ETF Investors Stood Strong During BTC Crash; HOLDers Showed Weak Hands, Says Analyst

Despite a turbulent October that saw Bitcoin’s price plunge by 20% amid a historic crypto market crash, Bitcoin ETFs have surprisingly experienced a modest rebound in investor interest. Following weeks of persistent outflows, recent data indicates that ETFs are beginning to attract fresh capital, signaling a potential shift in sentiment among institutional and retail investors alike as the crypto markets navigate ongoing volatility amidst macroeconomic uncertainties.

- Bitcoin ETFs halted a six-day outflow streak with about $240 million in inflows.

- Long-term Bitcoin holders sold over 400,000 BTC during the market downturn, liquidating billions worth of assets.

- Crypto market crash in October wiped out approximately $20 billion in leveraged positions, leading to sharp price corrections.

- Investor interest in cryptocurrency ETFs remains strong, with nearly half of surveyed investors planning to increase holdings.

- ETF capital flows are contributing to increased stability and market maturity in the crypto space.

The recent turnaround in ETF flows comes after a period of widespread selling by long-term Bitcoin holders, including significant liquidations by whales who cashed out around the $100,000 mark in October. Senior analyst Eric Balchunas highlighted that ETF investments, traditionally viewed as more conservative, are beginning to show signs of renewed interest. The rebound marks a potential shift as institutional and retail investors reassess their positions amid ongoing macroeconomic concerns.

Source: Eric BalchunasThe market crash in October wiped away around $20 billion in leveraged crypto bets within a single day, representing the most significant liquidation event in crypto history. The downturn was enough to prompt analysts to revise downward their Bitcoin price forecasts, reflecting the sector’s heightened volatility during turbulent macroeconomic conditions.

Long-term investors are liquidating while ETF inflows grow

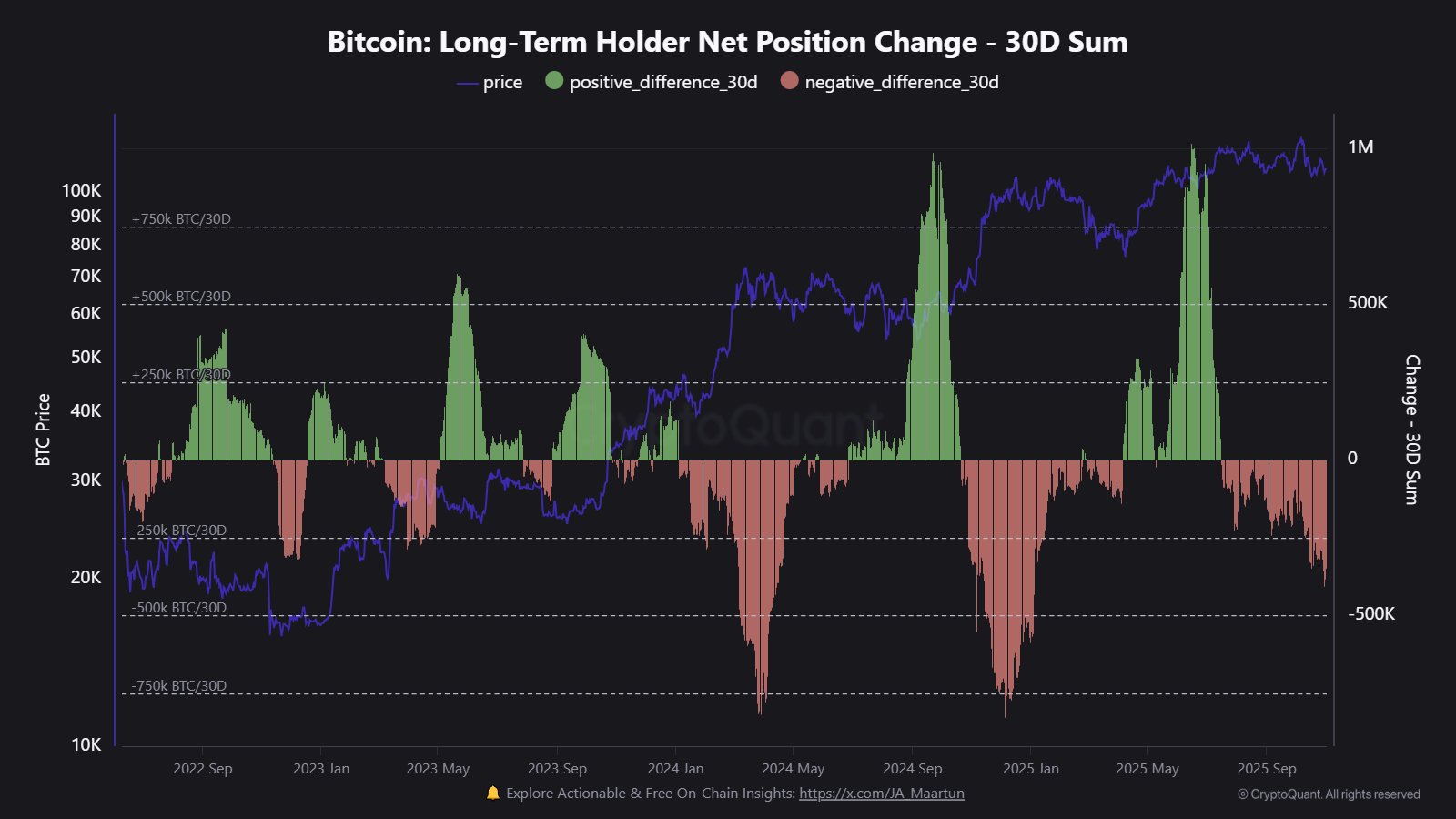

Data from CryptoQuant reveals that long-term Bitcoin holders, those who have kept BTC for more than 155 days, sold over 405,000 BTC worth approximately $41.3 billion. This trend underscores the ongoing risk-off sentiment among established investors during market downturns. Meanwhile, nearly 50% of investors, according to a recent Charles Schwab survey, plan to increase their holdings in crypto ETFs, signaling confidence in blockchain-based assets as long-term stores of value.

Net change in long-term Bitcoin holdings 2022-2025. Source: Maartunn

Net change in long-term Bitcoin holdings 2022-2025. Source: Maartunn

Market analysts note that capital flowing into Bitcoin ETFs tends to stabilize prices and reduce volatility, providing a foundation for long-term price appreciation. These passive investment channels are also viewed as a sign of market maturity and growing conviction among investors in Bitcoin’s role as a macroeconomic asset and inflation hedge.

As the crypto industry continues to evolve amid macroeconomic challenges and regulatory scrutiny, investor interest in blockchain assets and ETFs remains resilient, suggesting that the sector’s fundamentals may be steadily strengthening despite recent shocks. The increasing flow of funds into crypto ETFs indicates a desire among investors to participate in the broader digital asset market through safer and regulated channels, potentially paving the way for sustained growth in the crypto markets.

This article was originally published as ETF Investors Stood Strong During BTC Crash; HOLDers Showed Weak Hands, Says Analyst on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Now Supports Coinbase’s Crucial Crypto Futures For Institutions

Banco Santander Launches Retail Crypto Trading via Openbank in Germany