PolyMarket Airdrop Confirmed – Here’s What You Need to Know Ahead

Polymarket has confirmed plans to launch its long-awaited POLY token alongside an airdrop, marking a key step for the fast-growing prediction market platform.

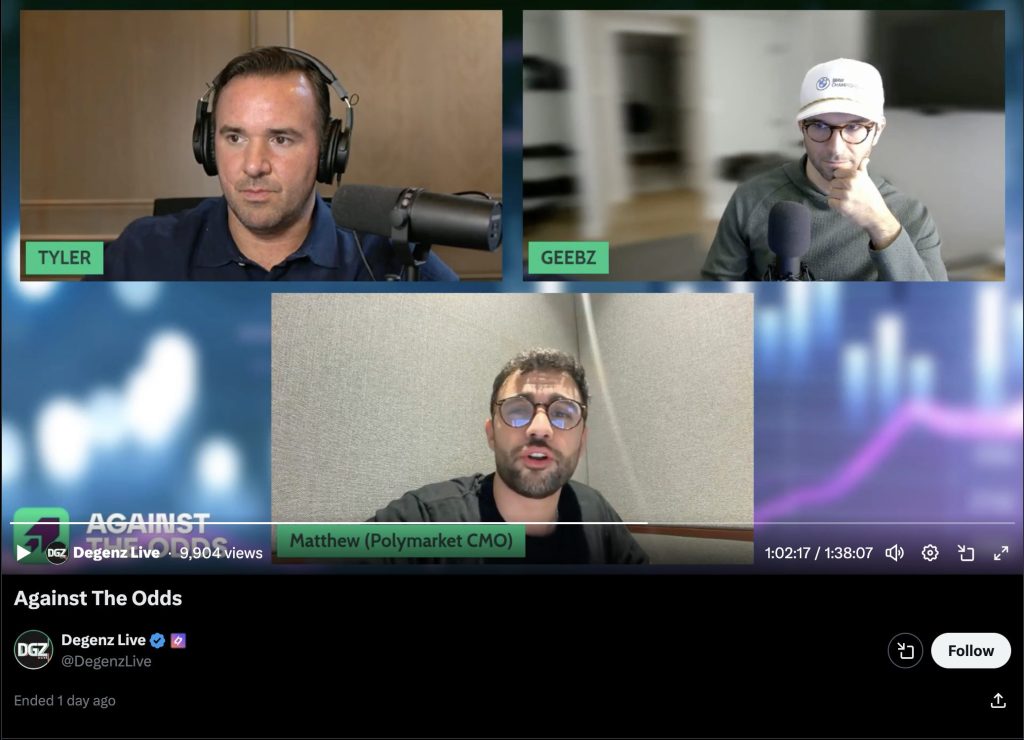

The confirmation came from Chief Marketing Officer Matthew Modabber, who said during an interview on the Degenz Live podcast Thursday that the project would “definitely” include both a token and an airdrop.

Source: X

Source: X

“There will be a token, there will be an airdrop,” Modabber said. “We could have launched a token whenever we wanted, but we want it to have true utility and longevity—to be around forever. That’s what we expect from ourselves, and that’s what everyone in the space expects from us.”

The remarks put to rest months of speculation following founder Shayne Coplan’s October 9 post hinting that a native $POLY token could eventually rank among the largest cryptocurrencies by market capitalization.

It also represents the first official acknowledgment from the company after a year of steady user growth, record trading volumes, and major institutional backing.

Polymarket Bets Big on the U.S. Market Before Rolling Out Its Token

The confirmation comes as Polymarket cements its position as the leading prediction market platform, commanding over 95% of total market volume, according to recent Dune Analytics data.

In the week ending October 13, Polymarket processed around $690 million in trading volume, outpacing rivals Kalshi, Limitless, and Myriad combined.

The company’s dominance reflects renewed trader engagement and a broader resurgence in the prediction market sector after a mid-2025 slowdown.

Despite the excitement surrounding the upcoming token, Modabber emphasized that Polymarket’s immediate focus remains on its long-awaited U.S. app launch.

The company recently secured regulatory clearance to re-enter the American market after being forced to halt operations in 2022 due to a Commodity Futures Trading Commission (CFTC) enforcement action.

“Why rush a token if we need to prioritize the U.S. app?” Modabber said. “We’ve been dying for this app for the past five years. A lot has happened because of this—regulatory issues and whatnot. After the U.S. launch, there will be a focus on the token and getting that live and making sure it’s well done.”

Polymarket’s return to the U.S. follows its $112 million acquisition of QCX LLC earlier this year, granting it a Designated Contract Market license.

This allows the company to self-certify prediction markets for American users, including those tied to sports, elections, and geopolitical events.

CEO Coplan confirmed in September that the platform had been “given the green light to go live in the USA,” calling it a major breakthrough after years of uncertainty.

The company’s comeback is happening alongside a rapid rise in both institutional attention and market valuation.

In October, Polymarket secured a $2 billion investment from Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, at a $9 billion post-money valuation.

Bloomberg also reported that the company is exploring a fresh funding round that could value it at up to $15 billion.

The firm’s valuation has multiplied over the past year, accelerating from $1 billion after a $200 million round in June 2025 led by Peter Thiel’s Founders Fund.

According to data from Dune Analytics, the broader prediction market sector has rebounded sharply since mid-2025.

Polymarket and rival Kalshi together processed over $4.3 billion in trades last month, with Polymarket alone handling $2.9 billion, capturing over 95% of total market volume.

Weekly trading volumes now exceed $700 million, with nearly 6.6 million transactions across major platforms.

The upcoming POLY token launch adds another layer of anticipation to the company’s trajectory. While no official date has been provided, market participants have begun speculating that the airdrop could be structured around user activity, potentially rewarding the most active traders.

Polymarket currently hosts about 1.35 million active users, with community data showing that just 1.7% of wallets trade more than $50,000.

Analysts say this distribution could allow for one of the broadest airdrops in crypto history, potentially rivaling Uniswap’s $6.4 billion and Pi Network’s $12.6 billion giveaways.

Additionally, analysts view the POLY token as a potential cornerstone of Polymarket’s next growth phase, likely serving governance, fee-sharing, or staking functions once the U.S. rollout stabilizes.

You May Also Like

Gold Price Struggles: Strong US Dollar and Soaring Yields Crush Gains

UK banking bug gives customers the blockchain experience