DoorDash (DASH) Stock: Soars After Deliveroo Acquisition and Global Expansion Moves

TLDRs;

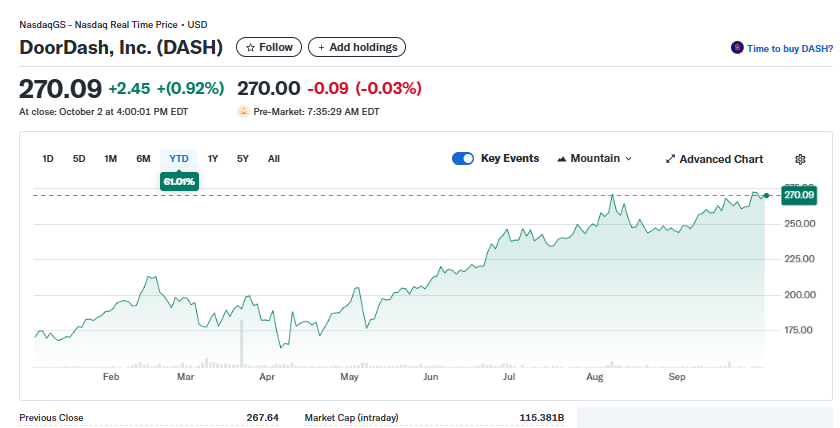

- DoorDash stock is up more than 60% YTD, fueled by Deliveroo’s $3.9B acquisition and strong earnings growth.

- Deliveroo adds nine new markets, expanding DoorDash’s global footprint and customer base with minimal brand disruption.

- DoorDash is diversifying with robotics and restaurant tech while shifting to consistent profitability in 2025.

- Analysts see growth potential but warn of risks tied to global competition and regulatory challenges.

DoorDash (NASDAQ: DASH) climbed nearly 1% on Thursday, extending its year-to-date gains to more than 60%. The rally has been underpinned by improving profitability and an aggressive acquisition strategy, highlighted by the $3.9 billion takeover of Deliveroo.

The completed deal significantly broadens the San Francisco–based company’s international reach, giving it direct exposure to markets where its presence had previously been limited.

Shares closed at $270.09 on October 2, underscoring investor confidence that DoorDash’s global expansion will fuel sustained growth. The stock’s performance has sharply outpaced the broader Nasdaq index, which has delivered comparatively modest returns over the same period.

DoorDash, Inc. (DASH)

DoorDash, Inc. (DASH)

Deliveroo Acquisition Adds Nine Markets

The acquisition of London-based Deliveroo marks DoorDash’s entry into nine new markets, including Singapore, the U.K., France, and several Middle Eastern regions.

Deliveroo’s existing network of 178,000 merchants and over 130,000 riders will remain intact, while Wolt co-founder Miki Kuusi will step in as Deliveroo’s new CEO.

DoorDash has confirmed that Deliveroo will continue operating its platform under the same name, preserving local brand recognition while benefiting from DoorDash’s technological and operational infrastructure. Analysts see the acquisition as a strategic move that adds millions of monthly active users without the burden of building a new customer base from scratch.

Expanding Beyond Food Delivery

The Deliveroo purchase comes alongside other bold moves by DoorDash aimed at diversifying beyond simple food delivery. In May, the company acquired restaurant software provider SevenRooms for $1.2 billion, giving it deeper exposure to restaurant operations and data management.

Meanwhile, DoorDash Labs unveiled “Dot,” an autonomous robot designed to handle short-distance deliveries. The robot is currently being tested in Arizona, with plans to roll out to additional markets in the future.

Together, these steps highlight a company intent on combining logistics with technology-driven innovation, creating efficiencies while offering broader services to merchants.

Financial Performance Strengthens Investor Confidence

DoorDash’s financials are also improving significantly. In Q1 2025, the company reported $193 million in net income, a sharp turnaround from a $23 million loss in the same quarter a year earlier. Revenue came in at $3.03 billion, up 21% year-over-year, while adjusted EBITDA rose 59% to $590 million.

With profitability now firmly within reach, DoorDash has shown it can sustain large-scale acquisitions without jeopardizing its balance sheet. The stock’s rise of over 60% in 2025 suggests investors are betting on continued global expansion and margin improvements.

Still, challenges remain. Operating in more than 40 countries exposes DoorDash to foreign exchange fluctuations, regulatory hurdles, and intensifying competition from Uber Eats, Just Eat Takeaway, and local delivery apps.

Analyst Outlook

Market watchers view DoorDash as one of the strongest players in the food delivery sector. Analysts highlight its combination of profitability momentum and global acquisitions as a key driver of future gains. However, concerns around geopolitical risks and increased competition could temper upside potential.

For now, the stock’s YTD rally shows strong investor faith. Whether DoorDash can sustain this momentum into 2026 will largely depend on its ability to integrate Deliveroo successfully while scaling new technologies like autonomous delivery.

The post DoorDash (DASH) Stock: Soars After Deliveroo Acquisition and Global Expansion Moves appeared first on CoinCentral.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

XLM Price Prediction: Targets $0.25-$0.27 by February 2026