Syndicate becomes first DAO to release compliant financials

While quarterly financial reports are not new for companies, they are new for DAOs, potentially setting a new standard for transparency.

- Syndicate released its full quarterly financial report, compliant with U.S. law

- Public corporations are required to publish these reports, but DAOs are not

- The move makes it the first DAO to publish its financials under Wyoming’s DUNA framework

For the first time in crypto history, a decentralized network has filed professional-grade financials, potentially setting a new standard for transparency. On October 15, the Syndicate Network Collective published its third quarter report, up to the standard for U.S. public firms.

Prepared by Cowrie Administrator Services LLC, the report shows everything from token holdings to deferred tax liabilities. This includes the Syndicate treasury’s cash position, accounting methodology, and tax classification.

Namely, as of September 30, the DAO held $138.4 million in SYND (SYND) tokens as well as $285,000 in cash. As for accounting, it is based on an accrual basis with fair-value accounting for token holdings. The organization is also classified as a U.S. C Corp for tax purposes.

Wyoming enables Syndicate DAO move

This is the first financial disclosure since the introduction of the Decentralized Unincorporated Nonprofit Association into Wyoming law. Namely, the DUNA legal structure enables DAOs to operate with real-world legal recognition.

Still, until recently, no company has taken it upon itself to offer the same level of transparency that public companies are required to provide by law. This is a problem, as a lack of transparent financials can lead investors to make bad investment decisions and shield companies from scrutiny.

You May Also Like

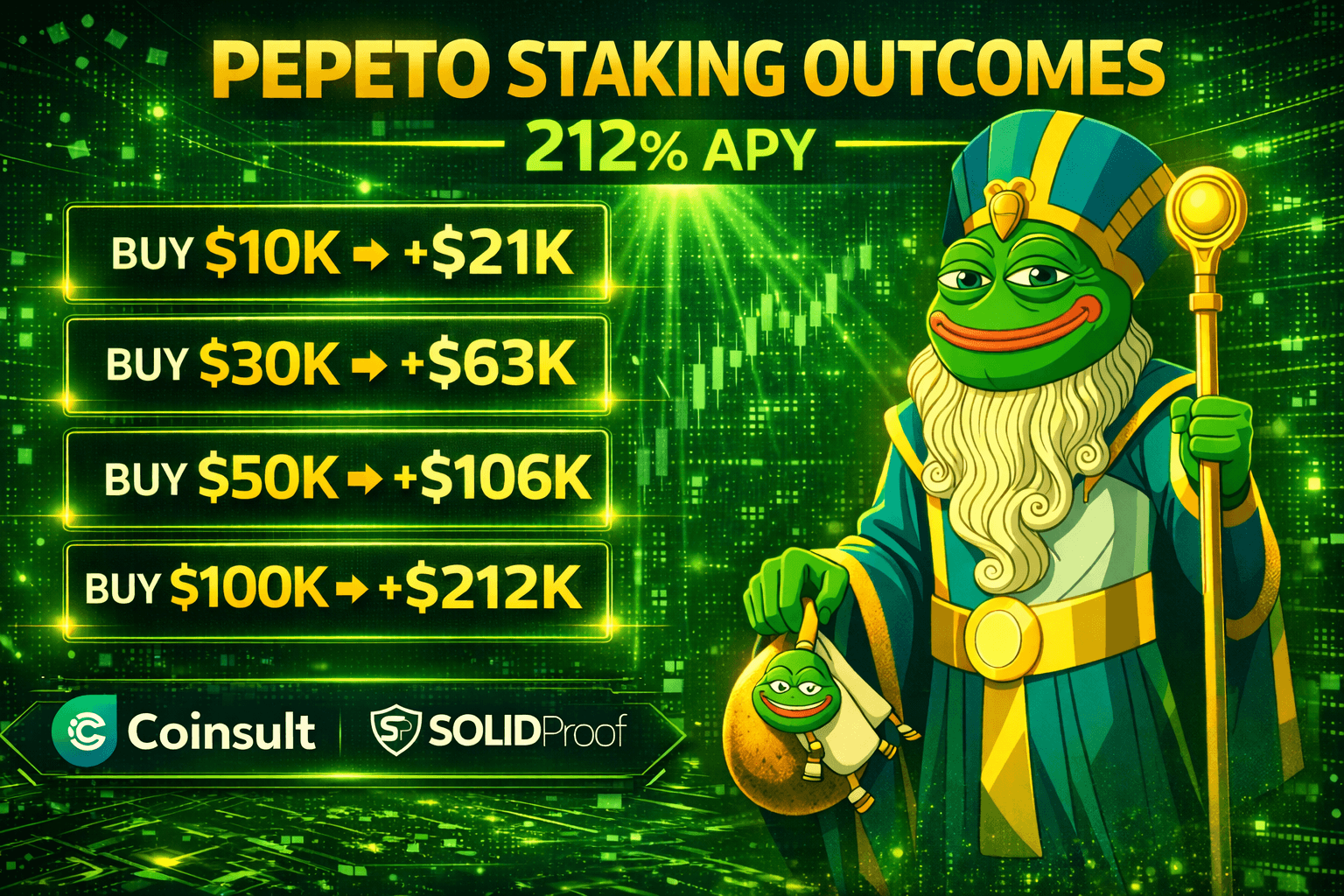

Top 100x Coin to Buy: Pepeto, XRP, Dogecoin, and Solana Lead the Market Pulse This February

MYX Finance price surges again as funding rate points to a crash