Crypto Markets Wiped $1Trillion, but Raoul Pal sees a Strong Bitcoin Recovery

The post Crypto Markets Wiped $1Trillion, but Raoul Pal sees a Strong Bitcoin Recovery appeared first on Coinpedia Fintech News

The crypto market is going through one of its toughest periods in over the past weeks, wiping out roughly $1 trillion from the market. Prices are falling fast, traders are panicking, and rumors about weakened market makers are adding more fear to the fire.

But while the drop looks scary, macro investor Raoul Pal believes this kind of heavy shake-out has happened before and often leads to strong recoveries.

Bitcoin’s Historical Pattern Repeating Again

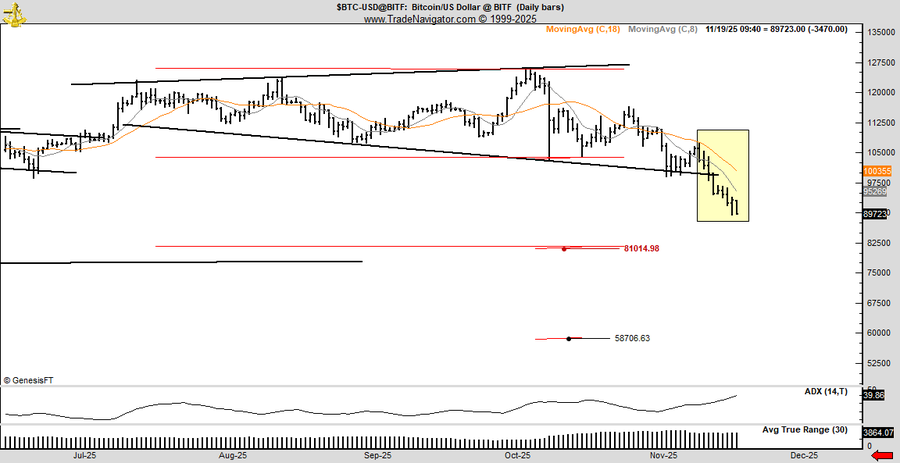

In his post, Pal shared a striking long-term Bitcoin chart, comparing today’s drop with the shocking crash of 2021. Back then, Bitcoin fell 56% in just one month, Ethereum dropped 62%, and Solana plunged 68%.

Everyone panicked, and then the market suddenly flipped, and crypto exploded to new all-time highs.

That wasn’t the only time. From 2019 to 2020, Bitcoin fell 72% before bouncing back stronger. Between 2016 and 2017, Bitcoin saw seven drops of more than 30% each, yet the overall trend remained upward.

Each time, altcoins fell even harder. Each time, fear won in the short term, and patience won in the long term.

Pal’s View: Pain Now, Opportunity Later

Despite the chaos, Pal remains calm. He says he is adding to his positions during this drop because he sees the long-term trend as strong. However, he also reminds everyone that each person’s risk level and time horizon are different.

Pal also shared an important price point to watch. According to him, if Bitcoin can break above the $85,000 level and turn it into a strong support, the next target would be $89,326. He believes this zone could act as the next step before Bitcoin decides its bigger move.

Bitcoin Could Drop to $58K

While some analysts expect a recovery, veteran trader Peter Brandt is warning that Bitcoin could still see a deeper drop.

According to him, Bitcoin made a small breakout on November 11, but instead of building strength, the price kept falling for eight straight days, creating “lower highs.” This shows that sellers are still in control and buyers are not able to push the price up.

Based on his analysis, he sees $81,000 and $58,000 as important levels Bitcoin could revisit if the selling continues. A drop to $58,000, he said, could trigger strong panic among traders.

You May Also Like

PayPal and Google team up to bring AI-powered shopping and payments

Nexus Traps Tightening Nationwide