Financing Weekly Report | 21 public financing events, stablecoin company Conduit completed $36 million in Series A financing, led by Dragonfly Capital

Highlights of this issue

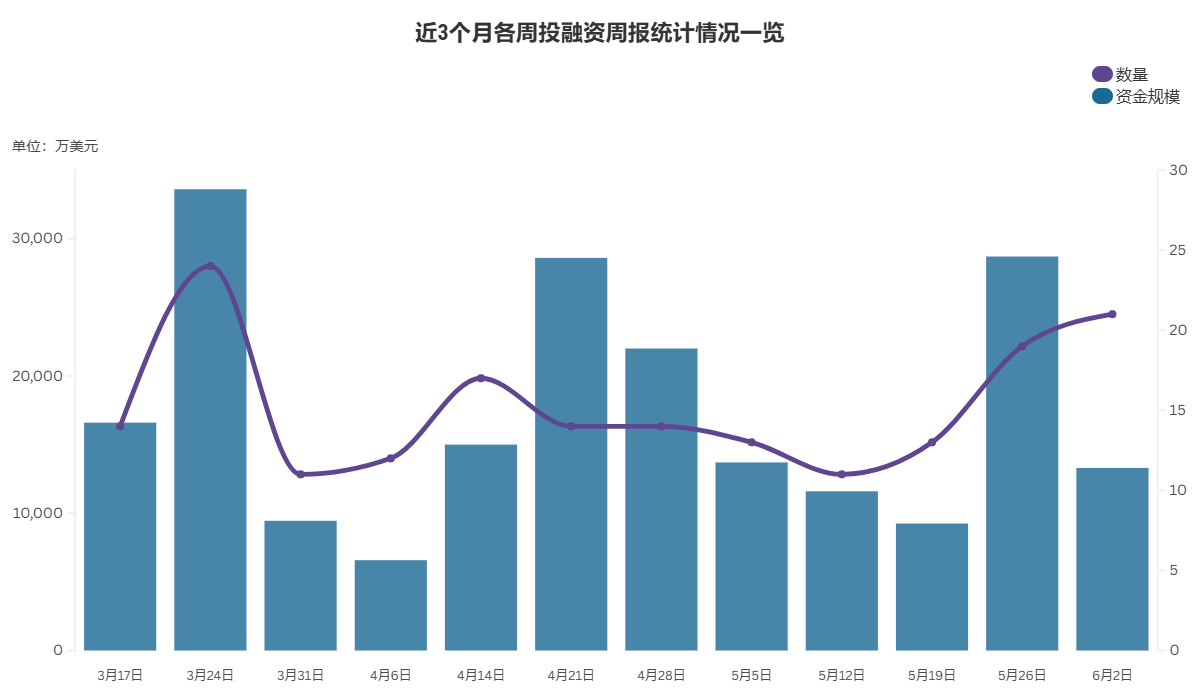

According to incomplete statistics from PANews, there were 21 investment and financing events in the global blockchain last week (May 26-June 1); the total scale of funds exceeded US$133 million, and the inflow of funds decreased compared with the previous week. The overview is as follows:

- DeFi announced five investment and financing events, among which the decentralized trading platform Dexari announced the completion of a $2.3 million seed round of financing, led by Prelude Ventures and Lemniscap;

- The Web3 game track announced two investment and financing events, among which the Web3 game distribution platform Oncade completed a $4 million financing, led by a16z crypto CSX;

- Web3+AI announced four investment and financing events, among which the crypto AI project Freysa AI completed a $30 million financing, with Coinbase Ventures and Selini Capital participating;

- The Infrastructure & Tools sector announced 7 investment and financing events, among which Donut Labs announced the completion of a $7 million Pre-Seed round of financing, led by Sequoia, Bitkraft, and HackVC;

- In terms of other applications, one investment and financing event was announced. Matador completed a second round of non-broker private placement financing of approximately 1.42 million Canadian dollars to support the purchase of Bitcoin;

- Centralized finance announced two investment and financing events, among which Velocity, a European fintech infrastructure platform, completed a $10 million pre-seed round of financing, led by Activant Capital.

DeFi

Conduit Completes $36 Million Series A Funding, Led by Dragonfly Capital

Stablecoin company Conduit announced the completion of a $36 million Series A financing round, led by Dragonfly Capital, with participation from Sound Ventures, Altos Ventures, DCG and Commerce Ventures. This round of financing brings the company's total fundraising to $53 million, with an undisclosed valuation. Conduit was founded by Kirill Gertman in 2021 and focuses on building stablecoins and related infrastructure.

Dexari Completes $2.3 Million Seed Round Led by Prelude Ventures and Lemniscap

Decentralized trading platform Dexari announced the completion of a $2.3 million seed round of financing, led by Prelude Ventures and Lemniscap, with participation from several well-known angel investors in the Hyperliquid ecosystem.

Solana Ecosystem DEX Fermi Labs Completes $1.2 Million Pre-seed Round of Financing

Solana ecosystem DEX Fermi Labs announced the completion of a $1.2 million Pre-seed round of financing, led by Equilibrium and BBig Brain Holdings, with participation from multiple angel investors. According to reports, Fermi Labs is a Web3 R&D studio focused on developing dApps and infrastructure. Its flagship product, Fermi DEX, is a decentralized exchange (DEX) that runs on the Solana blockchain and uses instant order settlement and liquidity abstraction technology. In addition, Fermi Labs also provides consulting services and educational programs.

ego.tech completes $800,000 Pre-Seed round of financing, with founders of multiple projects including Solana and dYdX participating

Solana ecosystem project ego.tech announced the completion of a $800,000 Pre-Seed round of financing. Investors include Sam Lessin of Slow Ventures, Solana co-founder Raj Gokal, dYdX founder Antonio Juliano, Wintermute founder wishful cynic (@EvgenyGaevoy), Magic Eden co-founder Zhuoxun Yin, Hustle Fund, Polygon CEO Marc Boiron, and Andrena co-founder James Smits. According to reports, Ego is a protocol designed to financialize any personal data on the Internet, and the protocol is now online. Ego aims to build a clear financial layer to evaluate the value of users' online and offline existence.

Avalon Labs announces completion of strategic round of financing, led by YZi Labs, with participation from GSR and others

Avalon Labs, a Bitcoin on-chain capital market, announced the completion of a strategic round of financing, led by YZi Labs, with participation from Mirana, CE Innovation Capital and GSR. The specific amount was not disclosed. Avalon said that this financing will support a number of initiatives including regional license applications, the launch of public funds, and the expansion of institutional lending business.

Web3 Games

Web3 game distribution platform Oncade completes $4 million financing, led by a16z crypto CSX

Web3 game distribution platform Oncade announced the completion of a $4 million financing led by a16z crypto CSX. According to reports, Oncade is committed to helping game studios increase revenue by enhancing player engagement and community interaction. Its core concept is to break the distribution model of traditional game platforms through a community-driven approach and build a game store directly for players.

Revolving Games Completes New Round of Funding Led by Pantera Capital

Web3 video game publisher Revolving Games announced the completion of a new round of financing led by Pantera Capital to expand its game distribution ecosystem based on RCADE Network. The specific amount was not disclosed. The company plans to accelerate the release of the "War of Nova" and "Hatchlings" series and the new work "Skyborne: Phoenix Flight", which will be launched in a PC limited beta version in the third quarter of 2025.

AI

Eternis AI, the team behind Freysa AI, has raised $30 million from Coinbase Ventures and other companies

Crypto AI project Freysa AI has completed $30 million in financing through its affiliated entity Eternis AI, with participation from Coinbase Ventures and Selini Capital. The project is developed on the Base blockchain and aims to build a "personal AI digital twin". A spokesperson for Selini Capital said the company invested in Freysa's token round involving its native FAI token, but declined to comment on the $30 million figure or share more details. A spokesperson for Coinbase Ventures said the company invested in Eternis as part of the project's $30 million financing. The Freysa team revealed in its Telegram group this month that it had received more than $30 million in funding.

Eternis AI was co-founded in 2024 by Srikar Varadaraj (who founded the credit scoring project Spectral), Pratyush Ranjan Tiwari (former Celo member), Ken Li (former Binance Labs investment director) and Augustinas Malinauskas (former Views CTO). The team claims that its members include PhDs in cryptography and theoretical physics and serial entrepreneurs.

Donut Labs raises $7 million to launch first AI-driven “proxy-style” encrypted browser

Donut Labs, headquartered in New York, announced the completion of a $7 million Pre-Seed round of financing, led by Sequoia, Bitkraft, and HackVC, with participation from ecosystem leaders such as Solana. Donut aims to create the world's first "agent-based" crypto browser, with a built-in AI agent that can identify web page intent and automatically execute on-chain transactions, such as currency swaps, mining, and asset optimization. The browser integrates wallets, DEX, and decentralized network access functions, and plans to develop into a user's crypto financial manager in the future.

Rumi receives $4.7 million in Pre-Seed funding, led by a16z crypto CSX and EV3

AI media company Rumi announced the completion of a $4.7 million Pre-Seed round of financing, led by a16z crypto CSX and EV3. Rumi is committed to transforming passive media content into an interactive experience, where users can contribute computing power and data in exchange for rewards through a "watch and earn" mechanism, and interact with AI in real time. Its decentralized infrastructure supports intelligent analysis of media content, and has established cooperation with TVision, Story Protocol, etc., aiming to create the world's first user-driven intelligent media ecosystem.

Solana Ecosystem AI Platform Assisterr Completes $2.8 Million in Financing, with Google for Startups, Outlier Ventures, and Others Participating

Solana-based AI platform Assisterr announced the completion of a $2.8 million financing, with a company valuation of $75 million. This round of financing was participated by Google for Startups, Outlier Ventures, Web3.com, Echo.xyz, Moonhill Capital and other institutions. Assisterr is committed to helping users create, deploy and monetize personalized AI agents through code-free tools. Its core technology focuses on small language models (SLMs) to reduce costs and improve customization capabilities.

Infrastructure & Tools

Spetz Inc. Raises $7.35 Million in First Private Funding Round to Purchase Sonic Tokens and More

Blockchain infrastructure company Spetz Inc (CSE: SPTZ) announced the completion of its first round of private placement financing, issuing 14,702,617 units at a price of 0.50 Canadian dollars per share, raising 7,351,308.50 Canadian dollars. Each unit consists of 1 common share and 0.5 warrants, and the warrant holder can subscribe for additional shares at 0.75 Canadian dollars per share within 24 months. The company's CEO Mitchell Demeter said that the financing will be used to purchase Sonic tokens, verify node infrastructure deployment and DeFi strategy implementation. Participating institutions include Canaccord Genuity Financial and others. According to the announcements on March 24 and May 12, the private placement can issue up to 5,297,383 units, with the final deadline being June 23, 2025.

Cooking.City Completes $7 Million Funding to Reshape Solana Ecosystem Token Issuance Mechanism

Cooking.City, the Solana ecosystem token issuance platform, announced the completion of a $7 million financing round, with investors including top institutions such as Jump, CMT Digital, Mirana, Bitscale Capital and EVG. The platform pioneered the "confidence pool" mechanism and social incentive rebate system, and is committed to creating a transparent, sustainable, and community-oriented new issuance paradigm, promoting the fair launch of on-chain projects and returning to the core of the Web3 spirit.

Blockchain security protocol Naoris Protocol completes $3 million strategic round of financing

Blockchain security protocol Naoris Protocol has completed a strategic round of financing of US$3 million, led by Mason Labs, with participation from Frekaz Group, Level One Robotics and Tradecraft Capital. The funds will be used to develop blockchain security infrastructure under the threat of quantum computing. According to reports, Naoris Protocol's core products include: plug-and-play network security grid architecture, Layer1 blockchain compatible with all EVM chains and using post-quantum encryption technology, and PoS consensus mechanism that complies with international security standards such as NIST.

Asigna, a Bitcoin smart multi-signature wallet service provider, completes $3 million in financing

Asigna, a Bitcoin smart multi-signature wallet service provider, announced the completion of a $3 million financing round, led by Hivemind Capital and Tykhe Block Ventures, with participation from Sats Ventures, Trust Machines and several angel investors. At the same time, the v2 version upgrade was released, adding embedded application support and developer SDK toolkits. The non-custodial multi-signature solution currently manages over $1.1 billion in assets, supports the Bitcoin main chain and Layer2 protocols such as Stacks, and can connect to meta-protocols such as Ordinals and Runes. The new version allows users to interact with DApps directly through a multi-signature environment, and introduces enterprise-level features such as sub-account management and privacy mode. Co-founder Vlad emphasized that it is built entirely on the Bitcoin native layer and has no smart contract risks.

BlockSpaces Completes $2 Million Funding and Launches Bitcoin-Native Risk Management Platform ARCC

According to BlockSpaces' announcement, the company has completed a $2 million strategic financing led by Axiom, which will be used to launch ARCC, a Bitcoin native mortgage and risk management platform. The platform builds a trust-minimized execution environment through HTLC technology, supporting institutions to manage BTC mortgage contracts, forward transactions and BitBonds in a native way without the need for side chains or custodial bridges. BlockSpaces said that ARCC will usher in a new era of Bitcoin smart contract finance and promote the modernization of institutional capital market infrastructure.

Smart crypto trading tool Alph.AI completes $2 million in financing, led by Bitrue

Smart cryptocurrency trading tool Alph.AI announced that it has completed a $2 million financing round, led by Bitrue. The new funds are intended to be used to promote the platform's AI intelligent construction to help users discover high-potential tokens early.

Mirage completes $1.6 million in financing, mainnet will be launched next week

According to official news from Mirage Protocol, the project has completed $1.6 million in financing, aiming to build a modular financial protocol based on the Move language. Its core products include the yield-based stablecoin mUSD and a low-cost, high-liquidity perpetual contract platform. Investors include Robot Ventures, Selini Capital, Native Crypto, Echo, Ambush Capital, etc. Angel investors include Mo Shaikh, co-founder of Aptos, and NB, founder of Nightly. The protocol is built on the Aptos and Movement ecosystems, and the mainnet is expected to be launched next week.

other

Crypto Reserves:

Trump Media Group completes $2.44 billion in financing and will become a major Bitcoin holder among listed companies

Trump Media Group announced today that it has completed its previously announced private placement with approximately 50 institutional investors. The offering includes: ① the sale of 55,857,181 shares of the company's common stock at a price of $25.72 per share, raising approximately $1.44 billion in gross proceeds; ② the issuance of convertible senior secured notes with a principal amount of $1 billion and due in 2028, with a conversion price of $34.72 per share. The two items raised a total of approximately $2.44 billion. Trump Media will use approximately $2.32 billion of net proceeds to establish a Bitcoin reserve and for other general corporate purposes and working capital. As one of the largest Bitcoin reserve transactions among public companies, the net proceeds of this offering and the company's strategy will make Trump Media Group one of the companies with the largest Bitcoin holdings among U.S. public companies. After this offering, Bitcoin will be included in the balance sheet of Trump Media Group, alongside cash, cash equivalents and short-term investments totaling $759 million as of the end of the first quarter of 2025.

(This financing is not included in the statistics of this issue’s financing weekly report)

VivoPower Completes $121 Million Funding Led by Saudi Prince, Focusing on XRP’s Crypto Reserve Strategy

Nasdaq-listed energy company VivoPower International (VVPR) announced the completion of a $121 million private placement financing and will transform into a crypto asset reserve strategy centered on XRP. Saudi Prince Abdulaziz bin Turki Abdulaziz Al Saud led the $100 million investment, and former SBI Ripple Asia executive Adam Traidman will serve as chairman of the advisory board. According to SEC documents, the company plans to issue 20 million common shares at $6.05 per share.

(This financing is not included in the statistics of this issue’s financing weekly report)

Matador Completes Second Non-Broker Private Placement Fundraising of Approximately $1.42 Million CAD to Support Bitcoin Purchases

Bitcoin technology company Matador Technologies Inc (TSXV: MATA) announced the completion of the second round of non-broker private placement, issuing 2,588,955 units at a price of 0.55 Canadian dollars per share, raising 1,423,925 Canadian dollars. Together with the first round of issuance completed on May 26, the company issued a total of 5,452,773 units, raising a total of 2,999,025 Canadian dollars. Each unit contains 1 common share and 0.5 warrants, and each full warrant can subscribe for additional shares at 0.75 Canadian dollars within 12 months. The funds raised will be used in three aspects: Bitcoin acquisition, gold business advancement and general corporate purposes.

Centralized Finance

Velocity, a European fintech platform covering stablecoin business, completes $10 million pre-seed round of financing

Velocity, a European fintech infrastructure platform, has completed a $10 million pre-seed round of financing, setting a record for the same stage of financing in Europe this year. This round was led by Activant Capital, with participation from Fuel Ventures and other institutions, and received strategic investment from executives of Stripe, Visa and other companies.

The company was co-founded by former Worldpay executive Eric Queathem and real-time payment company Volt founder Tom Greenwood, focusing on three major development areas: 1) a unified account architecture integrating virtual IBAN and digital wallets; 2) real-time foreign exchange intelligent routing supporting fiat currencies and stablecoins; 3) automated cross-border settlement systems. The team currently has 11 people and plans to expand to 30 people by the end of the year, focusing on strengthening engineering and compliance operations. Velocity relies on its experience in the traditional payment industry to build an enterprise-level fund management platform that is compatible with both traditional banks and blockchain systems. Its technology has realized functions such as programmable payment and liquidity collaboration, and can cope with actual scenarios such as supplier payments and multi-currency fund pools.

Stablecoin payment platform Beam completes $7 million financing, led by Castle Island Ventures

Stablecoin-based payment service provider (PSP) Beam has raised $7 million in a round of funding led by Castle Island Ventures, with participation from Archetype, Bankless Ventures, Verda Ventures, and Arca Fund. Beam is a payment platform that connects traditional finance with blockchain technology. The platform enables users to send and receive funds across borders using stablecoins and fiat currencies, providing real-time currency exchange, cryptocurrency to fiat currency conversion, and seamless integration with bank accounts and digital wallets. Beam is registered as a U.S. money service business and complies with SOC 2 Type II standards.

Venture Capital Fund

Blockchain Builders closes $28 million fund to support crypto startups

Blockchain Builders, founded by Stanford graduates Gil Rosen, Kun Peng and Steven Willinger, announced the completion of a $28 million fund raising, which was oversubscribed. The fund has invested more than $16 million in 40 blockchain startups, focusing on the intersection of AI and blockchain and financial technology applications.

Core investments include: investing $1 million each in modular AI company 0G and supercomputing project Nexus Labs (subsequent additional investments), and participating in their competitive rounds of financing. The fund plans to complete the deployment of the remaining $12 million by the end of 2025, and several invested projects are preparing for token generation events (TGE). The second phase of the fund plans to expand its investment network to universities such as Carnegie Mellon and Princeton.

Crypto VC Metalayer Ventures launches $25 million fund focused on stablecoins and tokenization

Metalayer Ventures, a crypto venture capital firm founded by former Chainlink and Two Sigma executives, announced the launch of a $25 million fund, focusing on early-stage projects in the fields of stablecoins, asset tokenization, and crypto infrastructure. Invested projects include seven companies including AnchorZero, Spark Capital, Ethena, and Theo. Co-founder Winton also developed a platform called "Moirai" to analyze on-chain data to discover potential projects. The fund plans to eventually provide early-stage financing for up to 30 companies, with a single investment expected to be between $500,000 and $1 million.

You May Also Like

SEC approves new exchange listing standards fast-tracking crypto ETF listings

Softer CPI keeps PBoC easing in play – TD Securities