KDA Token Crashes 60% as Kadena Team Walks Away From Project

TLDR

- The Kadena organization announced it is winding down all business operations immediately due to unfavorable market conditions

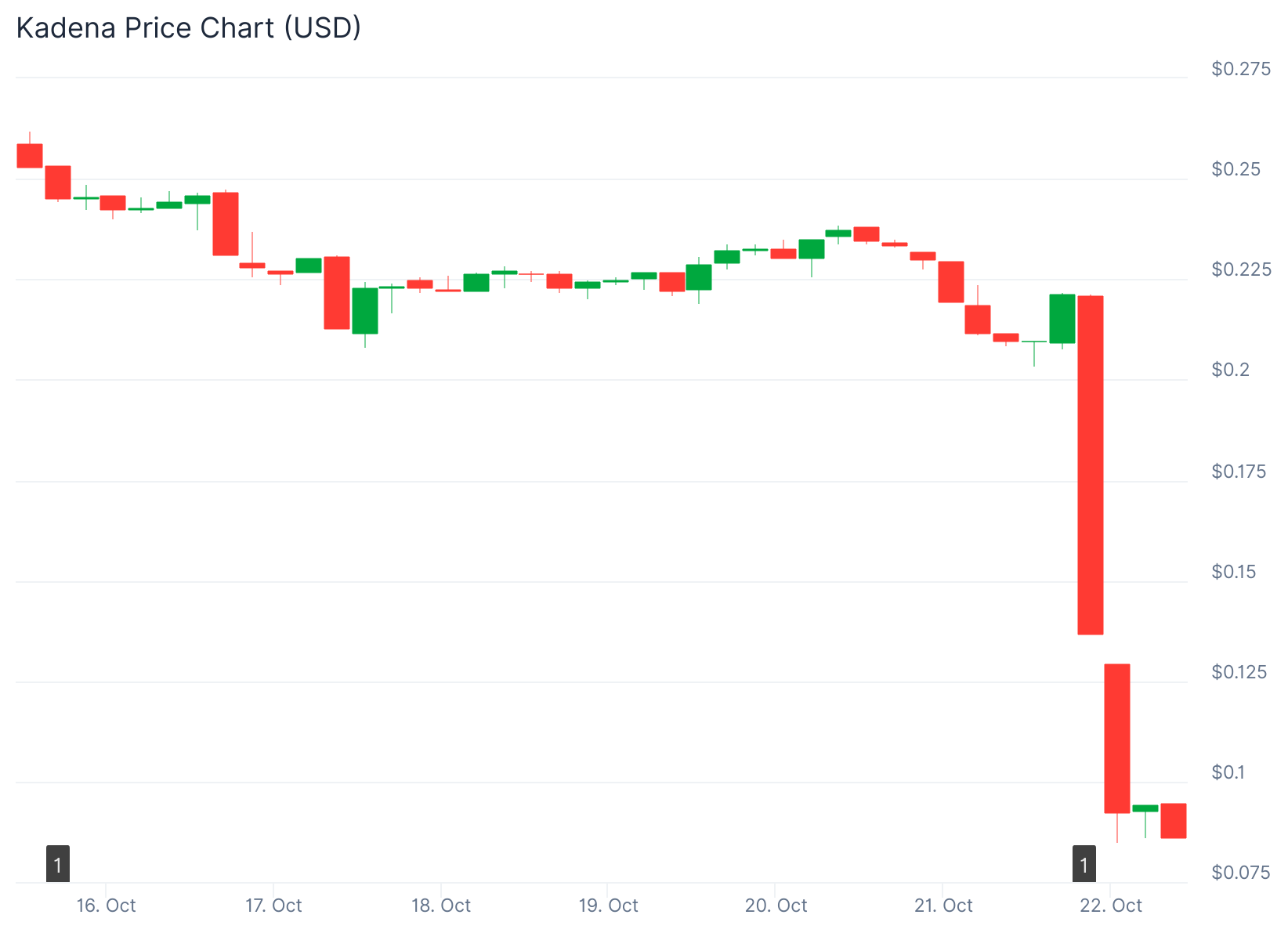

- KDA token plunged over 60% following the announcement, dropping from $0.207 to around $0.087

- The blockchain will continue operating through independent miners, with about 566 million KDA remaining for mining rewards until 2139

- Kadena was launched in 2019 by former JPMorgan and SEC employees and raised approximately $15 million in funding

- Trading volume surged 1,277% to $105.3 million as investors rushed to sell their holdings

The Kadena organization announced on Tuesday it will cease all business operations and stop maintaining its blockchain. The team cited unfavorable market conditions as the reason for the shutdown.

The announcement sent the KDA token into a sharp decline. The token dropped from $0.207 to $0.078 within hours of the news.

Kadena (KDA) Price

Kadena (KDA) Price

At press time, KDA was trading at approximately $0.087. This represents a 58% decline in 24 hours. The token now sits just 25% above its all-time low.

KDA had reached an all-time high above $27 in late 2021. The current price marks a steep fall from those levels.

The organization confirmed all employees have been notified. A small internal team will manage the transition period.

Stuart Popejoy and William Martino founded Kadena in 2019. Both previously worked at JPMorgan and the U.S. Securities and Exchange Commission. They helped launch the predecessor to JPMorgan Chase’s Kinexys blockchain.

Kadena positioned itself as a proof-of-work blockchain designed to attract institutional investors. The project raised about $15 million across three funding rounds.

Last year, Kadena announced plans for a hiring spree. Annelise Osborne told The Block the company aimed to regain market position and mindshare.

Blockchain Continues Without Corporate Support

The Kadena blockchain will remain operational through its decentralized network. Independent miners will continue to maintain the system.

The organization stated it will release a new binary to ensure smooth operation. Node operators must upgrade to maintain network continuity.

Over 566 million KDA tokens remain available as mining rewards. These rewards will continue distribution until 2139 according to the protocol’s emissions schedule.

More than 83 million KDA will unlock by November 2029. The reward structure follows the original protocol design.

The team said it would engage with the community regarding transition to community governance. Updates will be posted as they become available.

Market Response and Community Reaction

Trading volume jumped 1,277% to $105.3 million in 24 hours. The surge reflects investors repositioning their holdings rapidly.

Community members expressed frustration with the announcement. Analyst Huang described the situation as resembling an exit scam.

Ahmed Raza criticized the shutdown as poorly handled. He called it a betrayal of investors and builders who supported the project.

The sudden nature of the announcement drew particular criticism. Many felt the team lacked transparency about the decision.

The organization’s statement referenced only “market conditions” without detailed explanation. This vague reasoning fueled community concerns about the shutdown’s true causes.

The post KDA Token Crashes 60% as Kadena Team Walks Away From Project appeared first on CoinCentral.

You May Also Like

XRPL Sidechain Proposal Targets Options Trading and Leverage

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets