MetaPlanet Secures Fresh $130M Bitcoin-Backed Loan

Highlights:

- Japanese Bitcoin-focused company has secured another loan to expand its BTC treasury.

- The Bitcoin-backed loan worth $130 million comes from a $500 million credit facility.

- The new loan brings the total amount drawn from the credit facility to $230 million.

Japanese Bitcoin investment firm Metaplanet has secured a new $130 million loan under the $500 million credit facility, first announced in October. The loan facility enables Metaplanet to borrow at any time, using Bitcoin as collateral. According to a recent update, Metaplanet finalized the $130 million loan on November 21, 2025. This comes a few days after the company secured a $100 million Bitcoin-backed loan to expand its digital assets reserves.

On October 28, Metaplanet approved a share buyback to boost its market-to-net asset value (mNAV). In addition, the company’s board passed a ¥75.4 billion ($500 million) facility to enable it to fund the buyback. These allow the company to repurchase 150 million shares, representing 13.1% of the company’s total stock.

$130M Loan Details

The lender for the $130 million Bitcoin-backed loan chose to remain anonymous. The company can repay the loan at any time, while interest will be set using the normal USD rate plus an additional margin. Meanwhile, the loan term will renew daily.

Metaplanet explained that loans backed by Bitcoin might require more BTC as support if the asset’s price drops. As of October 31, the company holds 30,823 BTC, valued at roughly $3.5 billion. Metaplanet believes that its massive token store will cushion the impacts of possible BTC price declines, aligning with its strict policy that permits only borrowing what is fully backed by the company’s holdings

The Japanese company stated:

Metaplanet Plans to Fund Three Key Projects with the Loan

With the secured loan, Metaplanet plans to buy more Bitcoin. The company also noted that it will grow its Bitcoin income program and buyback company shares if market conditions remain favourable. The Bitcoin income program will support selling options, allowing the company to earn extra income from the option fees.

Metaplanet added:

Bitcoin Spikes Slightly as Metaplanet Secures New Loan to Expand Holdings

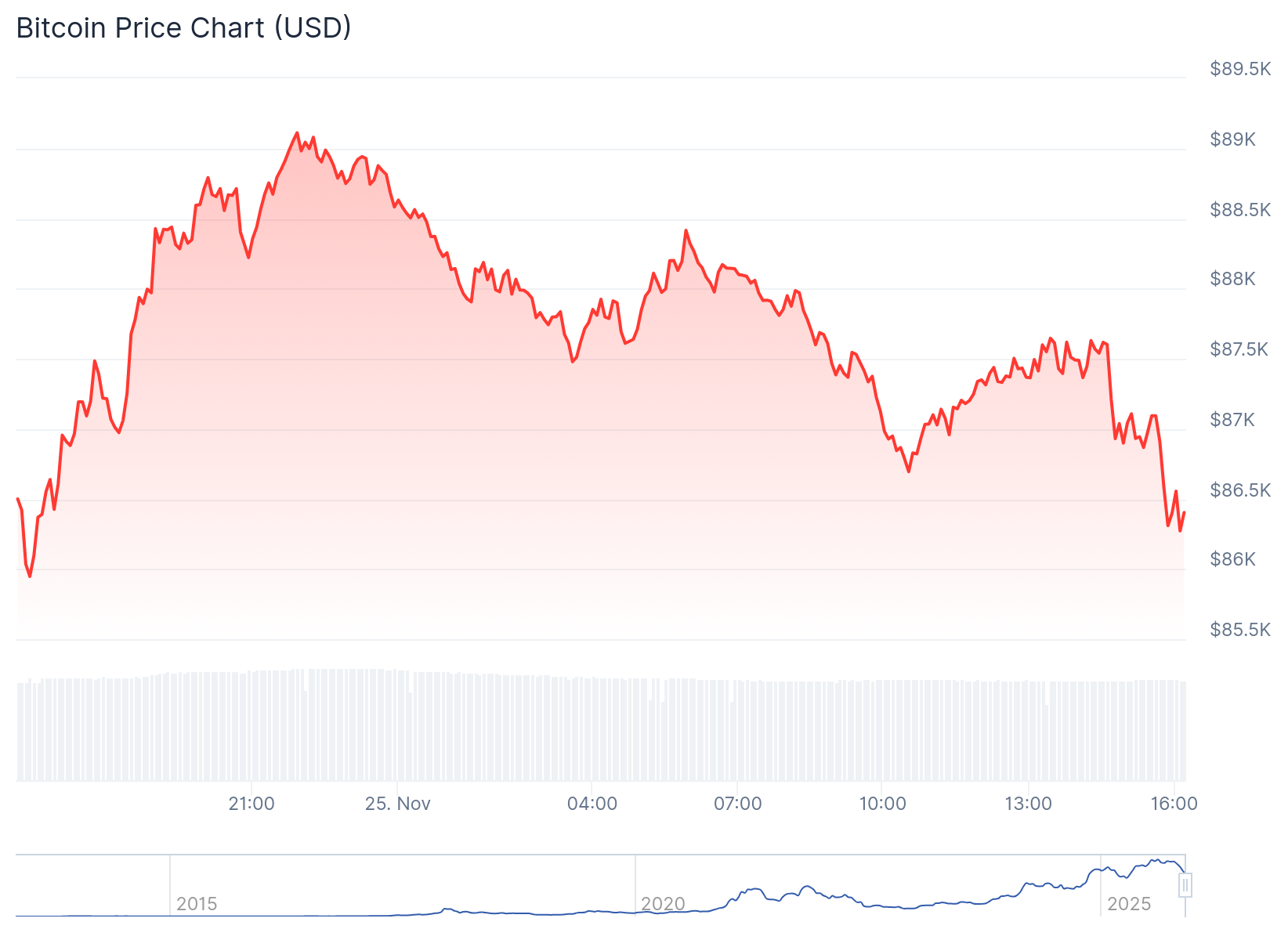

At the time of writing, the crypto market is 1.6% up with a trading volume of $160.76 billion and a market cap of $3.078 trillion. Mirroring the broader market outlook, BTC is up 0.8% in the past 24 hours, trading at $86,935 with a market cap of $1.738 trillion and a trading volume of $71.1 billion. Despite its short-term spike, BTC’s 7-day-to-date and month-to-date price change variables reflected declines of about 4.8% and 23.1%, respectively.

Source: CoinGecko

Source: CoinGecko

Coincodex data showed that Bitcoin volatility remains high at 8.88%, with a low supply inflation at 0.85%. “Fear & Greed Index” reflects “Extreme Fear” at 20, with a bearish sentiment. Renowned Bitcoin critic, Peter Schiff, recently warned that Bitcoin is finally having its IPO moment, suggesting that early holders can now sell their coins more easily. He likened BTC’s situation to a company that allows early investors to sell shares once it goes public. He added that moving much BTC from strong to weak hands will spike supply and increase future selloffs.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Bitcoin STHs Are Capitulating—60k BTC Hits Exchanges At Loss

Layer 2 Projects Social Activity Soars: Linea Outpaces Rivals with 3M+ Record Interactions