Crypto markets rebound on Iran-Israel ceasefire

- Crypto markets extend their recovery on Tuesday, supported by easing geopolitical tensions in the Middle East and favorable regulatory signals.

- US President Donald Trump confirms a ceasefire between Iran and Israel after a 12-day war, triggering risk-on sentiment.

- The Federal Reserve removes "reputational risk" as a component of its examination programs for supervising banks.

Cryptocurrency markets trade in green on Tuesday, extending the previous day’s recovery, as geopolitical and regulatory developments fueled investor optimism. The announcement of a ceasefire between Iran and Israel by US President Donald Trump triggered risk-on sentiment for markets, while the US Federal Reserve (Fed) announced the removal of reputational risk from its bank supervision criteria, reducing pressure on institutions with crypto exposure.

Trump announces Iran-Israel ceasefire

Donald Trump announced late on Monday that a “complete and total” ceasefire between Israel and Iran, pausing the ongoing 12-day war. This news announcement led to a sharp recovery in crypto markets, with major cryptos such as Bitcoin rising by 4.33% and closing above $105,333 that day.

Later on Tuesday, Donald Trump’s Truth Social account posted that the “THE CEASEFIRE IS NOW IN EFFECT,” and called on both nations not to violate it.

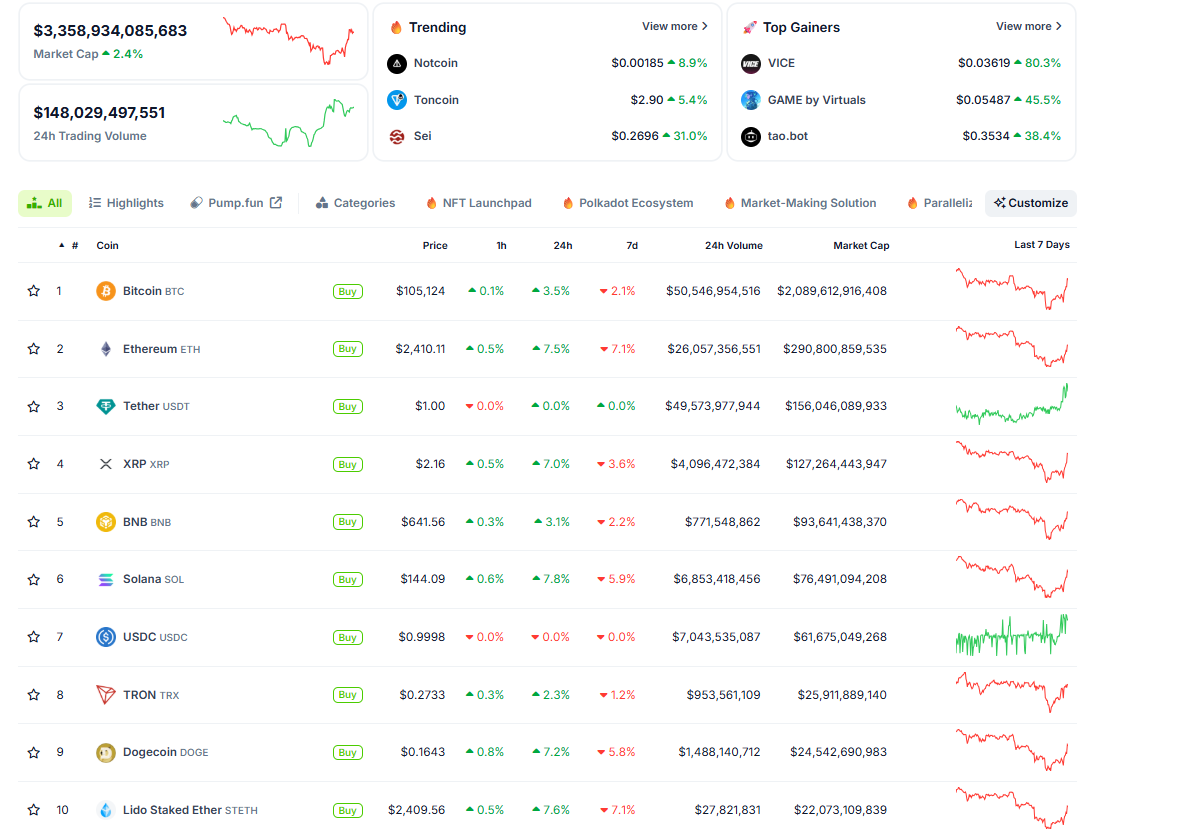

The top 10 and other altcoins continue to trade in green on Tuesday, data from CoinGecko shows.

Top cryptocurrency chart. Source: CoinGecko

The announcement of a ceasefire has fueled a wave of risk-on sentiment in the market, which has supported the riskier assets.

However, reports suggest that Israel has launched some attacks against Iran. Moreover, Iran’s Foreign Minister, Abbas Araqchi, said that if Israel stopped its illegal aggression against the Iranian people no later than 00.30 GMT on Tuesday, Iran had no intention of continuing its response afterward, per Reuters.

This, along with persistent trade-related uncertainties, keeps a lid on the market optimism, which could affect the price of riskier assets.

Fed easing policies boost cryptocurrencies

Apart from easing geopolitical tensions, regulatory policies also contribute to the recovery of the crypto market. The Federal Reserve Board announced on Monday that reputational risk will no longer be a component of its examination programs in supervising banks.

“The Board has started the process of reviewing and removing references to reputation and reputational risk from its supervisory materials, including examination manuals, and, where appropriate, replacing those references with more specific discussions of financial risk,” said the Fed in its press release.

The move follows Operation Choke Point 2.0, which prevents banks from providing custody services for crypto assets and financial services to digital asset companies. While removing reputational risk from supervision, the Fed expects banks to maintain robust risk management to ensure safety and soundness, as well as compliance with laws and regulations.

Senator Cynthia Lummis says on her X account, “This is a win, but there is still more work to be done.”

You May Also Like

Novelis’ Koblenz Plant Awarded Bronze Status in the Aero Excellence Initiative

Why Community-Driven Crypto Casinos Are Gaining Momentum in 2026