Cardano at a Crossroads: Can ADA Still Explode 25%?

TL;DR

- One famous analyst highlighted $0.80 as a crucial support level that ADA must hold.

- Another market observer predicts a bounce starting mid-October that could drive the asset to a new all-time high by Christmas.

Did ADA Lose Its Chance?

It has been just over a month since Cardano’s ADA surged above $1. Since then, though, it has been on an evident decline which has even worsened in the past few days. As of this writing, the asset trades at around $0.78, representing a 15% plunge on a weekly scale.

According to renowned analyst Ali Martinez, the drop below $0.80 could prove critical, potentially preventing the price from rebounding by roughly 25% to $0.95.

Earlier this month, he revealed that large investors (known as whales) have offloaded 160 million tokens in the span of just 96 hours. This adds more weight to the bearish view, as it signals diminished confidence in the asset from these market participants, which could also reflect on smaller players. In addition, such actions increase ADA’s circulating supply, potentially triggering a price decline if demand does not increase.

The lesser-known market observer, using the X moniker Man of Bitcoin, also outlined a bearish forecast. He believes the dip below $0.782 could be followed by an additional plunge to as low as $0.731.

ATH for Christmas?

The X user Sssebi recently agreed with the assumption that ADA can continue nosediving in the short term. However, the analyst thinks the downtrend will last only until next month and after that will be replaced by a resurgence, which could take the price to a new historical record by Christmas this year:

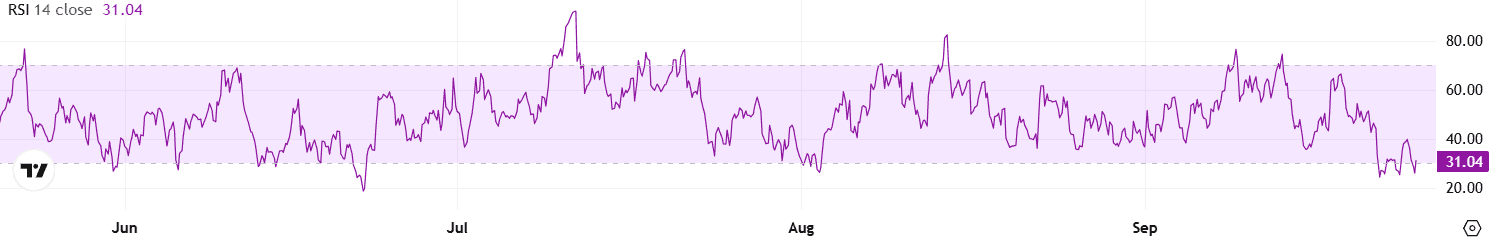

Bulls should also examine ADA’s Relative Strength Index (RSI), which has recently plummeted to approximately 30. Readings around and below that level indicate that the asset’s price has declined too rapidly over a short period, suggesting it may be on the verge of a revival. On the contrary, anything above 70 is considered bearish territory.

ADA RSI, Source: CryptoWaves

ADA RSI, Source: CryptoWaves

The post Cardano at a Crossroads: Can ADA Still Explode 25%? appeared first on CryptoPotato.

You May Also Like

USD/INR edges lower as Indian Rupee gains on improving equity inflows

Sahara AI has entered into a strategic partnership with South Korean payment giant Danal Fintech to jointly build a stablecoin AI payment system.