Chainlink Price Prediction: LINK Spikes 18% Amid Stable Derivatives Market

Highlights:

- Chainlink price has rallied 18% to $14.38, as the crypto market rebounds.

- The Chainlink derivatives market spikes following the Grayscale ETF launch on Tuesday.

- The LINK technical outlook suggests further upside move as bulls target $15-$17 resistance zones.

Chainlink (LINK) price has gained about 18% to exchange hands at $14.38 today. This recent surge is supported by the opening of the LINK Exchange Traded Fund (ETF) by Grayscale on Tuesday. The derivatives contracts indicate that there is an uptick in retail interest, with a futures Open Interest rising more than 20% over 24 hours. The technical perspective is positive as the Chainlink price is still on a path of growth and wants to continue the uptrend.

Chainlink has been among the most performing investments in the overall cryptocurrency market in the past 24 hours. This comes following the introduction of the Grayscale Chainlink Trust ETF (GLINK) on Tuesday.

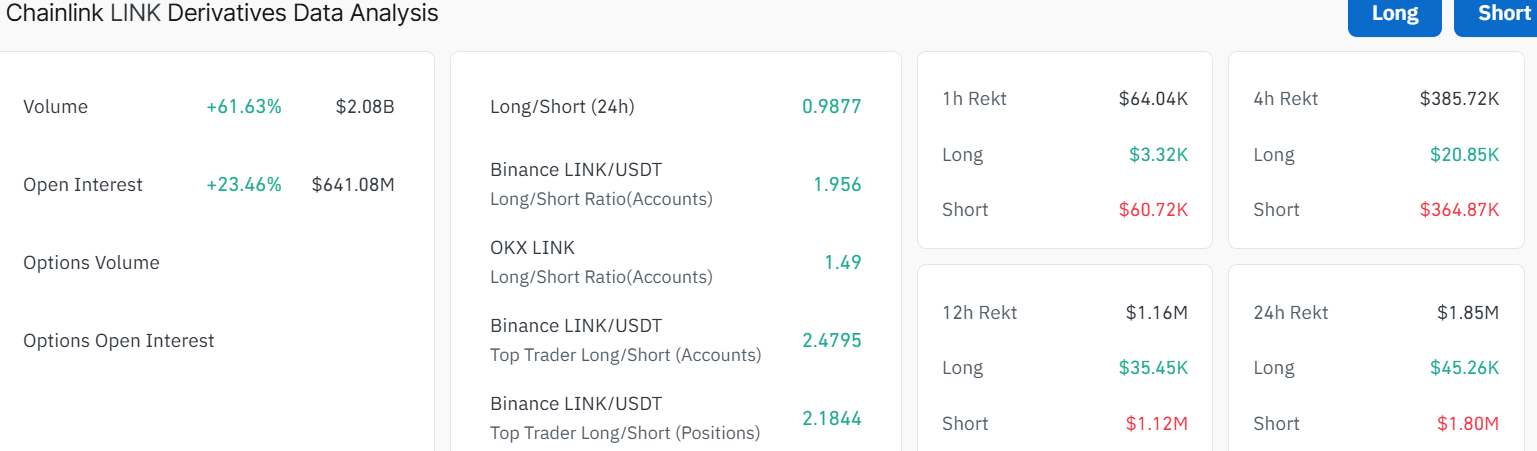

Notably, there has also been an influx of retail demand in the Chainlink derivatives market. According to CoinGlass data, the LINK futures Open Interest (OI) is at 641.08 million, 23.46% higher in the past 24hours. This uptick in OI suggests that the bulls are building a position.

LINK Derivatives Data: CoinGlass

LINK Derivatives Data: CoinGlass

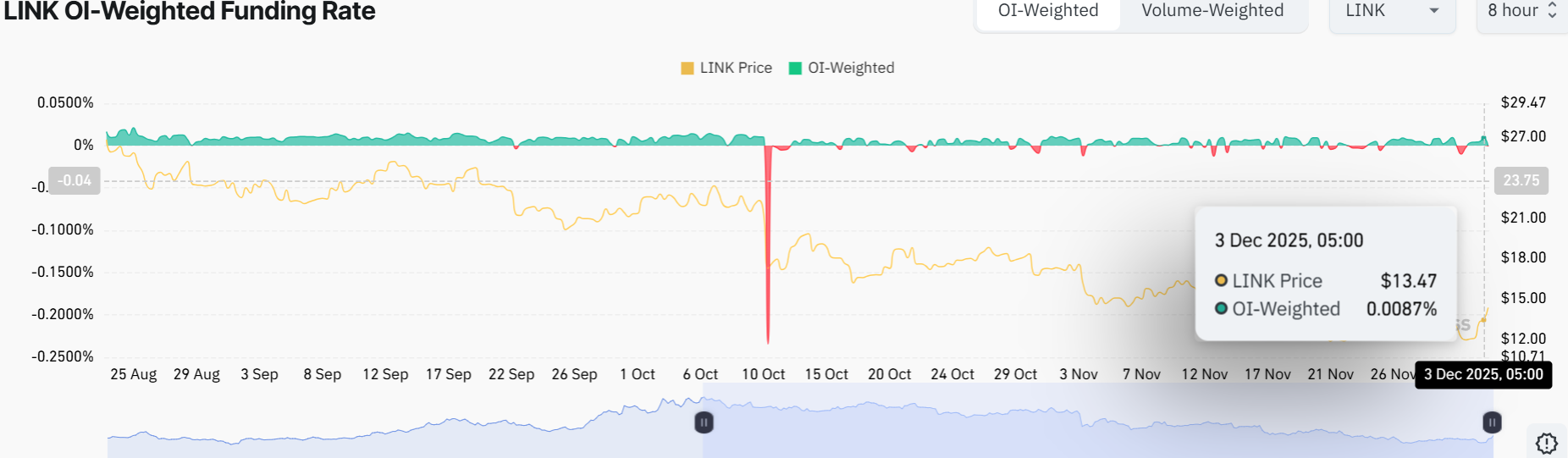

The volume has also spiked 61.63% to $2.08 billion, indicating heightened market activity. Moreover, the token has a great level of confidence in the LINK OI-weighted funding rate of 0.0087%. The positive funding rate reinforces the bullish picture in the LINK market.

Chainlink OI-Weighted Funding Rate: CoinGlass

Chainlink OI-Weighted Funding Rate: CoinGlass

Chainlink Price Poised for Further Upside Towards $15-$17

The chart shows Chainlink price breaking out of a falling parallel pattern. The bulls have shown great strength after establishing strong support at $12, leading to a strong recovery to $14. The 50-day Simple Moving Average (SMA) on the 1-day chart at $15.34 and the 200-day SMA (blue line) at $17.80 are, however, acting as barriers against upside movement.

The Relative Strength Index (RSI) at 52.85 is creeping around the neutral territory, leaving room for more upside in the market. Meanwhile, the Moving Average Convergence Divergence (MACD) shows bullish momentum as the MACD line (blue) soars above the signal line (orange).

LINK/USD 1-day chart: TradingView

LINK/USD 1-day chart: TradingView

Looking ahead, the Chainlink price now eyes the next target, which lies around $15.34, aligning with the 50-day SMA. However, this is only possible if the bulls keep exerting pressure on the crypto’s price, and hold above the current levels. If this happens, the LINK price could reclaim the $17.80 long-term resistance in the next few weeks.

Conversely, if Chainlink price faces rejection at the $15-17 resistance, there could be a dip back to $12. Below that, LINK may target $9.64, where the next major support lies.

Meanwhile, LINK’s trading volume has exploded in the last 24 hours by over 87%, backing the current breakout move. Historically, the Chainlink price follows a good bounce after breaking patterns like this, such as in the 2017 bull market. LINK has the potential for a short-term pump to $15-$17 if momentum holds. However, in the long term, it’s a hold if BTC keeps climbing, potentially leading to Chainlink hitting $25.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Unleashing A New Era Of Seller Empowerment

WIF Price Prediction: Targets $0.46 Breakout by February 2026