Ripple News : XRP ETFs Could Pull In $7–$10B Annually as Demand Accelerates

The post Ripple News : XRP ETFs Could Pull In $7–$10B Annually as Demand Accelerates appeared first on Coinpedia Fintech News

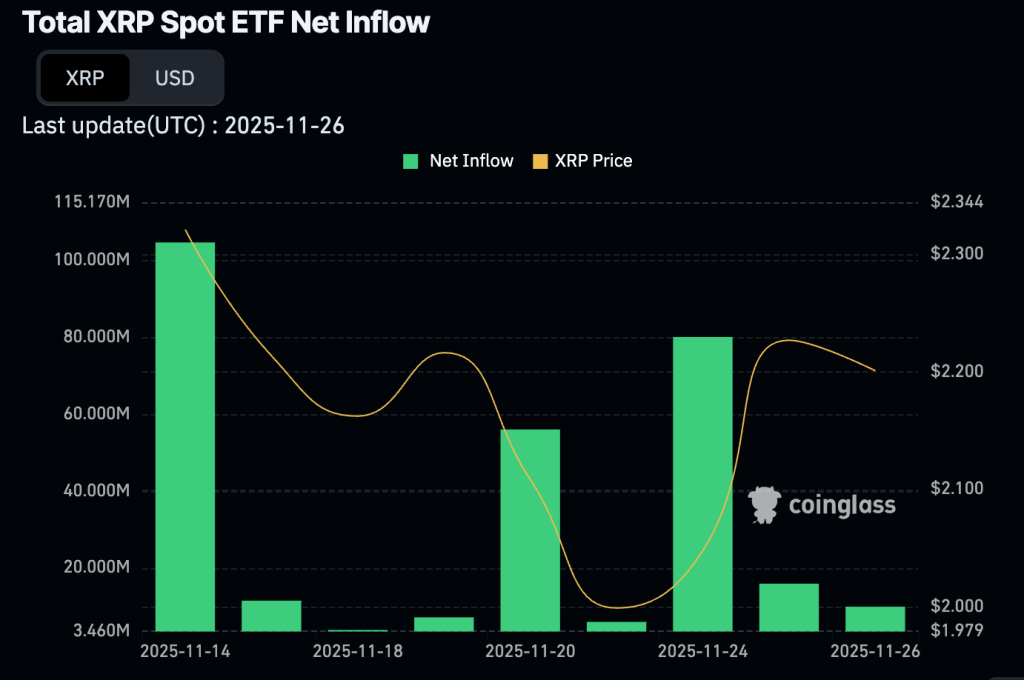

The launch of XRP exchange-traded funds (ETFs) is already shaking up the crypto market. Analysts believe that growing institutional interest could have a big impact on both the price of XRP and how these funds operate.

ETF Demand is Exploding

In just 8 trading days, XRP ETFs have gathered over $644 million in assets. Canary Capital, Bitwise, Grayscale, and Franklin Templeton are among the major buyers, snapping up large amounts of XRP.

Canary Capital’s XRPC ETF raised $245 million on day one and now stands at $329 million, while Bitwise has accumulated $168 million. Grayscale and Franklin Templeton each collected around $150 million within two days.

With more ETFs preparing to launch, early estimates suggest that seven XRP funds could attract $7–$10 billion annually.

XRP Price Forecast

According to Chad Steingraber, the average price needed as ETF demand grows. Even in a conservative scenario where institutions bring in $33.6 billion a year, the numbers show that the higher XRP’s price goes, the less ETFs can buy.

At $11.25, they could still collect almost 3 billion XRP a year. At $22.50, that drops to about 1.49 billion. At $45, it falls to 746 million, then 373 million at $90, 248 million at $135, and just 149 million at $225.

With ETFs entering the market, XRP’s price has to rise to slow down how quickly asset managers can accumulate the token.

- Also Read :

- Bitcoin, Ethereum on the Rise as Gold Price Signals Midterm Weakness

- ,

Despite these inflows, the XRP Price is trading quietly around $2. Early ETF purchases are mostly made through OTC desks, keeping activity off public exchanges and preventing sudden price spikes. With Bitcoin correcting below $100,000, XRP has remained stable for now.

However, Steingraber believes this calm won’t last. If ETF inflows continue while XRP supply tightens, the price may adjust sharply to meet institutional demand, potentially creating new opportunities for investors.

What Happens If XRP Supply Tightens?

Analyst Steingraber explains that as ETFs buy more XRP, the available supply could start to tighten. If it becomes harder or more expensive to source XRP, ETF managers may resort to share splits.

For example, one share holding 10 XRP could be split 2-to-1, so you would own 2 shares worth 5 XRP each.

This could happen repeatedly, with splits like 10-to-1 or even 50-to-1, allowing investors to maintain value while the actual amount of XRP per share decreases.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

XRP ETFs are gaining demand because institutions want regulated, easy exposure to XRP without managing crypto directly.

Higher ETF inflows can tighten XRP supply, which may push the price up as funds compete for available tokens.

Early estimates suggest multiple XRP ETFs could bring in $7–$10 billion annually as institutional interest grows.

You May Also Like

Aave CEO Breaks Silence on Game-changing Upgrade in Q4: Details

NZD/USD holds losses below 0.5750 ahead of China trade data

![Will dogwifhat [WIF] break $1.29 or stay stuck in consolidation?](https://ambcrypto.com/wp-content/uploads/2025/09/Erastus-2025-09-17T121713.938-min.png)