A Breakdown of the Fiscal Impact of Three UBI Scenarios in Brazil

Table of Links

Abstract and 1. Introduction

-

UBI schemes analysed and method

-

Fiscal effects

-

Distributional effects

4.1. Poverty and inequality indicators

4.2. Distributional effects in terms of winners and losers

-

Conclusion and References

3. Fiscal effects

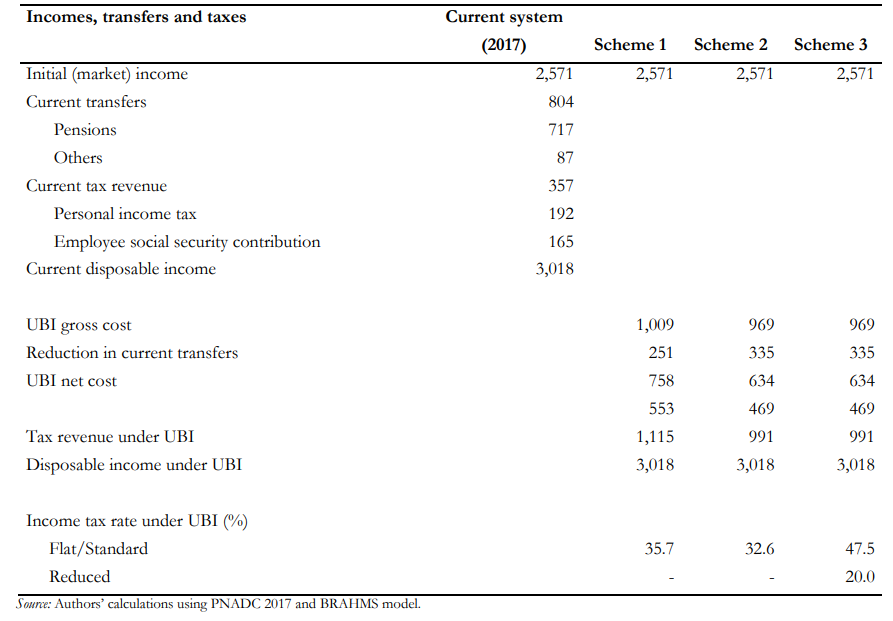

In this first section of the results some aggregates are computed that could help to determine the financial feasibility of the UBI schemes defined above. These are presented in Table 1, which shows in the first line household initial income, that is, income before tax and government transfers. Then transfer and tax aggregates are presented, followed by household disposable income, defined as income after taxes and transfers. Table 1 also shows the income tax rates calculated as required to ensure that the reforms are budget neutral, as well as the reduced rate in Scheme 3.

\ The total amount of transfers paid out by the Brazilian social security system in 2017 which are taken into account in this study was 804 billion reais. This corresponded to 12.2% of GDP and 26.6% of total household disposable income in that same year. Pension benefits (contributory and non-contributory) accounted for 89.2% of these cash transfers. The other (non-pension) transfers are essentially comprised of the unemployment benefit, the Bolas Familiar (Family Grant) conditional cash transfer, and in-work benefits (family wage and wage bonus). Looking at the revenue aggregates, in 2017 the personal income tax and employee social security contributions together amounted to R$357 billion, equivalent to 5.4% of GDP and to 16.8% of total tax revenue that same year.

\

\ The gross cost of the UBI is around R$1 trillion (about 15% of GDP in 2017) in Scheme 1, and only slightly lower (R$969 billion) under Schemes 2 and 3. However, the elimination of the current non-pension benefits along with the downward adjustment of pensions offset nearly 25% of the gross cost of the UBI under Scheme 1, and nearly 35% under Schemes 2 and 3. Note that the total removal of the existing benefits would enable the government to offset about 80% of the UBI gross cost. It can be verified that, as intentioned by the microsimulation model, total disposable income after each UBI reform matches the current disposable income.

\ The flat tax rates that ensure the budget neutrality of Schemes 1 and 2 are respectively 35.7% and 32.6%. These rates are lower than the marginal tax rate on some higher income individuals under the 2017 tax system, which reaches 38.5%, taking the personal income tax and employee social security contribution together. However, in Scheme 3, where we establish the rate of 20% on lower incomes, the marginal tax rate on higher incomes must be 47.5% for revenue neutrality.

\ Although total disposable income before and after each reform is equal, at the household level the UBI reforms produce changes in disposable income that vary substantially across income groups, both in magnitude and direction. The resulting distributional effects are examined in the next section.

\

:::info Authors:

(1) Rozane Bezerra de Siqueira, Department of Economics, Centro de Ciências Sociais Aplicadas, Universidade Federal de Pernambuco, Av. dos Economistas s/n, Recife-PE, CEP 50740-580 (rozane_siqueira@yahoo.com.br);

(2) José Ricardo Bezerra Nogueira, Department of Economics, Centro de Ciências Sociais Aplicadas, Universidade Federal de Pernambuco, Av. dos Economistas s/n, Recife-PE, CEP 50740-580 (jrbnogueira@yahoo.com.br).

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

[11] BRAHMS is a proprietary model. For its details, see Immervoll, Levy, Nogueira, O’Donoghue, and Siqueira (2006).

\ [12] PNADC microdata is publicly available and can be accessed at IBGE’s PNADC home page, https://www.ibge.gov.br/estatisticas/sociais/rendimento-despesa-e-consumo/17270-pnad-continua.html?=&t=downloads

\ [13] More details on the essential features of the microsimulation model used in this study are provided in Immervoll et al. (2009).

You May Also Like

Trump Issues an Ultimatum to Wall Street

Best Crypto Presale 2026: Strike’s New York BitLicense Opens Bitcoin to 8.3 Million New Residents as Samson Mow Challenges the Bitcoin Scarcity Narrative and Pepeto Builds Ahead of the Capital Wave