Crypto News: Atkins Launches ‘Project Crypto’ as SEC Freezes 92 ETF Applications

U.S. shutdown halts 92 crypto ETF filings, and Project Crypto by SEC Chair Atkins ushers in a new era of U.S. digital asset regulation.

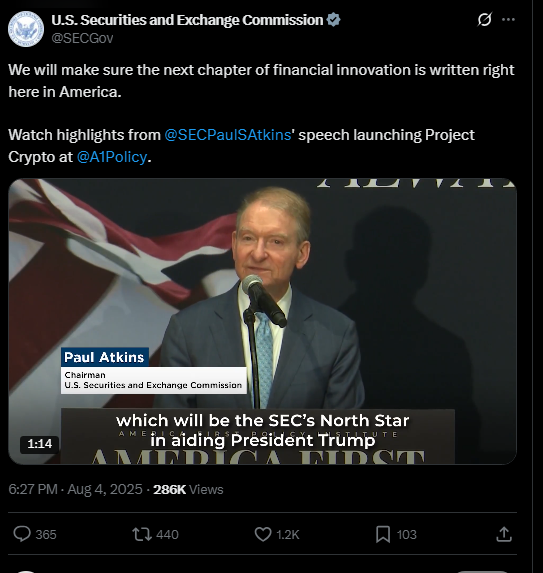

The U.S Securities and Exchange Commission (SEC) is at a crossroads in its regulation by the introduction of a project dubbed Project Crypto by Chair Paul Atkins, which aims at updating and modernizing securities law in digital assets.

This news arrives at a time when the government is shut down, essentially paralyzing 92 crypto exchange-traded fund (ETF) applications, halting much of the progress in regulation.

Source – X

Project Crypto will help in explaining how most crypto assets can be classified and regulated. Chairman Atkins underlined the fact that not all crypto-tokens are securities, and he instructed the staff to prepare articulate rules in order to clarify unresolved regulatory issues.

The program promotes crypto capital formation in the U.S. and market innovation based on blockchain.

As the staff of the SEC undertakes Project Crypto, their operation is restricted to only essential functions, as they no longer review proposals for new financial products.

This suspension has postponed the decision on more than 90 altcoin ETF submissions, such as spot ETFs on Solana, Cardano, and Litecoin.

The investors and fund managers are confronted with an unsound time schedule since the regular ETF season is paralyzed.

Crypto ETFs are stuck in Regulatory Purgatory.

The effects of the shutdown on the process of applying ETFs are acute. Approaches to various crypto-linked ETFs had been anticipated previously, but were stopped in their tracks.

Such filings had been seeking to create new avenues of investor exposure to cryptocurrencies in a regulatory environment that has been viewed as dynamic but wary.

As the SEC freezes, the applicants are waiting to resume operations as the market anticipations continue to rise.

Atkins is not giving up on the U.S. being the one at the forefront of crypto innovation.

In his address to the America First Policy Institute, he highlighted intentions to act on presidential recommendations given by the Presidential Working Group on Digital Asset Markets.

More than modernizing regulations, Project Crypto will also transform the U.S. financial markets in line with new-generation blockchain technologies.

The contrast between the launch of Project Crypto in the situation of the regulatory freeze points to the complicated nature of the current state of the U.S. crypto regulation, as a balancing act between ambition to innovate and the threats posed by political and institutional limits.

The post Crypto News: Atkins Launches ‘Project Crypto’ as SEC Freezes 92 ETF Applications appeared first on Live Bitcoin News.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

While Bitcoin Stagnates, Gold Breaks Record After Record! Is the Situation Too Bad for BTC? Bloomberg Analyst Explains!