Yala released a report analyzing the liquidity incident involving its YU token and plans to determine a clear recovery path and other solutions by December 15th.

PANews reported on November 17th that Yala, a Bitcoin liquidity and native stablecoin project, released an update on the X platform regarding the recent liquidity issue of its YU token: On September 14th, 2025, an attacker used a temporary deployment key to create an unauthorized cross-chain bridge and withdrew 7.64 million USDC (approximately 1636 ETH), causing YU to temporarily become unpegged. However, no core protocol vulnerabilities were compromised, and there was no loss of Bitcoin reserves. The team injected $5.5 million of its own funds and supplemented liquidity through the Euler platform. By September 23rd, YU had fully recovered, and the Yala protocol had returned to normal. On October 29th, Bangkok law enforcement arrested the attacker, and most of the recovered funds are pending legal review. Some funds were converted to Ethereum in advance, and the price has fallen. Additionally, the attacker had already spent some funds, reducing the actual value recovered. More detailed information will be provided when legally permissible.

Recent retail investor withdrawals from DeFi have exacerbated market panic and liquidity shortages, impacting Euler and restricting some of its previously stabilized YU positions and liquidity. Yala is not integrated with Kamino's lending products, and wallet addresses starting with AyCJS5 are unrelated to Yala and its team. The team is focused on protecting user interests and Yala's long-term operation, and is assessing its funding needs and raising funds with law enforcement and funding partners. Due to the tight liquidity of the protocol and assets, this process will take time, and a clear solution, including a fund recovery path and next operational measures, is planned for release by December 15th.

You May Also Like

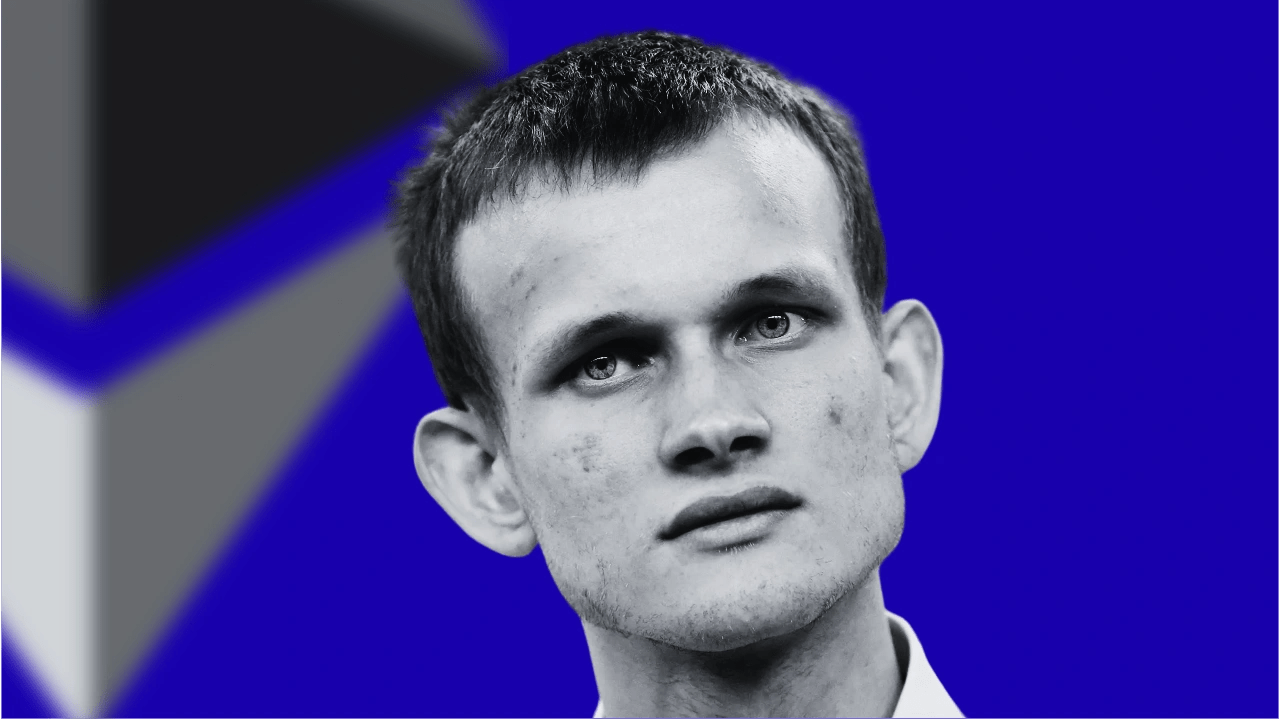

Vitalik Buterin is not happy about the current trajectory of prediction markets

River (RIVER) Plunges 19.4% as Post-ATH Correction Deepens to 83.6%