

Recent guidance projects adjusted EBITDA back in negative territory for Q3. Management cited inventory mix issues and market softness as key factors.

The housing market remains interest rate sensitive with transaction volumes still subdued. Competition from larger players like Zillow adds another layer of difficulty.

The post Opendoor (OPEN) Stock: Is It a Buy Right Now? appeared first on CoinCentral.

You May Also Like

Qatar wealth fund commits $25bn to Goldman investments

Positive view remains intact above 185.00, with bullish RSI momentum