Bitcoin Soars Above $113K as US Secretary Hints at China Trade Deal

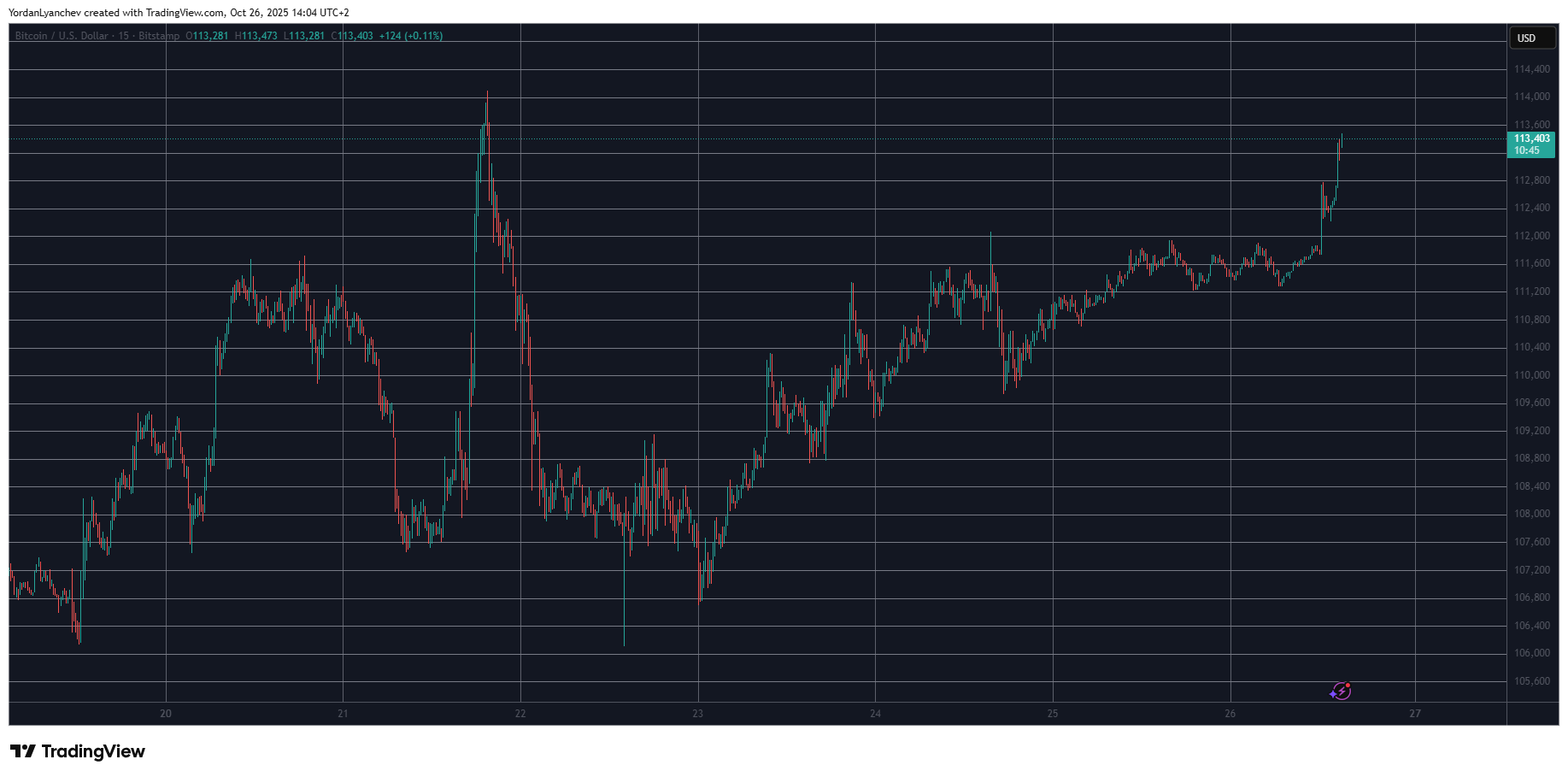

Bitcoin’s unexpected Sunday pump continues as the asset surged past $113,000 minutes ago for the first time since Tuesday.

This comes following positive news from US Secretary Bessent, who noted that China is ready to make a deal that will remove the 100% tariff imposed by the POTUS.

Recall that Donald Trump shocked the financial markets on October 10 when he claimed that China was deceitful in some sensitive economic areas and warned that the US would impose a 100% tariff against several products. Later, he confirmed the new taxation, which was supposed to become official on November 1.

However, the leaders of the two superpowers have scheduled a meeting this week in Europe. In the meantime, both parties’ delegations have met on a couple of occasions to discuss the terms.

According to a Reuters report from earlier today, the POTUS said he was confident of striking a deal with President Xi Jinping, after top economic officials reached a preliminary consensus in the trade talks.

The Kobeissi Letter noted that this is the 10th and final step of Trump’s tariff plan, which includes announcing a new deal and a subsequent surge in the financial markets.

Since most of them are closed on Sunday, the only beneficiary for now is the crypto industry. The leader, bitcoin, has rocketed to a multi-day peak of almost $113,500 after breaking past $112,000 and $113,000 earlier today. The asset plunged hard during the October 10 massacre, dropping to as low as $101,000 on some exchanges.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

The post Bitcoin Soars Above $113K as US Secretary Hints at China Trade Deal appeared first on CryptoPotato.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

How much money do you need invested to make $1000 a month?