BTC Tanks Toward $80K, Second XRP ETF Hits US Markets, Fed Sparks Rate Cut Hopes: Your Weekly Recap

Another eventful, volatile, and mostly painful week went by, in which BTC dug a new multi-month low, while XRP saw the launch of a second ETF tracking its performance go live in the US.

But first, we need to rewind the clock to last Friday. At the time, bitcoin and the rest of the market were already in shambles. The largest cryptocurrency had lost the $100,000 level and dumped below $95,000, which was then the lowest level since late April.

Although the asset found some support during the weekend and even touched $96,000 briefly, the bears were in complete control and drove it south further starting on Sunday afternoon. The landscape worsened on Tuesday with a price slip below $90,000, but that level managed to hold, at first.

Just a day later, though, it gave in and BTC plunged toward $88,000. Another leg down followed on Thursday, with bitcoin dropping to $86,000. After a minor bounce-off to $88,000, the bears returned in full force earlier today and drove the cryptocurrency south hard to just over $80,000. This is the lowest level BTC has traded since April.

Following this calamity, in which BTC had lost $10,000 since last Sunday and more than $26,000 since November 11, the asset posted a relief rally to $85,000. It came after the New York Fed President John Williams hinted that the central bank might lower the interest rates in the near future, which was in contrast to the overall expectations for a no-change decision in December.

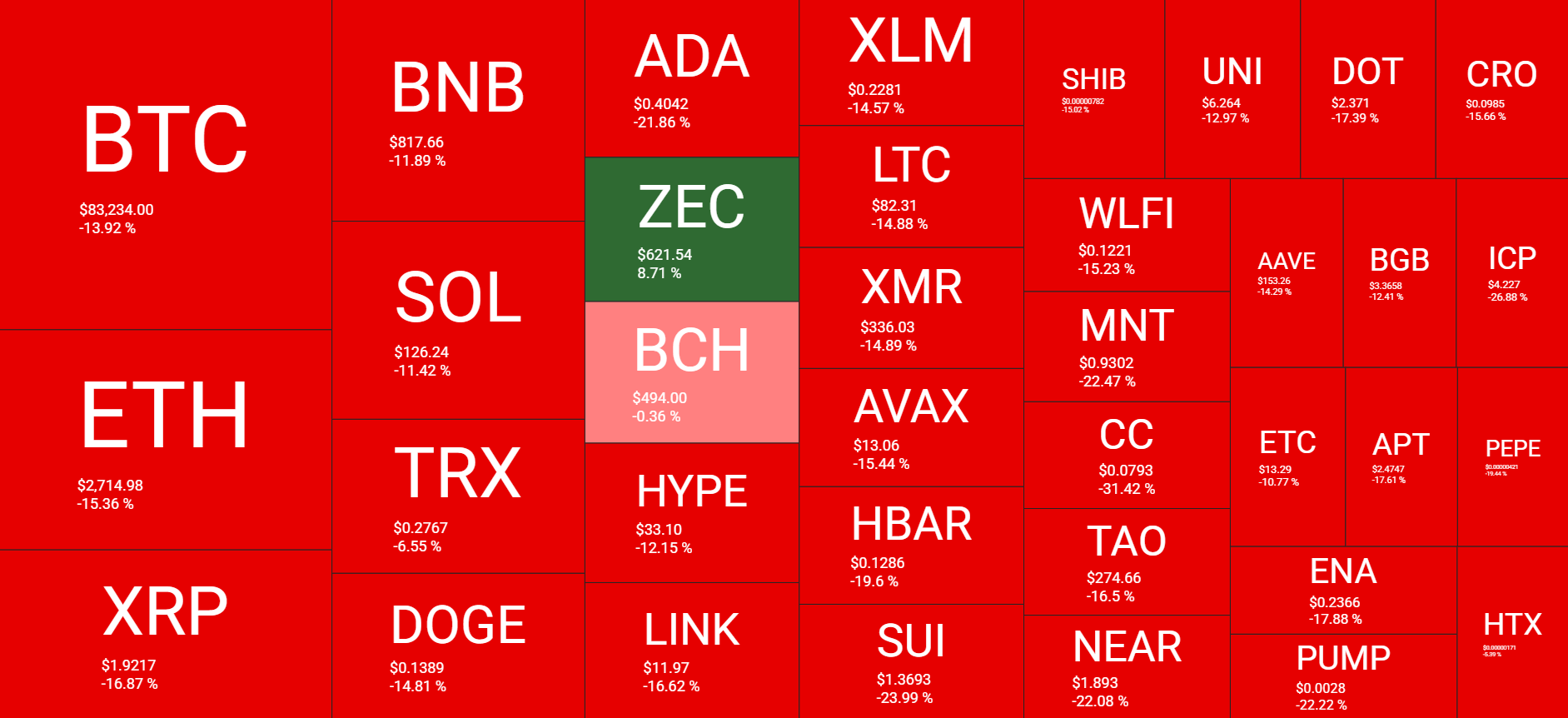

Nevertheless, BTC quickly lost the momentum and is now back down to $83,000, painting a painful 14% weekly loss. Most larger-cap alts have charted similar declines, such as ETH, XRP, DOGE, LINK, HYPE, and others. ZEC is the only exception with an actual gain this week of almost 9%.

Market Data

Cryptocurrency Market Overview Weekly. Source: QuantifyCrypto

Cryptocurrency Market Overview Weekly. Source: QuantifyCrypto

Market Cap: $2.935T | 24H Vol: $307B | BTC Dominance: 56.6%

BTC: $83,200 (-14%) | ETH: $2,715 (-15%) | XRP: $1.92 (-17%)

This Week’s Crypto Headlines You Can’t Miss

XRP ETF Debut Battle: How Bitwise’s Launch Day Matched Up Against Canary’s XRPC. Despite the overall market weakness, Ripple’s token saw the release of a second exchange-traded fund tracking its performance in the US. Bitwise’s XRP debuted on Thursday, but its launch day paled in comparison with last week’s release of Canary Capital’s XRPC.

Bitcoin’s Crash to $82K Liquidates Andrew Tate, the ‘Anti-CZ’ Whale, and More: Details Inside. On its way south, BTC liquidated over $1 billion worth of longs in the past 24 hours alone, with some notable names, such as Andrew Tate, getting wrecked. Before that, reports showed that an OG whale disposed of over $1.3 billion worth of BTC in the span of just over a month, with the latest transfer executed on Thursday.

BTC Crash Triggers Spike in $1M Bitcoin Whale Buys: On-Chain Data. On a more positive note related to whale behavior, on-chain data displayed resurgance in such activity during BTC’s initial correction this week. Over 100,000 bitcoin transactions worth more than $100,000 were executed at the time.

Kraken Submits Confidential IPO Filing With the US SEC. The popular US crypto exchange made two big moves in the past week. It secured $800 million in funding through two separate tranches and then submitted a confidential IPO filing with the US SEC.

Peter Schiff Taunts Bitcoin Over 40% Loss Against Gold. When bitcoin goes down, Peter Schiff’s criticism increases. This unwritten rule proved true once again this week as the BTC basher said the cryptocurrency’s losses are bad against the dollar but even worse when compared to gold.

Saylor’s Strategy Makes Biggest BTC Buy Since July After Sale Rumor Fizzles. In contrast to the sale rumors from last Friday, Saylor’s Strategy announced its biggest BTC purchase since July. The company accumulated 8,178 BTC last week for over $835 million and now holds nearly 650,000 units.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid – click here for the complete price analysis.

The post BTC Tanks Toward $80K, Second XRP ETF Hits US Markets, Fed Sparks Rate Cut Hopes: Your Weekly Recap appeared first on CryptoPotato.

You May Also Like

Ripple (XRP) Pushes Upwards While One New Crypto Explodes in Popularity

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets