Less Than Half of Investors Expect a December Interest Rate Cut

- Only 45.9% of investors expect a December interest rate cut, down from expectations on Nov. 7.

- Market analysts and banking giants forecast multiple rate cuts in 2025, but near-term uncertainty persists.

- Federal Reserve Chair Jerome Powell suggests the December rate decision remains uncertain, favoring flexibility over predetermined moves.

- Crypto markets continue to decline following the October rate cut, with investor sentiment turning negative.

- Economist Ray Dalio warns of the dangers of rate cuts fueling market bubbles amid high asset prices and low unemployment.

As the US Federal Reserve approaches its upcoming policy meeting, market participants are grappling with diverging expectations on whether interest rates will be lowered in December. Currently, just 45.9% of investors anticipate a rate cut, a sharp decline from previous levels. Meanwhile, the probability of a 25 basis point reduction in December has dropped to under 50%, reflecting increased market caution amid weakening sentiment and a downturn in the cryptocurrency markets.

Earlier in September, major banking institutions forecasted at least two rate cuts in 2025, with investment banks like Goldman Sachs and Citigroup projecting three 25 BPS reductions. This optimism for easing trends contrasts sharply with the sentiment surrounding the upcoming Federal Reserve meeting, where uncertainty prevails.

Interest rate probabilities. Source: CME GroupDecisions on interest rate adjustments profoundly impact crypto prices. Lower rates tend to increase liquidity, boosting asset prices, while rate hikes often constrict liquidity, leading to declines. Currently, the decreasing odds of a December rate cut have contributed to a bearish sentiment in crypto markets, with many investors fearing more short-term downside before the Federal Reserve potentially eases policy again.

The Federal Reserve’s recent communication signals caution. Federal Reserve Chair Jerome Powell emphasized that the next move remains uncertain, stating, “There were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it. Policy is not on a preset course.”

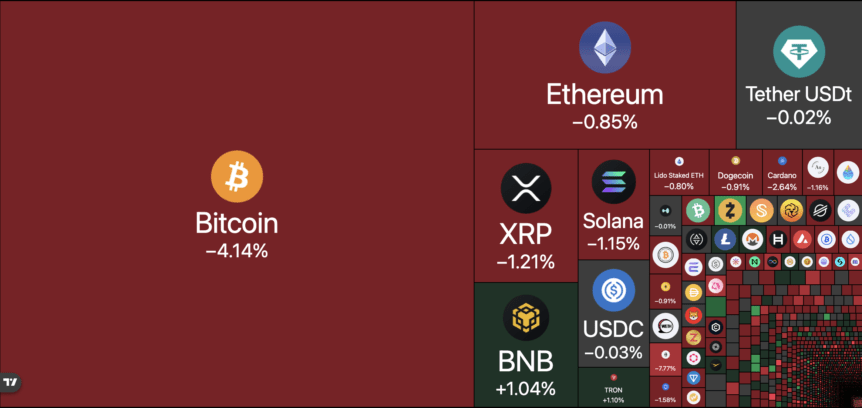

The crypto market continues to bleed, extending the October decline. Source: TradingView

The crypto market continues to bleed, extending the October decline. Source: TradingView

Market analyst Matt Mena from 21Shares noted that the October rate cut was “fully priced in” well before the Federal Reserve’s decision, indicating that markets had largely anticipated the move. Meanwhile, renowned economist and former hedge fund manager Ray Dalio expressed concerns that the Fed’s rate cuts are fueling a dangerous bubble. He warned that stimulating rates into a period of record-high asset prices and subdued unemployment is a classic sign of a debt bubble heading toward potential hyperinflation and currency destabilization.

As the crypto sector endures continued declines amid this macroeconomic backdrop, market participants remain vigilant to signals of future policy shifts. The unfolding scenario underscores how traditional monetary policy and crypto market health are intricately linked, with investors closely monitoring Federal Reserve actions for clues on liquidity and risk appetite in the rapidly evolving world of blockchain and cryptocurrencies.

This article was originally published as Less Than Half of Investors Expect a December Interest Rate Cut on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Now Supports Coinbase’s Crucial Crypto Futures For Institutions

Banco Santander Launches Retail Crypto Trading via Openbank in Germany