What new Labour Codes mean for you; Payment risks in EV transition

Hello,

Since the launch of ChatGPT, analysts and even Google insiders deemed Alphabet a laggard in the AI race.

Well, not anymore.

With a rally in its shares, Alphabet is poised to shake up the status quo of the world’s most valuable companies. Gains this year have left the Google parent about $300 billion away from Nvidia’s $4.2 trillion market cap.

Rave reviews for Alphabet’s new Gemini AI model and demand for its TPU chips have only pushed its shares higher. In fact, Meta Platforms is in talks with Google to spend billions of dollars on the company's chips for use in its data centres starting from 2027, as per The Information.

As far as models go, Anthropic’s no slouch, either. The company is rolling out a new version of its most powerful AI model, designed to be better at automating coding and office tasks.

Yay to no more sleepless nights poring over buggy programs!

If you were planning on using that time for a mini-vacation, though, you might want to hold onto your plans. Air India and Akasa Air said they were cancelling some flights after ash plumes from a volcanic eruption in Ethiopia disrupted operations.

Mankind’s no match for the wrath of nature.

In today’s newsletter, we will talk about

- What new Labour Codes mean for you

- Payment risks in EV transition

- Making BFSI automation work

Here’s your trivia for today: What job did "knocker-uppers" once have in Great Britain?

Explainers

What new Labour Codes mean for you

On November 21, the government brought into force four consolidated Labour Codes, restructuring a large part of India’s central labour law framework. India’s new Labour Codes formalise gig and contract work, redefine wages and benefits, tighten labour rules, and shift compliance systems, though many operational details await further notifications.

The new codes allow for modernisation with simpler compliance, fewer overlapping filings, more transparency in employment relationships and wider social protection.

Key takeaways:

- The Code on Wages introduces a statutory right to a floor wage where the central government prescribes one. It also replaces multiple legacy definitions with a single, uniform definition of “wages.”

- Advisory firm EY warns that this uniform definition could create ambiguities, for example, around incentive payments and bonuses, until implementing rules clarify how different pay components are treated for statutory calculations.

- Fixed-term employment now enjoys parity of benefits with permanent roles; importantly, fixed-term employees become eligible for gratuity after one year of service. BDO India highlights that this change may prompt employers to rethink reliance on fixed-term hires.

Funding Alert

Startup: Zinit

Amount: $8M

Round: Seed

Startup: Morphle Labs

Amount: $5M

Round: Series A

Startup: CrisprBits

Amount: $3M

Round: Pre-Series A

Explainers

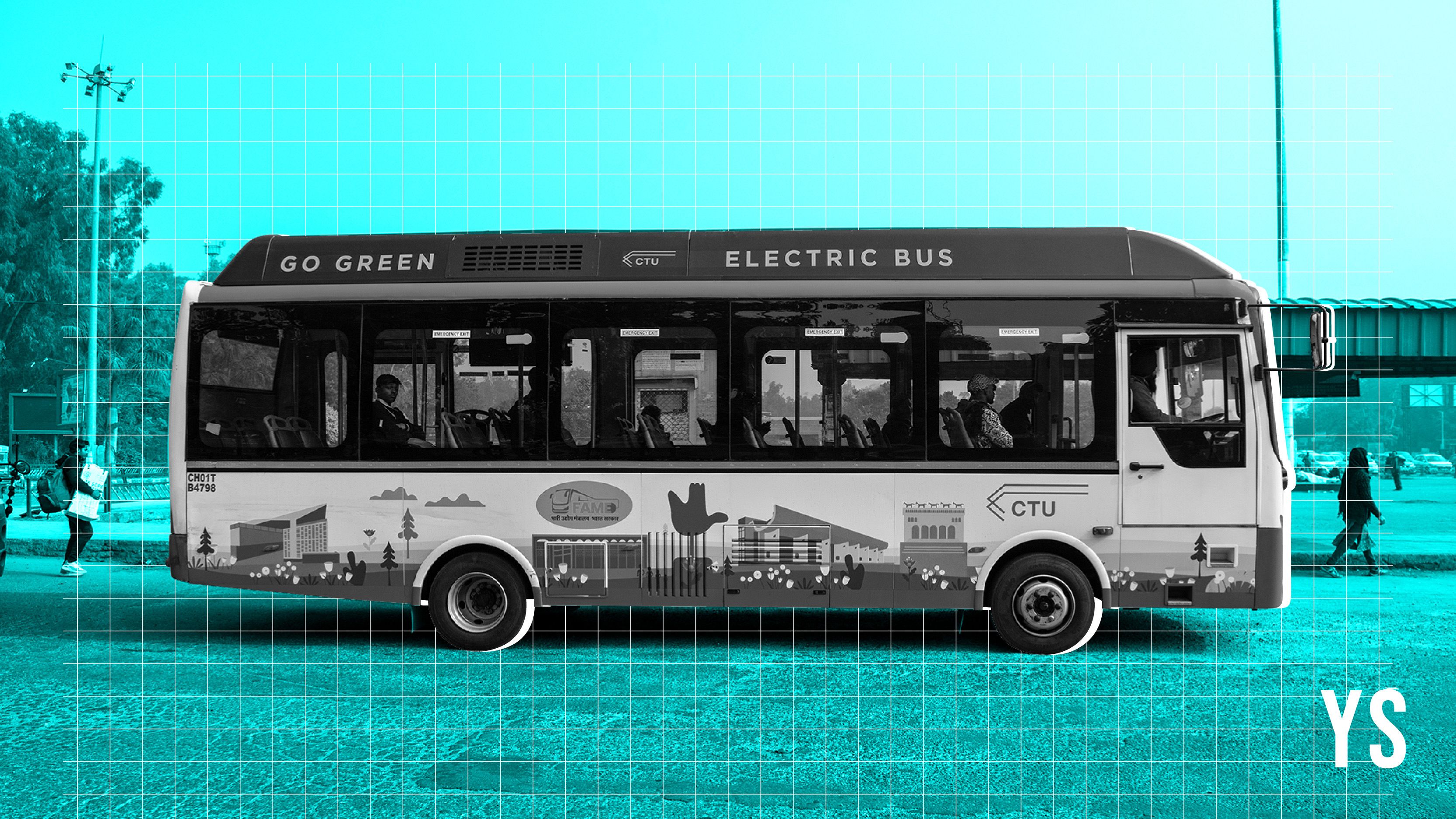

Payment risks in EV transition

In October 2024, the Ministry of Heavy Industries rolled out the PM e-Bus Sewa Payment Security Mechanism (PSM) for the procurement and operation of electric buses, which aims to mitigate payment risks and improve bankability for OEMs and operators who have entered into concession agreements with public transport authorities.

Prior to its adoption, the segment saw rising delays and defaults in payments from state transport undertakings to electric bus OEMs and financing agencies.

All the details:

- Direct Debit Mandate (DDM) is the payment mechanism under the PM e-Bus PSM that ensures automatic and timely payments to OEMs and operators through a dedicated payment security mechanism fund.

- Under this, the OEMs and the operators get paid on time, and states cannot indefinitely delay payment. The automatic recovery brings financial discipline into the payment system and discourages late payments.

- Further, the state or union territory must sign a DDM with the RBI, which will give the government the right to automatically debit from the state’s account if it fails to repay the scheme fund. However, RBI will debit from the state’s account only if enough free funds are available.

Startup

Making BFSI automation work

“More than 90% of the AI projects in BFSI fail not because the technology is weak, but because they’re not battle-tested for the industry,” Deviprasad Thrivikraman, Managing Director of Zentis AI, says. Zentis AI, incorporated in April 2025 in Trivandrum, was born from this view of what truly blocks automation in the BFSI sector.

Over the last six months, the startup—incubated at Techvantage.ai—has been working on what Thrivikraman describes as a “BFSI-native agentic automation platform”. It uses lightweight, CPU-friendly specialised language models to automate core processes in banks and insurers without demanding heavy GPU infrastructure.

Deviprasad Thrivikraman, Managing Director of Zentis AI, is building a BFSI-native agentic automation platform designed to help banks and insurers deploy AI that actually works in real-world conditions.

News & updates

- IPO: Electronics contract manufacturer Zetwerk has hired a slate of banks and plans to file draft papers for its IPO in March 2026, Reuters reported. In March, Zetwerk's CEO and Co-founder Amrit Acharya said it was considering a listing within 24 months.

- Forex: The IMF is likely to reclassify India's foreign exchange rate management regime in the near future, according to Bloomberg News. The reported shift comes two years after the international body had characterised India's FX management regime to "stabilised arrangement" from "floating" in December 2023.

- Jump: Alibaba could ramp up AI spending beyond its projected levels if demand for the technology continues to remain strong, CEO Eddie Wu said, after the Chinese tech giant reported accelerated sales at its key cloud division. Alibaba’s New York-listed shares were around 4.3% higher in pre-market trade as investors looked past a plunge in profitability at the group.

What job did "knocker-uppers" once have in Great Britain?

Answer: Waking people up by knocking on their doors or windows using a baton or long stick.

We would love to hear from you! To let us know what you liked and disliked about our newsletter, please mail nslfeedback@yourstory.com.

If you don’t already get this newsletter in your inbox, sign up here. For past editions of the YourStory Buzz, you can check our Daily Capsule page here.

You May Also Like

Senate Democrats Resist Trump’s European Tariff Plan

Wall Street rallies, Ethereum slips – But ETH/BTC tells another story