Messari Research Report: What’s missing for the prediction market to truly explode?

By Dylan Bane

Compiled by: TechFlow

The application of prediction markets has expanded beyond elections, demonstrating proof-of-market fit (PMF).

Betting volumes are surging, investors are flocking in, and new approaches, from information perps to Telegram bots, are entering the market.

So, what methods actually work and maximize the growth of trading volume?

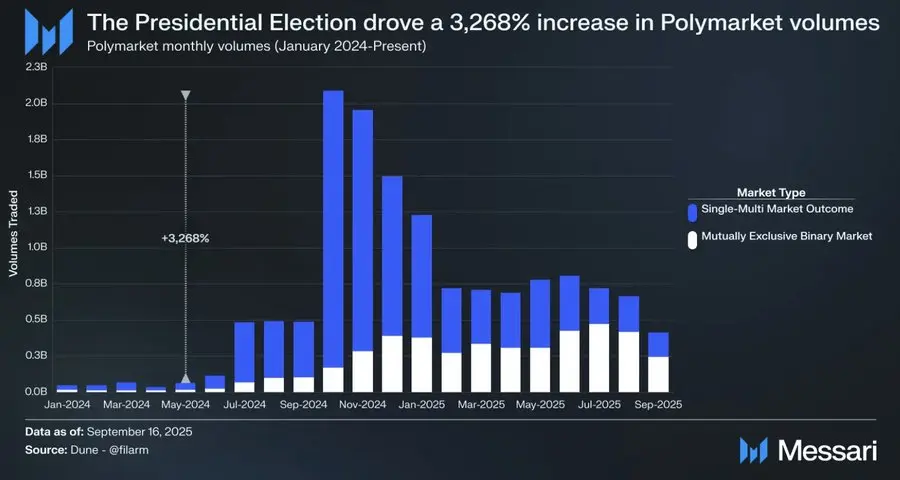

The 2024 election caused Polymarket’s trading volume to surge from $62 million in May to $2.1 billion in October, a 3,268% increase.

Mainstream media outlets like CNN and Bloomberg cited Polymarket's odds in their live broadcasts, presenting them alongside traditional polling data.

In fact, prediction markets ultimately beat opinion polls in predicting election outcomes.

After the election, prediction market trading volume declined but remained stable at over $1 billion per month.

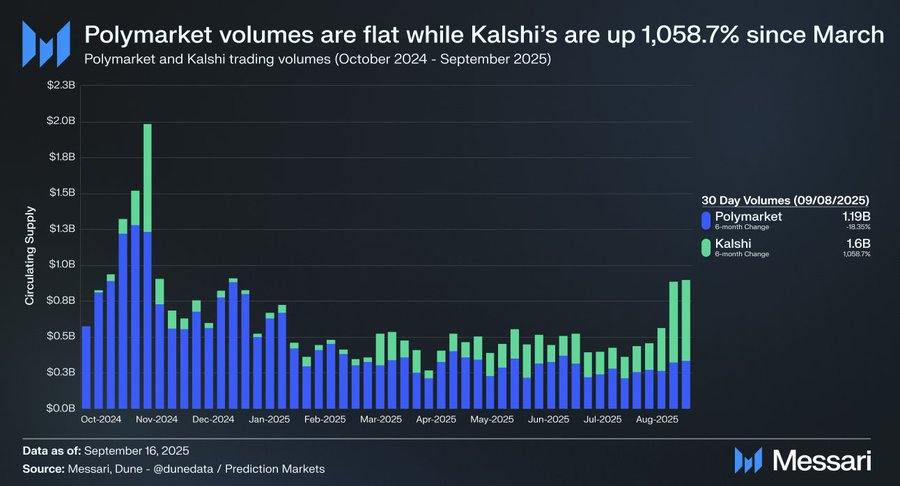

Combined with Kalshi’s recent surge in trading volume, investors believe that the prediction market has validated demand and is primed for further growth.

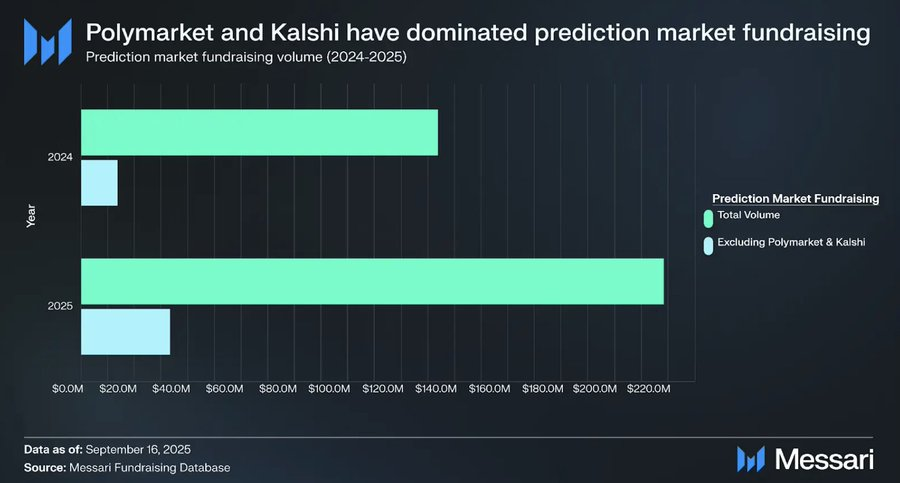

About 90% of the funds are concentrated in two platforms, Polymarket and Kalshi, with valuations approaching tens of digits (i.e. billions of US dollars).

These industry leaders have already built liquidity and are now focused on expanding trading volumes and strengthening market defensibility as larger exchanges like Hyperliquid and Coinbase are eyeing this space.

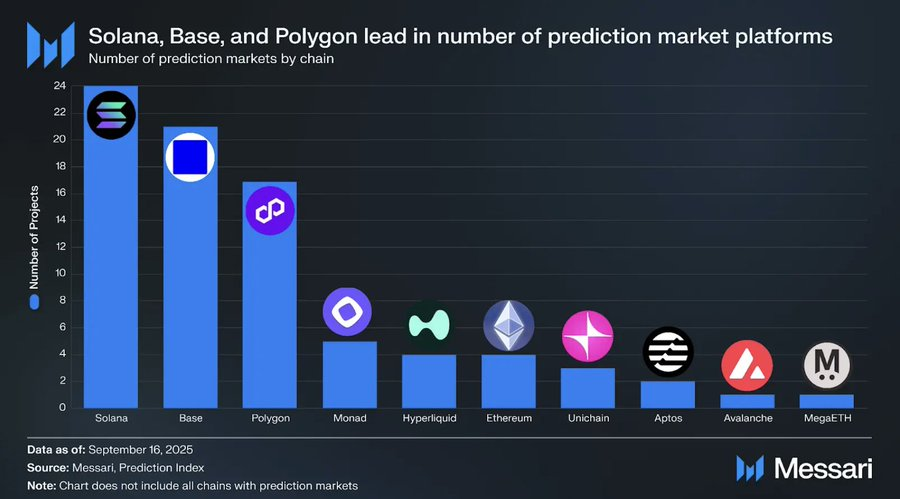

However, with over 100 prediction market projects and growing, there are a lot of opportunities.

The question is, how should investors identify the best opportunities in this increasingly complex and noisy landscape?

We believe that the best way to solve liquidity issues and increase trading volume is to attract retail speculators.

Prediction markets can attract this segment by focusing on accessibility, fun, user experience, and high potential financial gains.

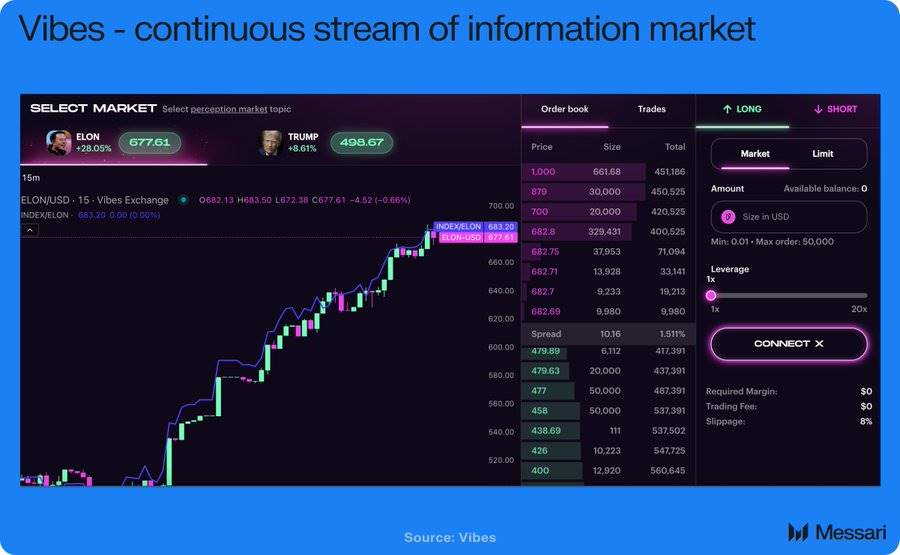

Continuous flow of information perpetual contracts

Because perpetual contracts fluctuate continuously, they overcome the slow settlement times that often deter speculators in binary outcome markets.

Such perpetual contracts can also track interesting and well-understood topics for which there are currently no existing markets.

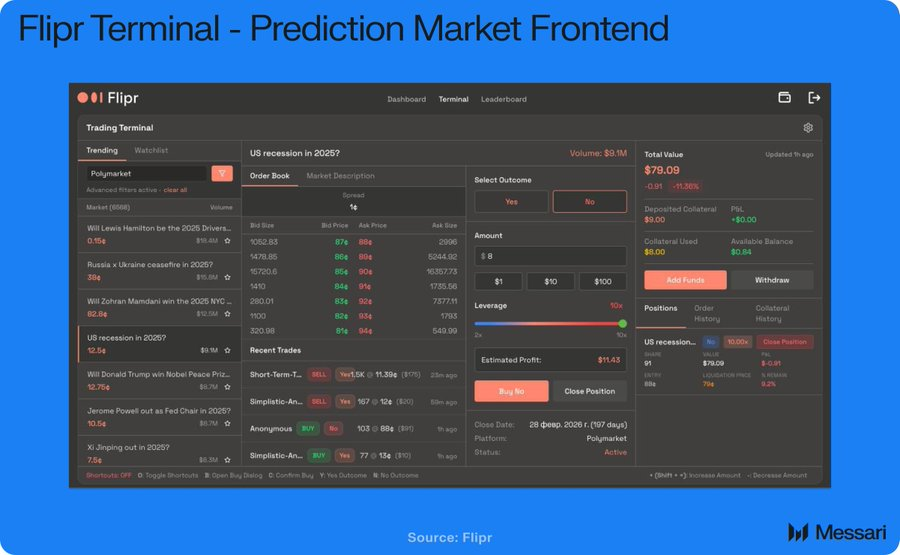

Front-end platform

Rather than building native liquidity, startups can source supply from existing industry leaders and provide users with a higher-quality trading experience.

For example, Flipr offers a trading terminal, trading bots on the X platform, and up to 10x leverage using existing liquidity.

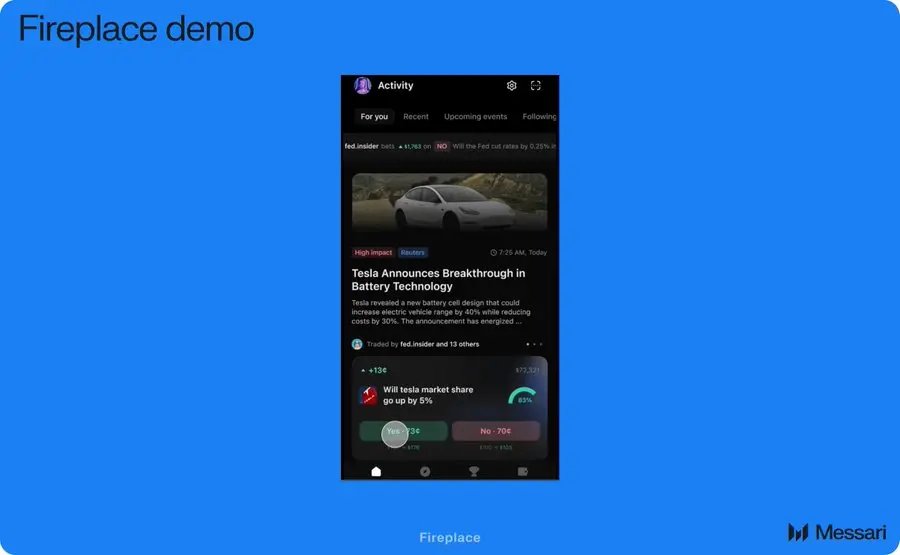

Social Apps

Gamified apps or social experiences can make forecasting more fun.

Just as sports betting is an inherently social experience, prediction markets can foster a similarly interactive experience.

In the early stages of prediction market adoption, the design space is very broad.

Basket trading, managed indices, celebrity copy trading, parlays, and more are all worth exploring.

You May Also Like

Gensler Defends Strong Crypto Regulation Amid Speculative Concerns

TRX Price Prediction: Testing $0.32-$0.35 Resistance Zone as Technical Momentum Builds

Pi Network DEX Launch Confirmed for March 12, 2026: A New Chapter for Picoin and Web3 Trading

Pi Network has officially confirmed the launch date of its decentralized exchange (DEX), scheduled for Marc