Billionaire Paul Tudor Jones Exits Palantir for Quantum Computing Stock Rigetti – Here’s Why

TLDR

- Paul Tudor Jones’ hedge fund Tudor Investment Corporation sold all 175,212 Palantir shares in Q2 2025

- Jones purchased 905,700 shares of quantum computing company Rigetti Computing in the same quarter

- Palantir trades at high price-to-sales and price-to-earnings multiples compared to software peers

- Rigetti generates minimal revenue and burns cash but has potential catalysts with Ankaa-3 and Cepheus-1 systems

- Tudor Investment holds both call and put options on Rigetti, showing a hedged position

Paul Tudor Jones’ Tudor Investment Corporation exited its entire stake in Palantir Technologies during the second quarter of 2025. The firm sold 175,212 shares of the AI software company.

Rigetti Computing, Inc., RGTI

At the same time, Jones initiated a position in Rigetti Computing. Tudor Investment purchased 905,700 shares of the quantum computing startup.

Jones built his reputation after predicting the 1987 Black Monday crash. His firm now oversees billions in assets across equities, alternative investments, and venture capital.

Palantir’s Valuation Concerns

Palantir transformed from a government contractor into a profitable AI platform provider. The company’s Artificial Intelligence Platform powers operations across defense, healthcare, logistics, and financial services.

The stock gained strong momentum over the past year. However, Palantir now trades at price-to-sales and price-to-earnings ratios that exceed typical software-as-a-service company valuations.

The company’s price-to-sales multiple stands well above its industry peers. Jones likely viewed this as a reason to take profits and rotate capital elsewhere.

For a macro-focused investor like Jones, exiting premium-valued positions fits his strategy. He focuses on identifying market turning points rather than following momentum trades.

The Quantum Computing Bet

Rigetti Computing represents a speculative play in quantum computing. The company uses qubits instead of traditional binary bits for computing operations.

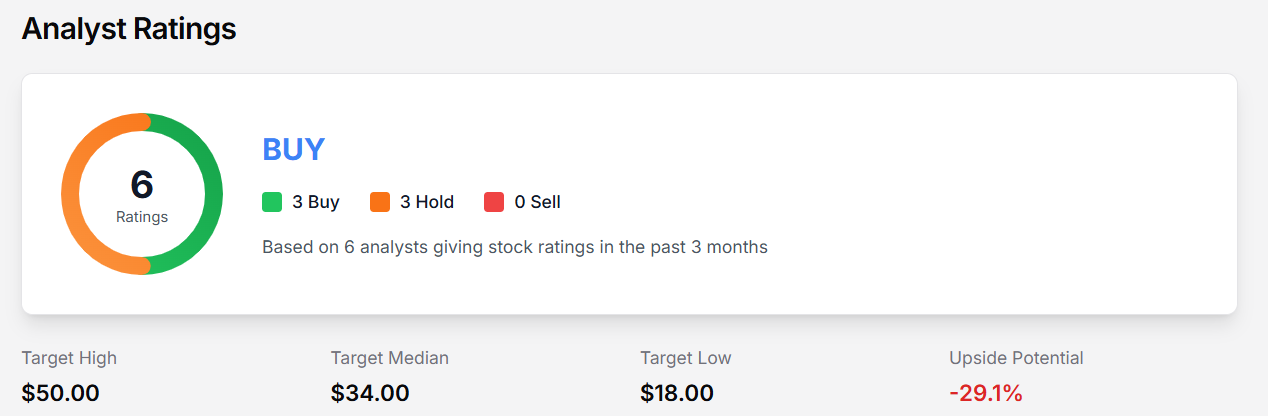

Source: Knockoutstocks

Source: Knockoutstocks

Some analysts estimate the quantum AI market could reach $10 trillion long-term. This projection attracts investors looking for emerging technology opportunities.

Rigetti currently generates little revenue and continues to lose money. The company has not shown a clear path to commercial scale.

Jones may see Rigetti as a high-risk trade ahead of potential catalysts. The company is developing its Ankaa-3 and Cepheus-1 quantum systems.

Progress updates on these systems could drive interest in the stock. Rigetti competes with companies like IonQ, D-Wave Quantum, and Quantinuum.

Tudor Investment holds both call and put options on Rigetti shares. This hedged position shows the trade is not a simple directional bet.

The options strategy aligns with Jones’ approach to risk-adjusted investing. It allows participation in potential upside while limiting downside exposure.

Rigetti’s market cap stands at $16 billion as of October 16, 2025. The stock trades at $47.92 per share.

The post Billionaire Paul Tudor Jones Exits Palantir for Quantum Computing Stock Rigetti – Here’s Why appeared first on Blockonomi.

You May Also Like

The Bitcoin network has produced its first block supporting BIP-110, sparking debate over restrictions on the use of on-chain data.

The U.S. CFTC appointed former federal prosecutor David Miller to lead law enforcement.