1USDT≠1USDC? Analyzing the “Dark Forest” Behind Stablecoin Swaps

Author: Barter

Compiled by: Tim, PANews

Stablecoin swaps: the good and the bad

The total supply of stablecoins will almost double in 2024, from $129.8 billion to $203.4 billion, more than half of which exist on the Ethereum chain. Faced with dozens of stablecoins circulating in the market and new currencies emerging, it is crucial to ensure that liquidity swaps are as close to a 1:1 exchange rate as possible. The Barter team conducted an in-depth study and found that:

Stablecoin swaps in China often deviate from the 1:1 exchange rate. This post will analyze this issue.

Looks ordinary, but is actually priceless

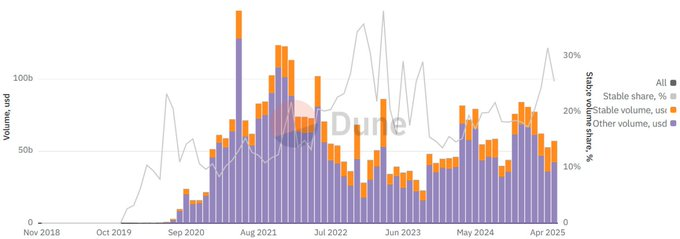

According to DEX transaction data, the proportion of stablecoin transactions in total transactions has remained in the range of 20-30%, while the number of transactions has always been less than 5%. During April 2025, the proportion of stablecoin transactions reached 31.5% (absolute value of US$16.6 billion), and the number of transactions accounted for only 4.6%. This means that the average size of a single stablecoin transaction is 9.5 times that of an ordinary DEX transaction.

The lower the TVL, the higher the efficiency

The TVL of stablecoin liquidity pools fell from a peak of $12.3 billion in January 2022 to $600 million in May 2025. However, since the beginning of 2022, stablecoin trading volume has continued to grow, increasing liquidity turnover by 34 times, and as of April 2025, the weekly turnover rate was as high as 824%. This means that the market structure is transforming towards higher capital efficiency, and liquidity pools now support significantly larger trading volumes.

Stable exchange ≠ stable execution

In retail transactions over the past year, $8.1 billion in stablecoin exchanges suffered slippage losses of more than 0.1%. Among them, $930 million in transactions had slippage of more than 1%, which is an abnormally high situation in stablecoin exchanges, and 78.5% of high slippage transactions were concentrated in stablecoin trading pairs with poor liquidity.

While 1% slippage may seem insignificant at first glance, it exposes deep-seated efficiency issues in the high-volume stablecoin exchange scenario. As a result, stablecoin exchanges currently account for 53.8% of all sandwich-attacked transactions, while MEV (miner extractable value) and arbitrage transactions account for 47.0% of total stablecoin exchange volume, or $1.61 billion per week.

Low cost but high price

The root cause of the high proportion of harmful transactions in stablecoin swaps is fee compression. In the past two and a half years, the average fee for stablecoin swaps has plummeted 5.5 times to only 0.011%, and the fee weighted by transaction volume is as low as 0.005%. Although low fees can attract order flow, they also lead to an abnormal increase in the proportion of harmful transactions. For example, on the Uniswap V4 platform, which offers an ultra-low fee of 0.001%, harmful MEV transactions now account for up to 80.2% of the stablecoin swap transaction volume.

Numerical analysis of friction costs in stablecoin exchange

You May Also Like

Coinbase Data Breach Fallout: Former Employee Arrest in India Over Customer Data Case Raises Bitcoin Security Concerns

Burmese war amputees get free 3D-printed prostheses, thanks to Thailand-based group