Lower your power bill with Bitcoin – Why the grid needs to welcome miners

Power markets are starting to price Bitcoin mining that can switch on and off as a grid service.

Curtailment remains elevated in regions with high renewable penetration, and short scarcity bursts continue to set value for fast demand reduction, which creates room for load that soaks midday surplus and idles during tight hours.

According to the California Independent System Operator, 179,640 megawatt-hours (MWh) of wind and solar energy were curtailed in September 2025. Market data in Europe and Asia show wider windows of negative or low daytime prices, which strengthens the case for flexible demand to complement storage and transmission buildouts.

Even after the recent crash, today’s spot hashprice is roughly $39/PH/day, and mining revenue continues to exceed typical power costs for well-managed fleets using efficient hardware and favourable power contracts.

This suggests the economic lane for demand-response (i.e., flexibly scaling operations around power pricing) remains open rather than closing.

That said, fleets with higher power costs or less efficient machines will face tighter margins, especially given the recent drop in BTC prices.

According to Hashrate Index, the six-month forward average is expected to dip to around $35 by April next year.

Bitcoin hashprice (Source: Hashprice Index)

Bitcoin hashprice (Source: Hashprice Index)

More intuitively, a 17.5 J/TH machine draws roughly 17.5 kW per PH. That means each PH consumes about 0.42 MWh per day, so a $39 hashprice equates to roughly $93/MWh in gross revenue.

That breakeven band sets the “max price to run” (before accounting for ancillary payments or hedging strategies that may justify running above that level.)

Loads can run below the threshold and should sell flexibility or switch off above it.

To make the comparison explicit, the table below shows a simplified view of miner gross revenue per MWh across two reference hashprices at a common modern efficiency.

| Efficiency (J/TH) | Hashprice ($/PH·day) | Gross revenue ($/MWh) | Implied breakeven power price ($/MWh) before opex |

|---|---|---|---|

| 17.5 | 39 | ≈93 | ≈93 |

| 17.5 | 35 | ≈83 | ≈83 |

After accounting for typical site overhead, cooling losses, and pool fees, the practical cutoff for many miners is closer to $70–$85 per MWh. Above that band, fleets begin shutting down unless they have unusually efficient hardware or hedged power.

Flexible load is not only an energy buyer, but it can also be a reliability product.

ERCOT allows qualified Controllable Load Resources to participate in real-time and ancillary markets, paying the same clearing price as generation for Regulation, ECRS, and Non-Spin services.

That framework pays mines for fast load reductions during scarcity in addition to the avoided cost of not running at high prices. ERCOT’s market design keeps scarcity events sharp but bounded, with a system-wide offer cap at $5,000 per MWh and an Emergency Pricing Program that lowers the cap to $2,000 per MWh after 12 hours at the high cap within 24 hours.

This preserves acute price signals while limiting tail risk, which supports the economics of price-responsive curtailment.

Policy is shifting from permissive to performance based, and Texas is the test case. Texas Senate Bill 6, enacted in 2025, directs PUCT and ERCOT to tighten interconnection and require participation in curtailment or demand management for specific large loads of 75 MW and above, and to review netting when large loads co-locate with generation.

According to McGuireWoods, rulemakings are underway, and the direction is toward clearer expectations for response capability, telemetry, and interconnection staging. Baker Botts notes that behind-the-meter netting and generator–load co-location will draw added scrutiny, which matters for sites paired with gas peakers that seek rapid curtailment and faster interconnection timelines.

The practical response may be modular footprints and staged buildouts that either remain below the statutory threshold or deploy capacity in tranches with explicit demand-response commitments.

Operations will also change as market plumbing evolves. ERCOT plans to move real-time to RTC+B on Dec. 5, 2025, which improves dispatch granularity and should benefit fast load that can follow sub-hourly signals.

Potomac Economics has documented how ORDC scarcity adders and brief real-time spikes concentrate a large share of economics into a small set of hours. That is where controllable demand can earn by dropping when prices climb and by selling ancillary capability across the rest of the day.

The global picture points in the same direction.

Japan’s renewable curtailments rose 38% year over year to 1.77 TWh in the first eight months of 2025 as nuclear restarts reduced flexibility.

China’s first-half 2025 curtailment rates climbed to 6.6% for solar and 5.7% for wind as new builds outpaced grid integration. Gridcog’s analysis shows the spread and depth of negative prices across European midday hours, reinforcing that the “duck-curve dividend” is no longer a California-only feature.

In the United States, wholesale averages trend higher in 2025 in most regions, yet volatility persists. That leaves value in price-responsive curtailment even where energy-only averages appear tame.

Project archetypes reflect these incentives. A roughly 25 MW modular mining site powered by flared gas reached full energization in April 2025, according to Data Center Dynamics, illustrating a waste-to-work pathway that converts otherwise flared gas into power for curtailable demand.

CAISO’s recurring midday curtailment strengthens the case for renewable co-location with load that runs through surplus hours and idles at evening peaks. Gas-peaker co-location remains relevant in markets with rapid ramping needs, although SB6 requires projects to plan for telemetry and netting requirements during interconnection.

Hardware and environmental policy shape the capex and off-grid thesis from another angle. The United States doubled Section 301 tariffs on certain Chinese semiconductors to 50% in 2025, raising the prospect that ASIC import costs rise materially depending on classification.

The Inflation Reduction Act’s Waste Emissions Charge for methane ramps from $900 per ton in 2024 to $1,200 in 2025 and $1,500 in 2026, although implementation has been contested. Regional hashrate placement will reflect these cross-currents.

Cambridge’s 2025 industry report shows the United States as the center of gravity, with surveyed firms representing nearly half of implied network hashrate.

New ultra-large sites in ERCOT face higher process overhead and explicit performance obligations, which can steer incremental growth toward modular builds, SPP and MISO South, Canada, or off-grid gas until interconnection timelines and rule clarity catch up.

For miners and grids, the math is simple, then the details matter.

Revenue per MWh is a function of hashprice and efficiency, so the run-price threshold moves with Luxor’s curve and fleet mix.

Uptime becomes a choice variable, not a constraint, as long as curtailment aligns with high-price intervals and ancillary capacity offers are qualified and dispatched.

The operational playbook is to submit load as a controllable resource, earn when the grid is tight by dropping, and run when energy is cheap enough to beat the marginal run price.

In markets where midday surplus is routine, curtailment stops being waste and becomes the runway for demand that can be dispatched like generation.

The post Lower your power bill with Bitcoin – Why the grid needs to welcome miners appeared first on CryptoSlate.

You May Also Like

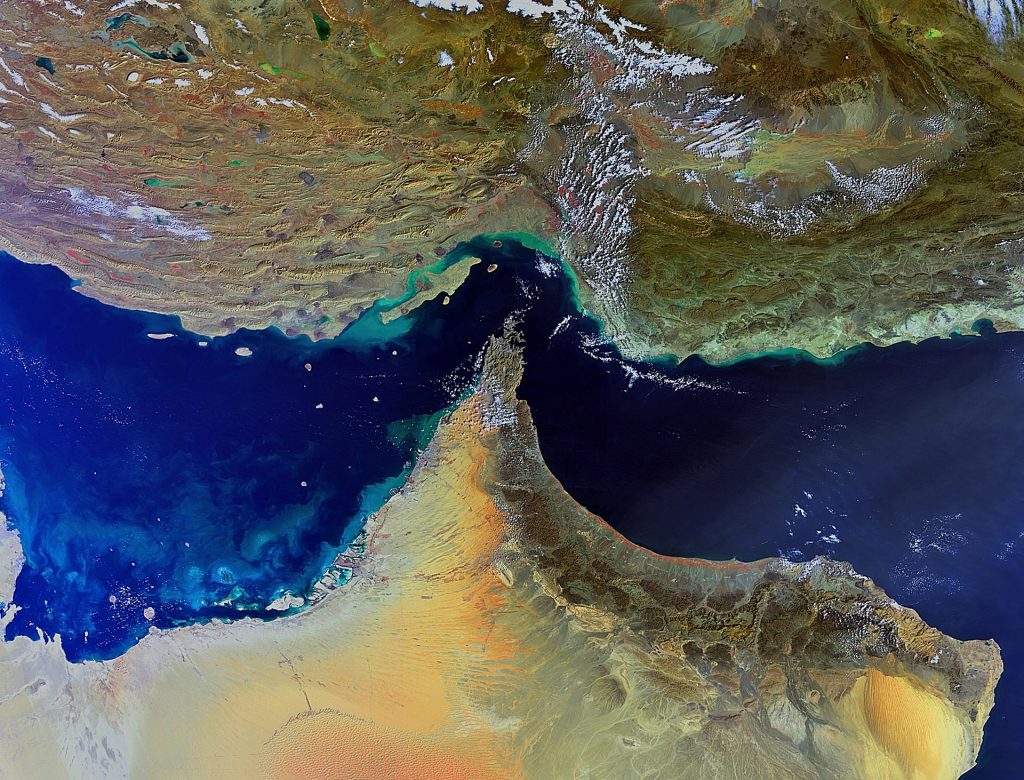

İran Hürmüz Boğazı’nı Kapatırsa Ne Olur? Verilerin Gösterdiği Tek Bir Şey Var!

TON Station Daily Combo 01 March 2026: Maximize Your $TONS Rewards Today