General Motors (GM) Stock: Rises as EV Lease Tax Credit Extension Fuels Optimism

TLDRs;

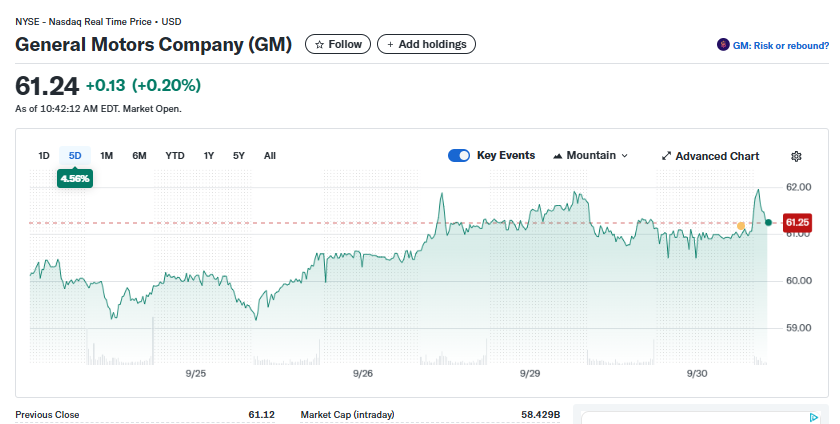

- GM stock rose 5% over the past week, lifted by optimism around the extension of the $7,500 EV lease tax credit.

- The program uses GM’s financing arm to help dealers apply the credit on EV inventory past the September 30 deadline.

- Analysts warn that EV demand could drop sharply once the subsidy fully expires, making the program a temporary lifeline.

- Investors see the move as a sign of GM’s commitment to protecting EV demand, fueling a rebound in stock sentiment.

General Motors (NYSE: GM) shares advanced nearly 1% at Tuesday’s market open, trading at $61.19, extending a broader upward trend that has seen the stock rise just over 5% in the past week.

The rally comes as investors digest fresh developments around the federal electric vehicle (EV) lease tax credit, a program that has long supported EV adoption in the U.S.

While broader market sentiment has been mixed in recent sessions, GM’s ability to capitalize on policy-driven incentives appears to have sparked renewed optimism. The automaker’s strategic move, alongside Ford, to extend the $7,500 EV lease tax credit through dealer programs is being viewed as a short-term boost to both demand and investor confidence.

General Motors Company (GM)

General Motors Company (GM)

Automakers Step In to Extend Subsidy

According to sources familiar with tha matter, General Motors and Ford have launched programs that enable dealers to continue offering the $7,500 federal tax credit on EV leases even after its September 30, 2025 expiration.

The process works through the automakers’ financing divisions, which make down payments on EVs held in dealer inventories. This transaction allows the vehicles to qualify for the tax credit before being transferred to customers via lease agreements. Dealers can then pass along the subsidy to consumers, effectively keeping monthly lease payments lower than they otherwise would be.

GM confirmed the program on Monday, while Ford has not yet commented publicly. Both companies developed the initiative after consulting with officials at the Internal Revenue Service (IRS).

Analysts Warn of EV Slowdown Without Credit

The federal EV tax credit, which has been in place for more than 15 years, has been a cornerstone of U.S. efforts to accelerate the shift from combustion engines to electric power. Analysts, however, have cautioned that its expiration could deal a major blow to EV sales and leasing.

Some industry executives expect a steep decline in demand, particularly after a surge of buyers rushed to secure vehicles before the September deadline. By temporarily extending the credit’s benefits through these dealer-backed programs, GM and Ford are attempting to cushion that anticipated drop-off.

Still, uncertainty lingers. Analysts note that unless lawmakers revisit the subsidy framework, U.S. automakers could face a more challenging sales environment in 2026 and beyond.

Investor Confidence in EV Strategy

For shareholders, GM’s willingness to find creative solutions has added a layer of reassurance. Extending access to subsidies not only supports near-term vehicle demand but also signals the company’s broader commitment to protecting its EV strategy amid shifting policy landscapes.

While the tax credit extension cannot last indefinitely, the short-term outlook suggests stability in EV leasing. That, combined with improving production efficiency and strong demand in North America, has supported GM’s recent stock momentum.

The big question for investors remains whether GM can maintain its growth trajectory without federal support. For now, however, Wall Street appears encouraged by the automaker’s adaptability.

The post General Motors (GM) Stock: Rises as EV Lease Tax Credit Extension Fuels Optimism appeared first on CoinCentral.

You May Also Like

X3 Acquisition Corp. Ltd. Announces Closing of $200,000,000 Initial Public Offering

North America’s Largest RV Dealers Still Failing Google Core Web Vitals–Overfuel Reports Nearly 79% Failure Rate for Second Year