The Only 3 Altcoins You Need to Watch for Parabolic Gains After the Market Bottoms

October 10th will go down in history. Countless altcoins experienced a dizzying fall, with some seeing their prices plummet to nearly zero within minutes. To be precise, over $19 billion worth of positions were liquidated, impacting more than 1.6 million traders, with individual positions exceeding $200 million. These events served as a message that volatility is still there even in a market that looks mature.

Today, the market is showing signs of stabilization. Trading volumes are on a ballpark level, the prices are ranging, and the sharper investors are already scouting for solid and undervalued projects that might skyrocket during the next rally. Against this backdrop, three altcoins show unshakeable strength: Solana, Chainlink, and Digitap.

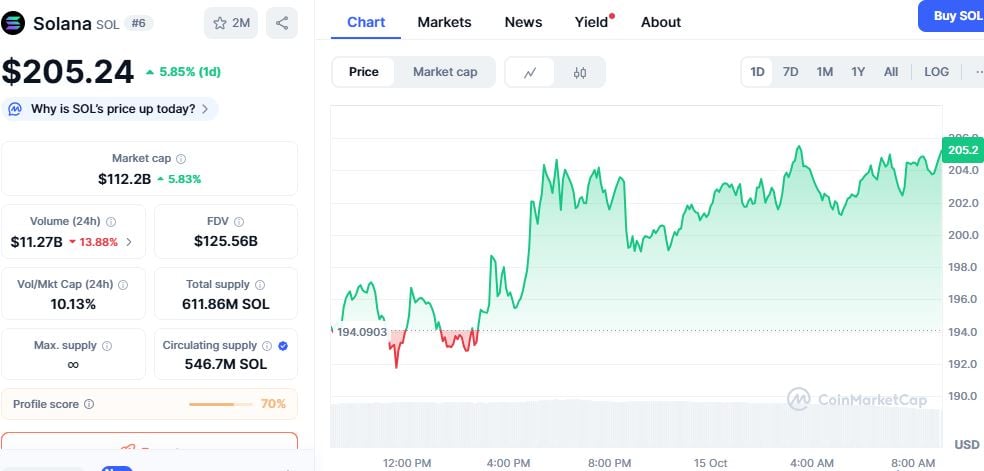

Solana – The Comeback of a Performance Giant

Solana is one of the most high-performance and robust networks in the crypto ecosystem. Despite the turbulence of October 10th, its infrastructure remained unaffected, and there was no disruption in DeFi and NFT activities.

SOL token’s price has slowly been picking up since finding a local bottom. On-chain data and technical indicators are pointing to a massive bounce-back which could give SOL a way back to its recent highs and beyond, with potential levels near $300.

For investors looking to consolidate their portfolios after a turbulent market, Solana remains a strong pillar that could sustain a multi-day rebound.

Chainlink – The Safe Haven of the Decentralized World

Chainlink proved its resilience during this weekend’s plunge. Its decentralized oracles have become indispensable for many DeFi projects and institutional initiatives, guaranteeing data integrity and reliability in a volatile environment.

The tokenization of real assets, via the CCIP protocol, remains one of LINK’s growth drivers, and its strong institutional presence reinforces its position as a safe haven. Even after the sharp correction, Chainlink retains investor confidence and represents a stable, strategic project for rebuilding a post-bottom portfolio.

Digitap ($TAP) – The Jewel of Integrated Finance

The real altcoin to watch for those looking for exponential growth after the crash is Digitap. Unlike many still theoretical projects, Digitap is already fully operational via a mobile app available on the App Store and Google Play, allowing users to manage their cryptos and fiat, spend via an integrated Visa card, and enjoy a seamless, secure financial experience.

The project has raised over $700,000 and sold nearly 60 million tokens. Pre-sale is almost over, with the current price at $0.0159 and the next level already set at $0.0194, offering a potential gain of 22% for those who invest now. Early investors, who entered at $0.0125, have already achieved an ROI of 27%.

Security is another of Digitap’s strong points. The project was recently audited by Solidproof and Coinsult, guaranteeing the reliability of its smart contracts and the solidity of its infrastructure. With this combination of concrete utility, real adoption, recognized audits, and progressive returns, Digitap stands out as the altcoin to watch for a post-launch explosion.

USE THE CODE “LIVEAPP30” FOR 30% OFF FIRST-TIME PURCHASES

Digitap and Its Allies: The Key to the Next Bull Cycle

As the market gradually regains its equilibrium after this weekend’s crash, Solana and Chainlink offer the stability needed to rebuild a solid portfolio. But Digitap brings the potential for exponential growth with its integrated finance approach and a tangible product.

Today, these three altcoins represent the most coherent bets for those who want to maximize their return on investment after the flash crash.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale https://presale.digitap.app

Website https://Digitap.app

Social: https://linktr.ee/digitap.app

The post The Only 3 Altcoins You Need to Watch for Parabolic Gains After the Market Bottoms appeared first on Blockonomi.

You May Also Like

Trading Halted in Seoul: Kospi Suffers Historic Sell-off Amid Iran War Jitters

US Dollar rally pauses ahead of key US data