Ethereum’s Vitalik Buterin Funds Two Projects Driving Digital Privacy

- Vitalik Buterin sent 256 ETH to Session and SimpleX to support on-chain privacy.

- He called privacy “hygiene” and said low-risk DeFi on Ethereum has become safer over time.

Vitalik Buterin announced he donated 256 ETH total, split evenly between two privacy-focused messaging projects. He said encrypted messaging is now a core defense for digital privacy, and donated 128 ETH to each of two projects driving that goal. He named permissionless account creation and metadata privacy as the next hurdles for the messaging space. After that, he highlighted Session and SimpleX Chat as apps working toward those targets.

Decentralized routing is technically challenging, so teams struggle to deliver strong metadata protection across devices. In addition, multi-device support increases complexity. He added that problems such as Sybil resistance and protection against network abuse also increase security requirements when apps avoid phone numbers for signups.

Source: X

Source: X

Buterin said privacy work needs more review and public attention. He encouraged users to download and use privacy apps to understand their impact firsthand. Meanwhile, he noted these platforms are not finished and still require development work before they reach optimal device support and network abuse protection.

Buterin Calls Privacy “Hygiene” After Bank Data Alert

In a recent update, we covered, Buterin replied to a post that called data retention “the industrial pollution of our era.” The post referred to reports that JPMorgan Chase, Citi, and Morgan Stanley were told some client data may have been taken. Under that thread, Buterin wrote, “Privacy is not a feature. Privacy is hygiene.”

Source: X

Source: X

With that line, he treated privacy as a basic requirement, not an extra tool in digital services. His remark linked the reported bank data exposure to ongoing concerns over how large institutions store and manage user information. The comment also matched his other public statements on encrypted messaging and metadata protection. By calling privacy hygiene, he set it alongside routine practices that should be present in any system that handles personal data.

Buterin Now Sees Low-Risk DeFi as Everyday Finance

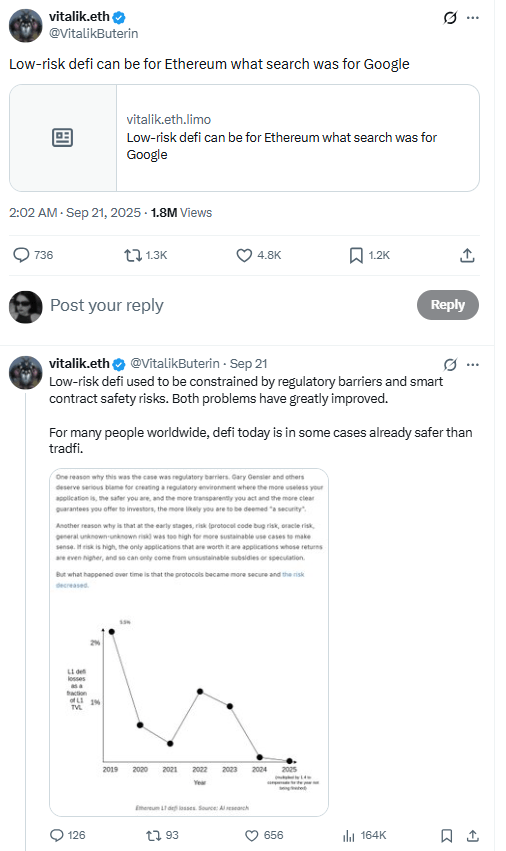

Buterin has long talked about risk in decentralized finance as Ethereum’s ecosystem grew. In a recent post we discussed earlier, he said “low-risk defi can be for Ethereum what search was for Google,” pointing to products that focus on safety and simple yield rather than speculation.

He wrote that DeFi used to face two main obstacles: regulatory barriers and smart contract safety issues. According to him, both areas have improved as frameworks matured and code review standards tightened.

Source: X

Source: X

Buterin added that, for many users, DeFi is already safer than traditional finance in some cases. His comment showed that low-risk DeFi has become safer over time, as stronger code reviews and clearer rules cut down on earlier security problems.

]]>You May Also Like

Ripple (XRP) Pushes Upwards While One New Crypto Explodes in Popularity

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets