Stripe’s Tempo Blockchain Secures $500M Funding, Valued at $5B

Stripe, the global payments giant, is making significant strides in the blockchain ecosystem with its latest funding round for Tempo, a blockchain project aimed at revolutionizing payments infrastructure. The company successfully raised $500 million in a Series A funding, valuing the network at $5 billion. This move highlights Stripe’s commitment to integrating blockchain technology deeper into mainstream financial systems, positioning itself as a key player amid the expanding digital currency and DeFi sectors.

- Stripe’s blockchain initiative, Tempo, secures $500 million in Series A funding, valuing the project at $5 billion.

- Major investors include Greenoaks, Thrive Capital, Sequoia Capital, Ribbit Capital, and SV Angel.

- Stripe team emphasizes Tempo as an optimized layer-1 blockchain for high-scale, real-world financial applications.

- Tempo faces competition from established stablecoin providers like USDC and emerging stablecoin-focused blockchains.

- The project reflects broader industry trends driven by recent crypto regulation and stablecoin adoption.

Stripe’s Blockchain Ambitions

Stripe’s blockchain project, Tempo, has garnered considerable attention within the crypto and fintech sectors after raising $500 million in a Series A round. The funding was led by Greenoaks and Thrive Capital, with notable participation from Sequoia Capital, Ribbit Capital, and SV Angel. Interestingly, Stripe and Paradigm did not inject additional capital but are actively assisting in the project’s development. The valuation of the network now stands at $5 billion, underscoring growing investor confidence in blockchain-backed payment solutions.

Less than two months prior, Stripe had announced plans to develop its own layer-1 blockchain, in collaboration with Paradigm, a prominent crypto-focused venture capital firm. CEO Patrick Collison explained that existing blockchains are not sufficiently optimized for stablecoins and crypto payments, prompting the creation of Tempo as a dedicated, high-scale layer-1 blockchain for real-world financial applications. The team behind the project includes open-source developers from Ithaca, who are now tasked with building the payment infrastructure needed for global adoption.

Competitive Stablecoin Landscape

While Stripe has yet to announce a native token for Tempo, the project’s focus on payment infrastructure puts it in direct competition with established stablecoin issuers, particularly USDC from Circle. Launched in 2018, USDC is backed 1:1 by the US dollar and is integrated with major payment networks like Mastercard and Visa. With a current market cap exceeding $75 billion, USDC remains a dominant force in the crypto markets and DeFi space.

Earlier this year, Circle revealed plans to launch a layer-1 blockchain aimed at providing enterprise-grade services for stablecoin payments, capital markets, and foreign exchange. This effort aligns with broader industry trends accelerated by legislation like the US’s recent passage of the GENIUS Act, which introduces formal regulation for stablecoin issuance and promotes stability and transparency within the crypto markets.

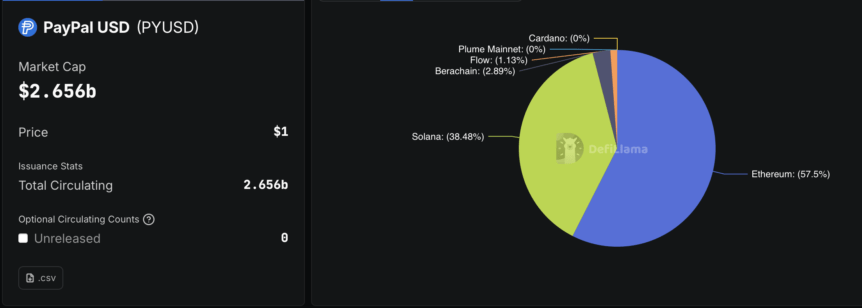

PYUSD market cap. Source: Defillama

PYUSD market cap. Source: Defillama

Beyond USDC, the European Union is also advancing its own euro-pegged stablecoins to better compete with dollar-backed tokens. As regulation and adoption of crypto and stablecoins grow worldwide, projects like Tempo and initiatives from Circle highlight an industry moving toward more scalable, regulated, and widely integrated blockchain solutions. The ongoing development and strategic investments underline the increasing importance of blockchain technology in transforming traditional finance and expanding the realm of digital assets.

This article was originally published as Stripe’s Tempo Blockchain Secures $500M Funding, Valued at $5B on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Pi Network Maps 50M Coins Daily as Mainnet Tops 9B

EUR/CHF slides as Euro struggles post-inflation data