Billionaire Michael Saylor’s Strategy Buys 487 BTC for $49.9M, Total Hits 641,692

Billionaire Michael Saylor’s Bitcoin acquisition vehicle, Strategy has added another 487 BTC to its growing treasury, according to a recent SEC filing.

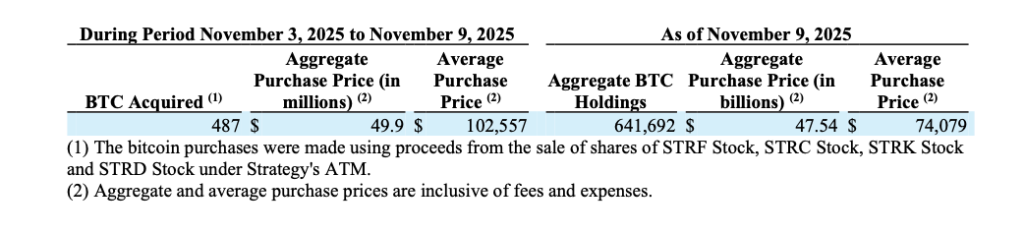

The purchases, made between November 3 and November 9, totaled $49.9 million in cash at an average price of $102,557 per Bitcoin, inclusive of fees and expenses.

This brings Strategy’s total Bitcoin holdings to 641,692 BTC, acquired for an aggregate $47.54 billion at an average purchase price of $74,079 per Bitcoin.

The company remains the world’s largest corporate holder of Bitcoin, continuing a multi-year accumulation strategy driven by Saylor’s belief that the asset represents the “world’s first digital property.”

Funded by Preferred Stock Proceeds

The filing revealed that the latest Bitcoin purchase was financed through proceeds from the sale of several classes of perpetual preferred stock under Strategy’s at-the-market (ATM) program.

Between November 3 and November 9, the firm generated approximately $50 million in net proceeds across four preferred stock offerings: Series A Strife, Stretch, Strike, and Stride.

No new common stock was issued during the period, signaling that Strategy continues to rely primarily on preferred share programs to fund its digital asset accumulation rather than diluting existing shareholders.

Accumulation Despite Market Volatility

Strategy’s latest purchase highlights its long-term conviction in Bitcoin amid an uncertain market backdrop. The company’s incremental acquisition approach—buying smaller tranches throughout periods of volatility—reflects a disciplined stance focused on long-term value rather than short-term speculation.

Saylor has repeatedly described Bitcoin as the most efficient way for institutions to preserve capital in an era of inflationary pressure and monetary instability. The continued accumulation demonstrates his unwavering commitment to a Bitcoin-centric treasury model, regardless of cyclical price fluctuations.

Largest Corporate Bitcoin Holder

As of November 9, Strategy’s total holdings of 641,692 BTC remain unmatched by any other corporation globally. At current market prices, the portfolio’s value exceeds $65 billion, showing the scale and influence of Saylor’s ongoing bet on digital assets.

The company also reported over $15.8 billion in Class A common stock still available for issuance and sale, leaving room for additional Bitcoin purchases in the future. The filing reinforces that Saylor’s vision for Strategy remains firmly tied to Bitcoin’s long-term appreciation, positioning the firm as a structural pillar in the evolving digital asset economy.

You May Also Like

Power Protocol Surges 868% in 30 Days: What On-Chain Data Reveals

Unleashing A New Era Of Seller Empowerment