Bitcoin Price Passes $87K As Michael Saylor Says ‘I Won’t Back Down,’ Fed Rate Cut Odds Surge

The Bitcoin price edged up over 1% in the past 24 hours to trade at $87,008 as of 2:28 a.m. EST on trading volume that rose 50% to $66.8 billion.

That comes as Michael Saylor, head of Bitcoin treasury firm Strategy, struck a defiant tone amid growing skepticism over the sustainability of the business model his company pioneered and that’s recently been cloned by dozens of companies.

”I wont’ back down,” he told his 4.7 million followers on X.

Last week, the firm acquired 8,178 Bitcoin for $835.6 million, bringing its total Bitcoin holdings to 649,870 BTC.

Meanwhile, investor sentiment was boosted by comments from New York Fed President John Williams, who said the central bank still has room to adjust rates further in the near term.

Expectations of a rate cut on Dec. 10 have surged to 75.5% from just 42.4% a week ago, according the CME Group’s FedWatch tool.

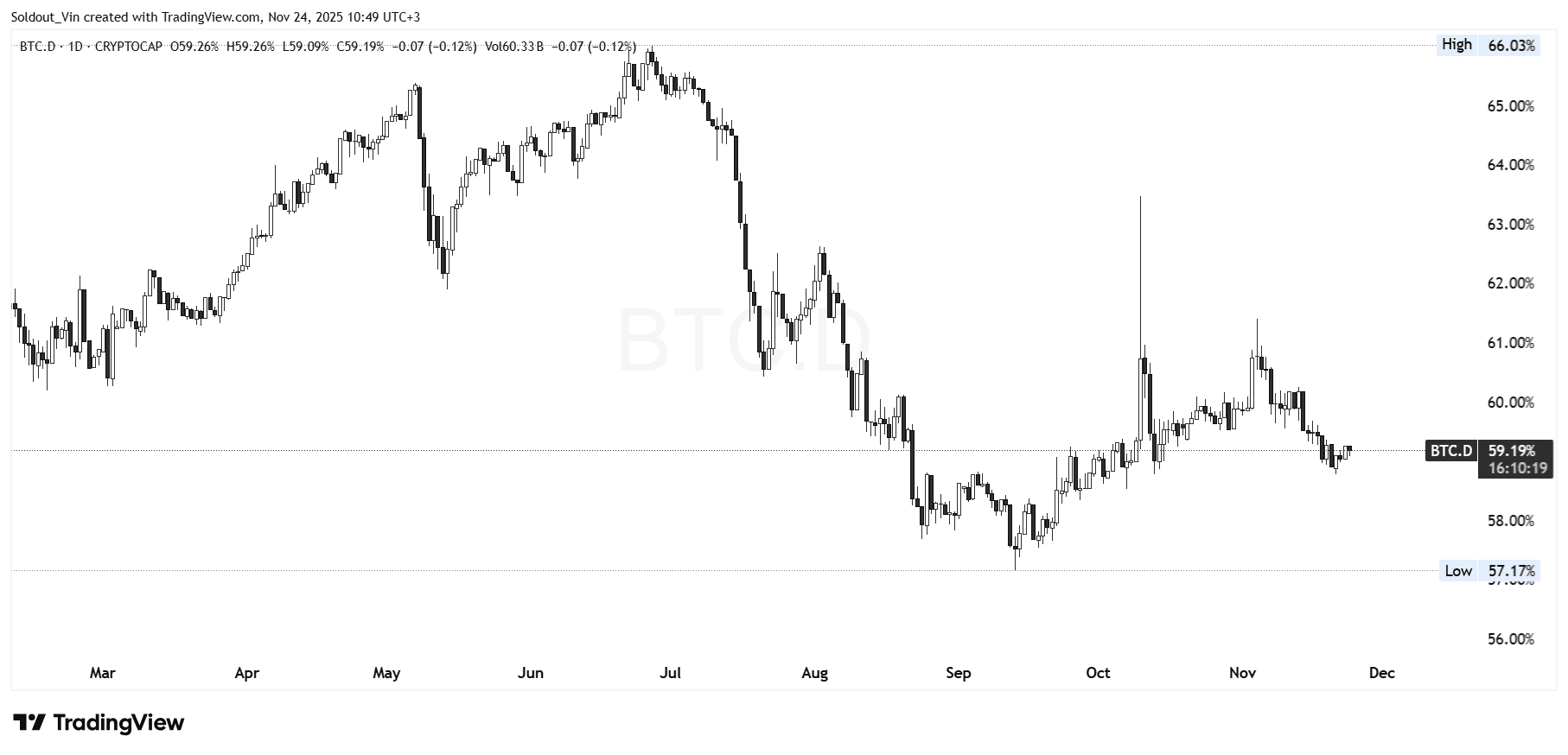

BTC Dominance Strengthens

As the crypto market corrected in recent weeks, BTC dominance still surged. Bitcoin dominance tends to surge during cyclical drawdowns, as speculative assets unwind more aggressively and capital consolidates back into the most established, most liquid asset in the ecosystem.

BTC.D: TradingView

BTC.D: TradingView

Bitcoin dominance crept back over 60% in early November and has since settled to around 59%.

Bitcoin Price Bearish – Aims For A Recovery

After surging to an all-time high above $126,000, the BTC price plunged to trade within the $113,000 consolidation zone.

The bears finally won the battle between the bears and the bulls, as the Bitcoin price dropped within a falling channel pattern to the $81,000 zone.

However, after touching this support area, the price of Bitcoin seems to be recovering above the lower boundary of the falling channel, now trading within the midline of the channel.

As a result of the continued downtrend on the 4-hour chart, BTC is now trading below both the 50-day and 200-day Simple Moving Averages (SMAs) at $89,196 and $102,063, respectively. This further cements the overall bullish trend.

Meanwhile, as the price of BTC recovers from the lower boundary of the channel, the Relative Strength Index (RSI) is also recovering, currently surging above the 50-midline level, currently at 51.

BTC Price Could Surge 6%

Based on the current 4-hour chart analysis, the BTC price appears to be attempting a relief bounce after a decline within a well-defined falling channel pattern.

The recent push toward the upper boundary of the rising channel suggests short-term bullish momentum, especially as the Bitcoin price presses against the 50-day SMA, which often acts as resistance in downtrends.

If bulls manage to secure a decisive breakout above the 50-day SMA, the Bitcoin price could surge 6.24% to $92,039. After this resistance, BTC could target the next liquidity pocket near $94,000, where prior consolidation and seller interest was.

A sustained move above that zone may open the door for a retracement toward the 200-day SMA around $102,000, though this level remains a major hurdle.

Conversely, failure to break the channel resistance may trigger another downward swing toward $82,000 support.

Overall, the chart hints at a possible short-term rebound, but the broader trend still dominates.

Related News:

You May Also Like

China Launches Cross-Border QR Code Payment Trial

Zero Knowledge Proof Auction Limits Large Buyers to $50K: Experts Forecast 200x to 10,000x ROI