The Token Economy as a Dynamical System

Table of Links

Abstract and 1. Introduction

- A Primer on Optimal Control

- The Token Economy as a Dynamical System

- Control Design Methodology

- Strategic Pricing: A Game-Theoretic Analysis

- Experiments

- Discussion and Future Work, and References

3 The Token Economy as a Dynamical System

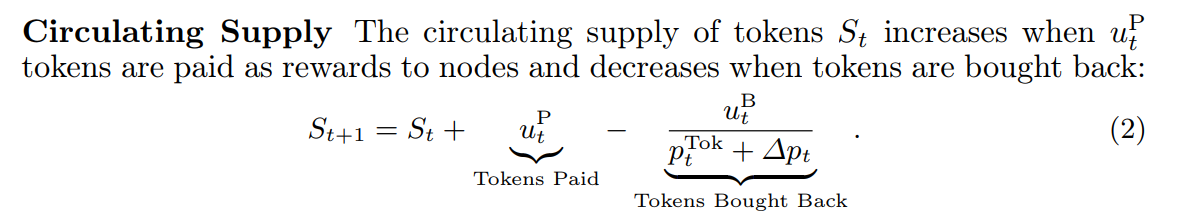

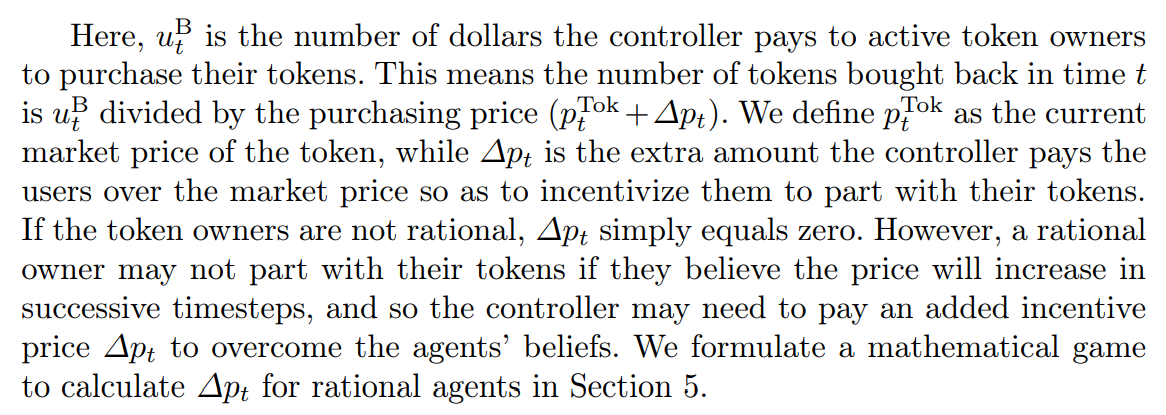

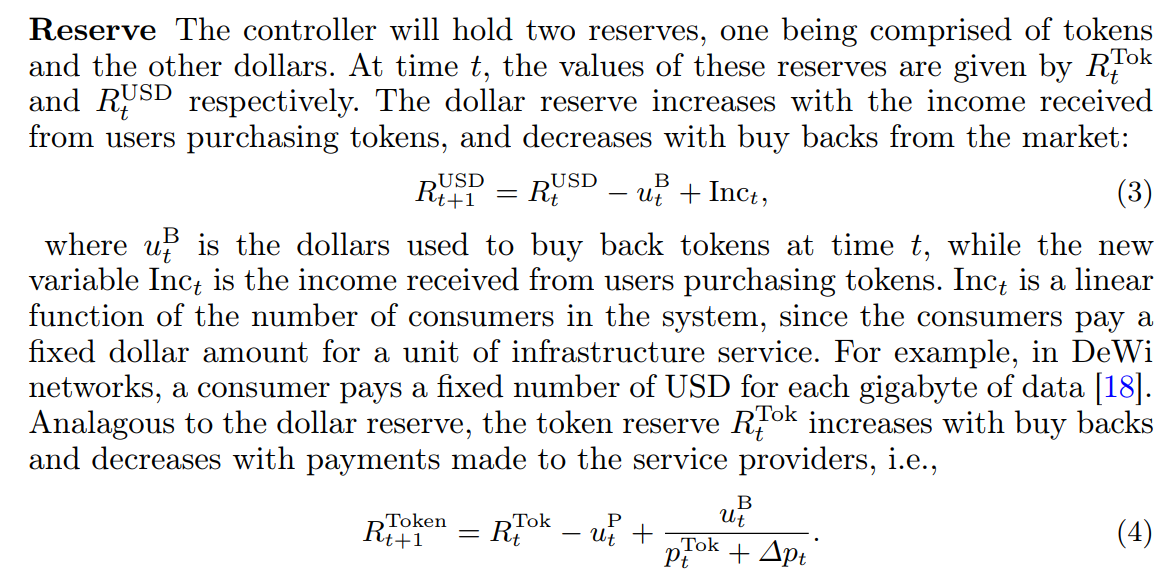

To model the token economy for infrastructure networks as a controlled dynamical system, we define our problem’s state xt, controls ut, exogenous forecast st, dynamics f(xt, ut, st), and cost function J. For the dynamics, we show the relationships between the token’s circulating supply, price, and reserve used by the controller. As shown in Fig. 1, these quantities will form our state variables which are controlled via buying back tokens and paying tokens to the user base.

\ We capture the following interaction: Nodes provide services (5G base stations, EV charging, etc.) for consumers. The consumers pay dollars to the controller to use these services, and the controller converts these dollars into tokens at market price to pay to the nodes as rewards for their services. This reward payment is the minting action. Furthermore, the dollars received from consumers is income that is placed in a dollar reserve. Funds from this reserve are in turn used to buy back tokens from the nodes at a price posted by the controller. The bought back tokens are removed from the circulating supply and placed into their own reserve, which is effectively the burn action. We model the token economy as a closed system, meaning that the power to change the circulating supply is endowed only in the buy back and pay mechanism and no exogenous actor. Effectively, this means that no node will intentionally burn their own tokens and lose assets. Finally, we examine the token economy as a discrete time system.

\ Before proceeding, one more comment: Recall, as in Fig. 1, the Blockchain network has a reserve that mints new tokens and buys back tokens from the market. Our controller resides in this reserve, and can be considered as logically “centralized”. Of course, the control logic is implemented by distributed nodes running smart contracts. However, all the smart contracts come to a consensus on the key state variables, which are aggregate (not node-specific) quantities such as the circulating supply, token price, total consumer demand etc. As such, the nodes can decide how much to pay/buy-back in a decentralized way.

\

\

\

\

\ Why Control? While the simple strategies in Remark 1 are stable, they do not provide much-needed flexibility for tokenomics. For example, we might need to increase the token dollar reserve to pay for upgrades, which requires saving income instead of directly paying it all to nodes. Further, we might want the token price to steadily grow at a certain rate, so that nodes can sell tokens to recover their capital investment costs (e.g., buying a 5G hotspot). In essence, we need control to flexibly steer the system away from the equilibrium in Remark 1 to achieve a high-level performance criterion, as formalized next.

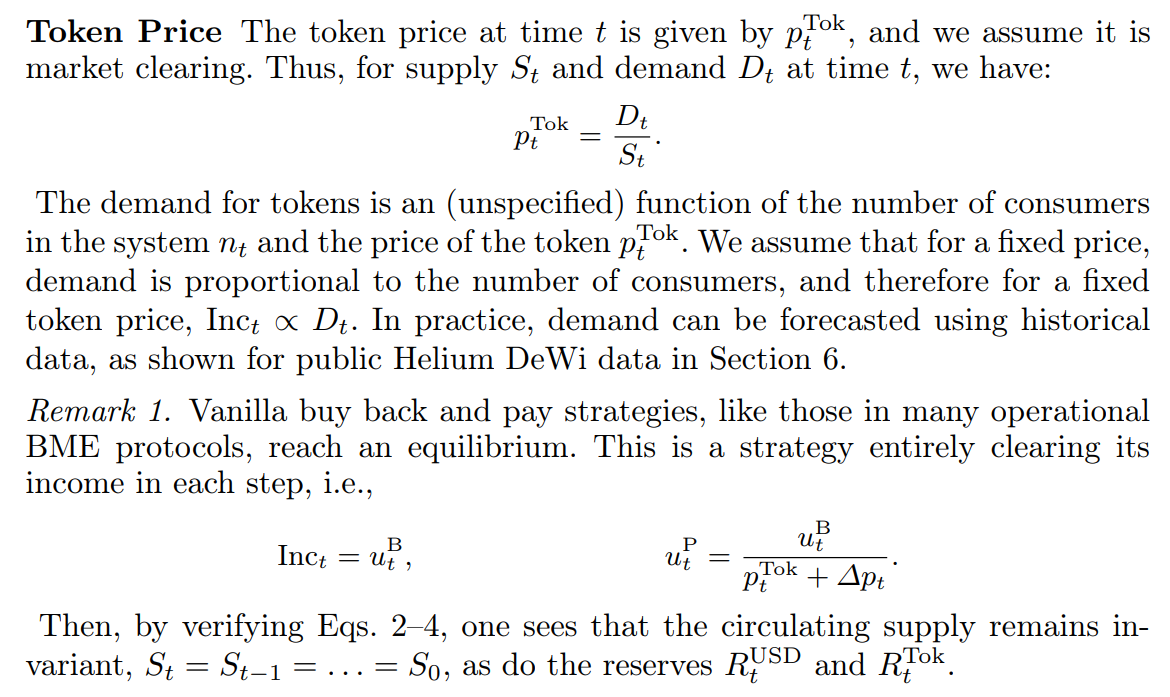

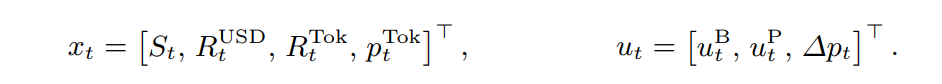

\ State, Control and Cost Variables: The state xt captures the dynamic quantities that are necessary to control the system. Likewise, the control vector ut consists of how much we adaptively pay, buy-back, and our incentive price:

\

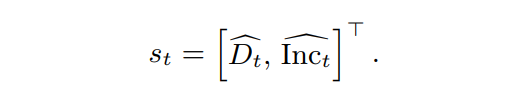

\ Additionally, as our method is predictive, we use forecasts predicting the future income and consumer demand. In practice, these can come from data-driven modeling using historical transaction data. The forecasts at time t are:

\

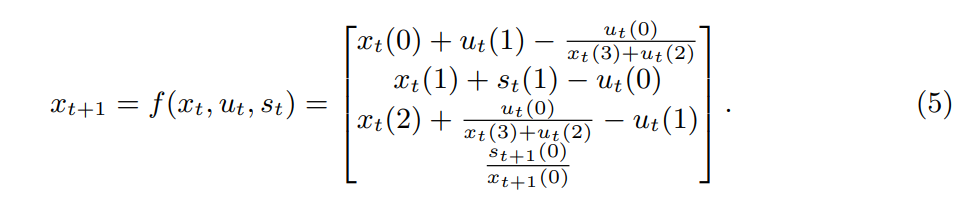

\ Now, we can write the nonlinear dynamics of our system using Eqs. 2–4:

\

\

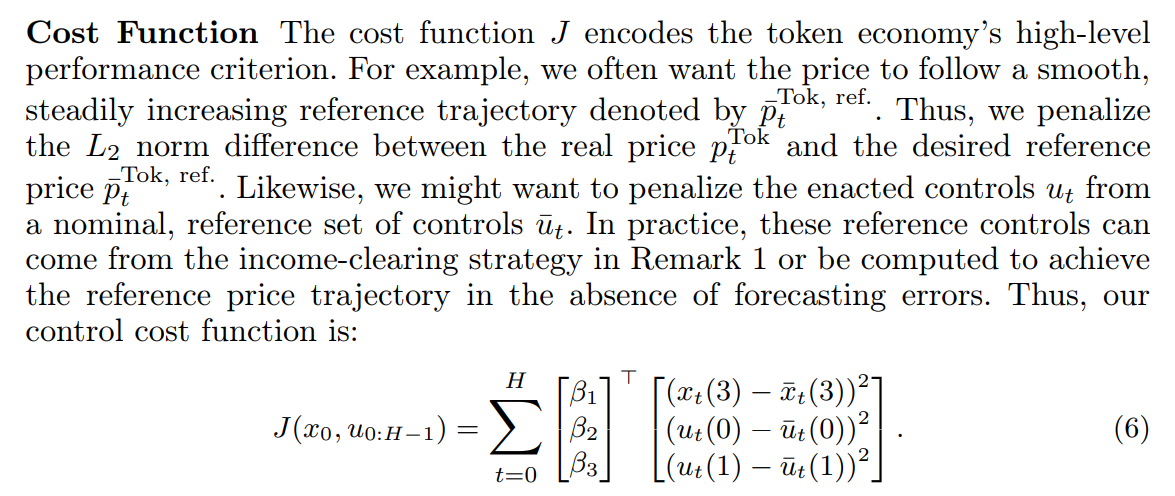

\ Blockchain designers can flexibly set parameters β1, β2, β3 to trade off how closely we track the reference price and our control effort. Our formulation is extremely general, since we can easily follow a reference token supply that scales with the number of nodes, or even a fixed reference token supply. Indeed, our formulation encompasses fixed supply systems, since we can implement an upper bound on the number of tokens (state constraints). Likewise, we can use any differentiable, non-convex cost function amenable to gradient-based optimization.

\

\

:::info Authors:

(1) Oguzhan Akcin, The University of Texas at Austin (oguzhanakcin@utexas.edu);

(2) Robert P. Streit, The University of Texas at Austin (rpstreit@utexas.edu);

(3) Benjamin Oommen, The University of Texas at Austin (baoommen@utexas.edu);

(4) Sriram Vishwanath, The University of Texas at Austin (sriram@utexas.edu);

(5) Sandeep Chinchali, The University of Texas at Austin (sandeepc@utexas.edu).

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

What is the latest news about cryptocurrency? — Market snapshot Jan 23, 2026