Best Upcoming Meme Coins in Q4 2025 – Next 10x Cryptos Set to Explode

The crypto market is entering one of its most exciting phases, with Bitcoin’s strength fueling a wave of momentum across smaller altcoins. Low-cap projects are beginning to surface with strong narratives and growing anticipation ahead of their exchange launches.

Among them, some of the best meme coins stand out as potential frontrunners for the next explosive rally, offering investors the chance to position themselves before broader market exposure.

With volatility on the rise and capital flowing into high-risk, high-reward assets, these emerging projects could deliver outsized returns as the bull cycle accelerates.

Samsung–Coinbase Deal Boosts Market – Meme Coins With 10x Potential

The crypto market saw an uptick today, with total market capitalization climbing 1.73% to $4.19 trillion. Nearly half of the top 100 coins gained value in the past 24 hours. This renewed momentum is being matched by major corporate moves.

Samsung has partnered with Coinbase to offer 75 million U.S. Galaxy device owners access to its priority trading service, marking Coinbase’s largest consumer distribution effort and Samsung Galaxy’s biggest crypto initiative so far.

At the same time, Nomura Holdings is seeking to expand its footprint in Japan’s digital asset sector, with its subsidiary Laser Digital Holdings in pre-consultation with regulators to secure a trading license for institutional clients.

Together, the market rebound and these strategic corporate initiatives highlight growing confidence in the crypto sector, directing investors’ attention to emerging low cap coins that could deliver outsized gains in the next phase of the rally.

This article highlights three of the best upcoming meme coins to buy now, as outlined by crypto analyst Alessandro De Crypto, whose full analysis can be found in the video below or on his YouTube channel.

Bitcoin Hyper (HYPER)

Bitcoin Hyper is emerging as one of the most anticipated low-cap cryptocurrencies in the market. Positioned as a new layer-2 solution built on top of Bitcoin, it has quickly gained attention across multiple crypto platforms and communities.

The project has already raised nearly $22 million, signaling strong investor confidence. According to its whitepaper, the token is expected to be claimable and officially launched in Q4 2025, aligning perfectly with the peak phases of the current crypto bull run.

This timing could make Bitcoin Hyper a strategic entry point for investors seeking exposure to fresh projects instead of older large-cap coins that have already seen their major pumps. The project positions itself as a transformative Bitcoin layer-2 solution designed to tackle the network’s long-standing challenges of slow transactions and high fees.

Using the Solana Virtual Machine, it enables lightning-fast settlements, decentralized applications, and low-cost payments that extend Bitcoin’s utility beyond a store of value. It has consistently appeared on lists of upcoming cryptocurrencies expected to perform well during this cycle.

In comparison to established assets, it offers higher risk but also higher reward potential. Overall, Bitcoin Hyper stands out as a no-brainer option for risk-tolerant investors eyeing exponential gains in the months ahead. To take part in the $HYPER token presale, visit bitcoinhyper.com.

DeXRP (DXP)

DeXRP is positioned as the first decentralized exchange built on the XRP network, marking a major step for the ecosystem. Unlike other chains that already host a variety of DEX platforms, XRP has seen fewer new projects, making DeXRP’s launch a unique development.

During its early access phase, the project has already raised $7 million, highlighting strong investor interest. The token is currently priced at around $0.20, with a planned listing price of $0.35, suggesting significant upside potential from early entry.

Initial backers benefited from much lower entry points, some even under a cent, reflecting rapid value growth. With its pioneering role on XRP and strong fundraising, DeXRP is attracting attention as one of the most promising upcoming launches.

Pepenode (PEPENODE)

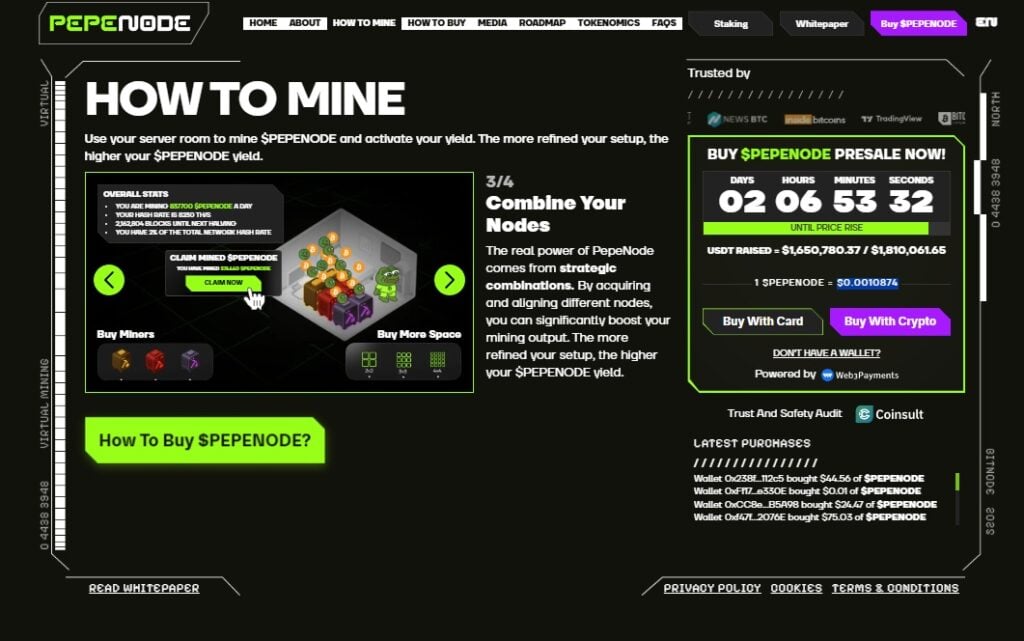

Pepenode is positioned as one of the most interesting upcoming meme coin projects. Unlike many new tokens that simply rely on hype, Pepenode introduces a crypto mining game format that allows investors to both buy and stake tokens while earning more over time.

Users can build customized virtual mining rigs by purchasing nodes with $PEPENODE tokens, combining and upgrading them to maximize mining power. The platform requires no physical computing power and rewards participants with additional bonuses in popular meme coins such as Pepe and Fartcoin.

The standout feature is its exceptionally high APY of up to 750%, making it one of the most rewarding opportunities among low-cap coins. Early investors can purchase PEPENODE tokens at $0.0010874, with about $1.6 million already raised.

Its design as a mining-style meme coin makes it stand out from traditional presales that only rely on token listings. Accumulation at this stage may provide significant upside once trading begins, especially given its current staking structure.

Pepenode’s combination of humor, staking, and strong APY positions it as a noteworthy contender in the next wave of meme tokens. To take part in the $PEPENODE token presale, visit pepenode.io.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

SOL Faces Pressure, DOT Climbs 2.3%, While BullZilla Presale Rockets Past $460K as the Top New Crypto to Join Now

Here’s How Consumers May Benefit From Lower Interest Rates