Shocking World Liberty Financial Investigation Demanded by US Senators Over Illegal Crypto Ties

BitcoinWorld

Shocking World Liberty Financial Investigation Demanded by US Senators Over Illegal Crypto Ties

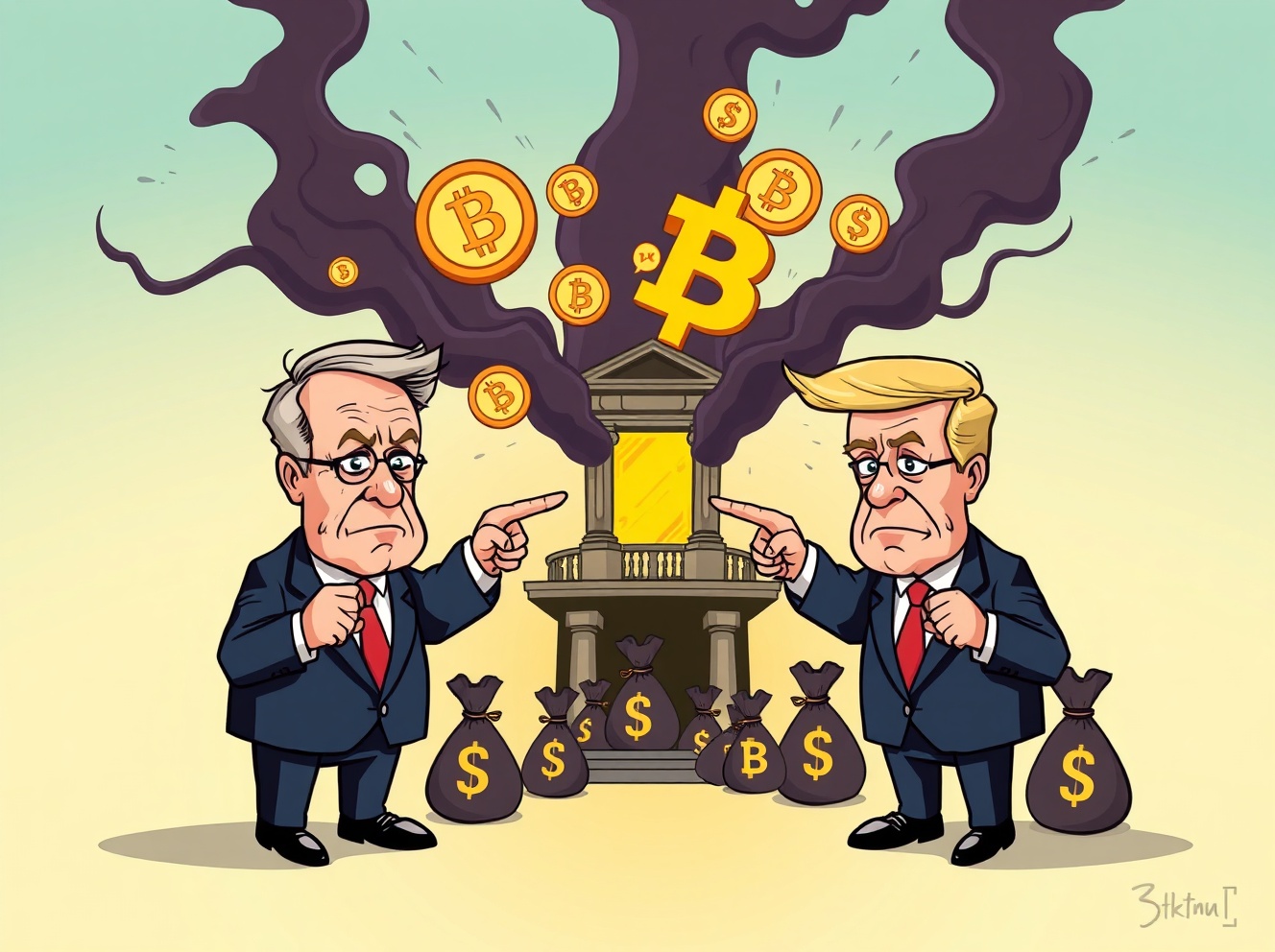

In a dramatic move that’s shaking the cryptocurrency world, prominent US senators are demanding a full-scale World Liberty Financial investigation over alarming allegations of illicit fund connections. This development comes as regulatory scrutiny intensifies around digital assets and their potential misuse.

Why Are Senators Targeting World Liberty Financial?

Senators Elizabeth Warren and Jack Reed, both known for their critical stance on cryptocurrency, have formally requested that the Department of Justice and Treasury Department launch a comprehensive World Liberty Financial investigation. Their concerns stem from reports suggesting the company sold tokens to entities linked to international bad actors.

The senators specifically highlighted several red flags in their official letter:

- Alleged token sales to North Korean hacking groups

- Connections to Russian sanctions evasion platforms

- Transactions with an Iranian cryptocurrency exchange

- Involvement with crypto mixer Tornado Cash

What Makes This World Liberty Financial Investigation So Urgent?

The call for a World Liberty Financial investigation represents a significant escalation in government oversight of cryptocurrency operations. Regulatory bodies are increasingly concerned about how digital assets might be used to bypass traditional financial controls and sanctions.

This isn’t just about one company – it’s about setting precedents for the entire cryptocurrency industry. The outcome of this potential World Liberty Financial investigation could shape how all crypto businesses operate under US jurisdiction moving forward.

How Could This Affect the Broader Crypto Market?

A thorough World Liberty Financial investigation could have ripple effects across the entire digital asset ecosystem. Market participants are watching closely because:

- It may lead to stricter compliance requirements

- Other companies might face similar scrutiny

- Investor confidence could be impacted

- International crypto regulations might tighten

The timing of this potential World Liberty Financial investigation is particularly significant given recent global events and increasing focus on financial security.

What’s Next in the World Liberty Financial Investigation Process?

As of now, World Liberty Financial has remained silent about the senators’ allegations. However, the pressure is mounting for both the company and regulatory agencies to address these serious claims. The Department of Justice and Treasury Department must now decide whether to proceed with a formal World Liberty Financial investigation.

This situation serves as a crucial reminder that while cryptocurrency offers innovation and freedom, it must operate within legal boundaries. The potential World Liberty Financial investigation underscores the growing importance of compliance in the digital asset space.

Frequently Asked Questions

What is World Liberty Financial accused of?

World Liberty Financial faces allegations of selling tokens to entities connected to North Korean hacking groups, Russian sanctions evasion platforms, an Iranian cryptocurrency exchange, and Tornado Cash.

Which senators are calling for the investigation?

Senators Elizabeth Warren and Jack Reed have formally requested the investigation through a letter to the Department of Justice and Treasury Department.

Has World Liberty Financial responded to these allegations?

As of the latest reports, World Liberty Financial has not issued any public statement or comment regarding the senators’ allegations.

Why is this investigation significant for the crypto industry?

This case could set important precedents for how cryptocurrency companies must comply with international sanctions and anti-money laundering regulations.

What agencies might conduct the investigation?

The Department of Justice and Department of the Treasury would likely lead any formal investigation into World Liberty Financial.

How long might such an investigation take?

Complex financial investigations involving international entities can typically take several months to years, depending on the scope and findings.

Found this article insightful? Help spread awareness about cryptocurrency regulation by sharing this piece on your social media channels. Your shares help educate others about important developments in the crypto space!

To learn more about the latest cryptocurrency regulatory trends, explore our article on key developments shaping cryptocurrency compliance standards and future regulatory frameworks.

This post Shocking World Liberty Financial Investigation Demanded by US Senators Over Illegal Crypto Ties first appeared on BitcoinWorld.

You May Also Like

Landmark Court Ruling Rejects Terrorism Financing Claims

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!