![Crypto Market News Today [LIVE] Updates 4th Dec: Ethereum Fusaka Upgrade, ETH ETF inflows, ETH Price Today](https://image.coinpedia.org/wp-content/uploads/2025/12/04161105/Crypto-Market-News-Today-LIVE-Updates-4th-Dec-Ethereum-Fusaka-Upgrade-ETH-ETF-inflows-ETH-Price-Today-1024x536.webp)

The post Crypto News Today [LIVE] Updates On Dec 4,2025 : Ethereum Fusaka Upgrade,ETH Price, Cardano Price, Ripple (XRP) Price And More appeared first on Coinpedia Fintech News

December 4, 2025 12:31:26 UTC

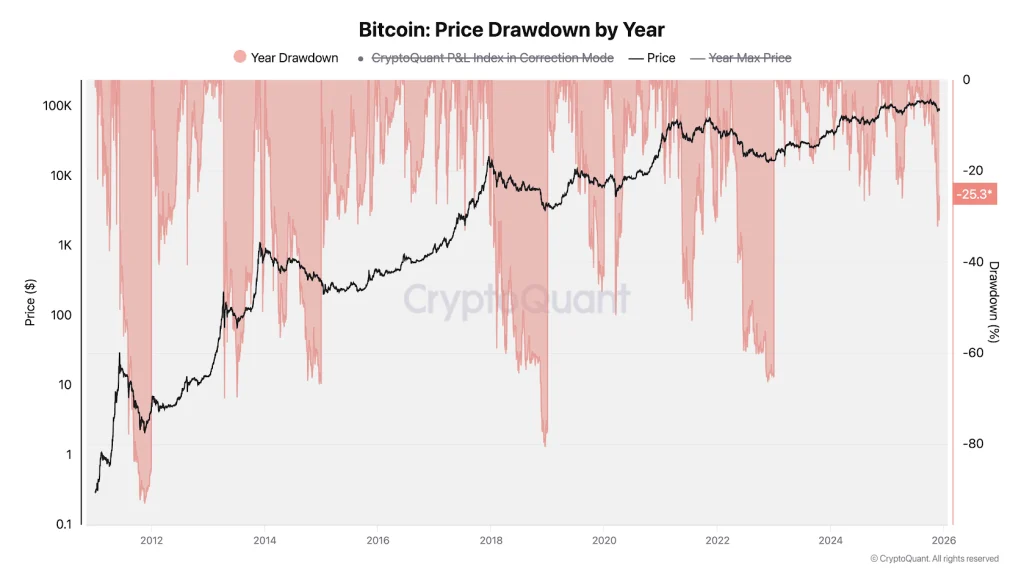

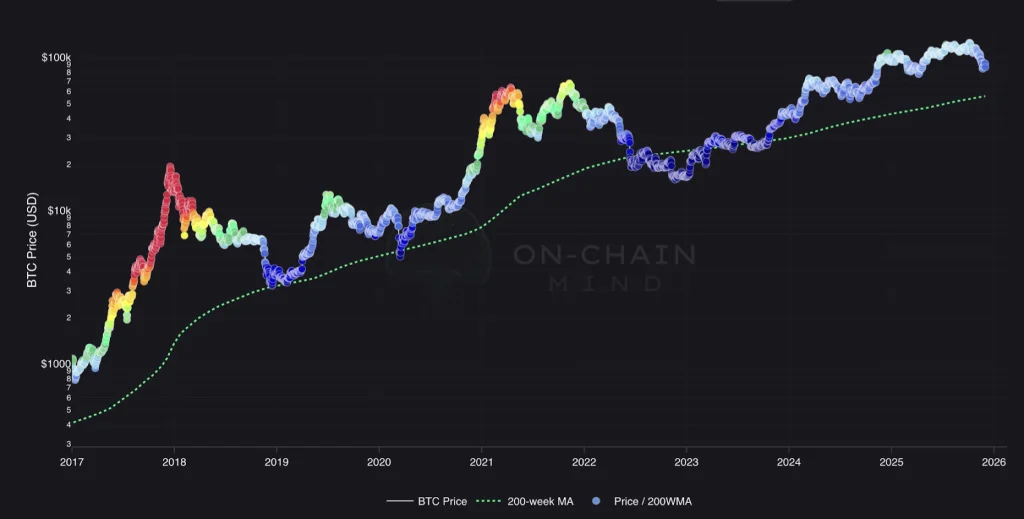

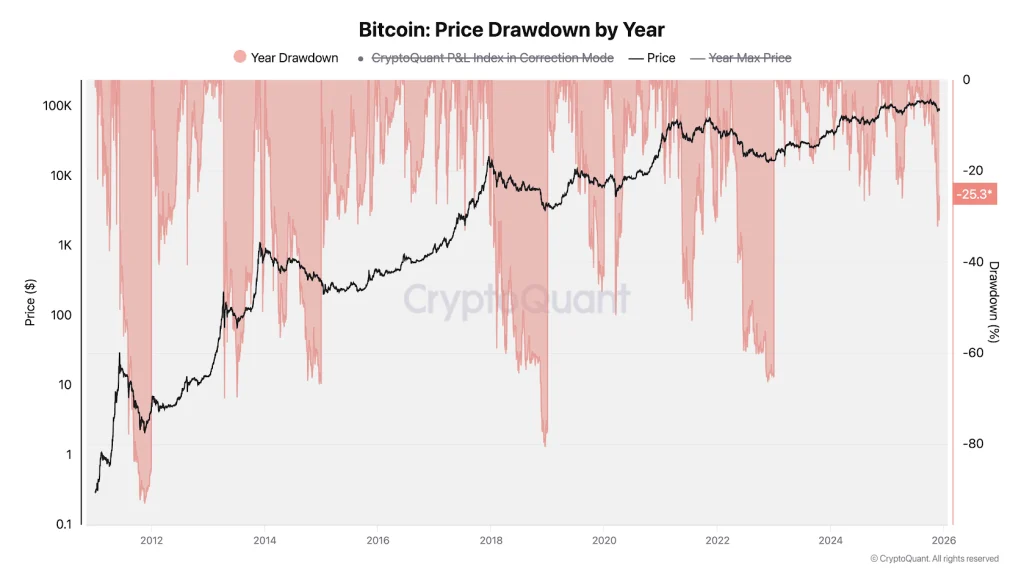

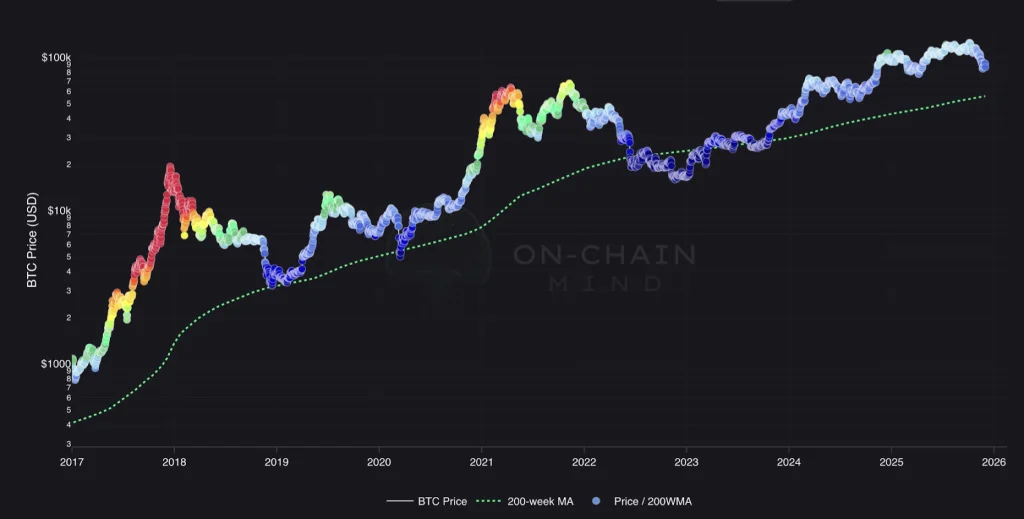

Bitcoin’s 200-Week MA Points to Strong Long-Term Support

Bitcoin’s 200-week moving average continues to rise even during downturns and now sits near $55,000, acting as one of the market’s most reliable adoption signals. Based on its historical slope, the indicator is projected to reach around $65,000 by mid-2026. Analysts say Bitcoin doesn’t need to revisit that zone unless a broad macro sell-off drags all assets lower. If it does, the mid-$60K range is seen as strong structural and psychological support—a level where past market bottoms have often formed.

December 4, 2025 12:16:10 UTC

Aster Unveils 2026 Roadmap With Mainnet Launch Set for Q1

Aster has released its H1 2026 roadmap, confirming that the Aster Chain L1 mainnet will go live in Q1 2026. The project plans to roll out ASTER staking, on-chain governance, and smart order-following tools in Q2. The team also highlighted major milestones completed in 2025, including the merger between Astherus and ApolloX, the TGE, mobile app launch, and multiple CEX listings. This December, Aster will introduce Shield Mode, TWAP strategies, and RWA stock perpetual upgrades, with the testnet set to open by month-end.

December 4, 2025 12:13:15 UTC

Bitcoin’s Real Driver Is Liquidity, Not the 4-Year Cycle

A new analysis argues that Bitcoin’s past bull markets weren’t powered by the halving cycle, but by global liquidity surges that happened at the same time. In earlier cycles, major money expansion from the Fed, ECB, BOJ, and China pushed markets higher, and Bitcoin followed. The key indicator, PMI, never recovered this cycle, which explains 2025’s weaker performance. Now, with QT ending, rates falling, and liquidity turning up, analysts say market conditions are finally shifting—suggesting the real bull phase may only be starting now.

December 4, 2025 11:54:44 UTC

XRP ETF Inflows Cross $700M as Institutional Interest Builds

XRP ETFs have quietly passed $700 million in inflows, a number highlighted by Ripple CEO Brad Garlinghouse. Analysts say this shows growing institutional trust, even though crypto ETFs still make up only 1–2% of the global ETF market. Despite past legal battles and regulatory pressure, XRP is attracting early exposure from major institutions like BlackRock and Vanguard. While retail traders focus on short-term trends, the steady inflows suggest XRP is becoming part of a long-term institutional rotation.

December 4, 2025 05:34:09 UTC

XRP Faces Resistance as Short-Term Rebound Lags Behind BTC and ETH

XRP’s 4-hour charts show clear resistance around $2.20, making its rebound weaker compared to Bitcoin and Ethereum. While the trend could shift quickly, XRP is currently struggling to break through this level. Analysts also note that there is no clear sign that inflows from the XRP ETF are creating any supply shock or lifting the price in the short term. Both the resistance and ETF impact could still change over a longer timeframe.

December 4, 2025 05:34:09 UTC

Connecticut Orders Kalshi, Robinhood, and Crypto.com to Halt Event-Based Betting

Connecticut has issued cease-and-desist orders to Kalshi, Robinhood, and Crypto.com, accusing them of running unlicensed online sports betting through event-based contracts. The state says these products count as sports wagering and cannot be offered without approval. All three firms were told to immediately stop promoting or providing these services to residents. Kalshi and Robinhood argue their contracts are federally regulated by the CFTC, not state gambling laws, setting up a regulatory dispute over how such products should be classified.

December 4, 2025 05:28:00 UTC

Bitcoin Downside Limited If Strategy Holds Its 650K BTC

Bitcoin is unlikely to face another deep correction like 2022 as long as Strategy keeps holding its 650,000 BTC. With Bitcoin now about 25% below its all-time high, any future pullback may look more like a long sideways phase than a major crash. The report adds that Bitcoin has stronger liquidity channels compared to past cycles, suggesting long-term holders should stay patient and avoid panic selling.

December 4, 2025 05:17:54 UTC

Ethereum’s Fusaka Upgrade Goes Live Today

Ethereum’s major Fusaka upgrade is live today, bringing big improvements to speed and network capacity. The update increases block space, makes data checks lighter for nodes, and helps reduce congestion caused by Layer-2 networks. This means faster confirmations, steadier gas fees, and cheaper L2 transactions for everyday users. Fusaka also allows rollups like Base and Arbitrum to scale more easily, which can increase overall activity on Ethereum. Analysts say the upgrade could strengthen ETH’s long-term demand.

December 4, 2025 05:17:54 UTC

Ethereum Price Climbs on Strong Wallet Buying

Ethereum rose to $3,215 as mid-sized investors holding 1,000–10,000 ETH increased their buying. Data from Santiment shows a sharp rise in new activity on the network, with 190,000 new wallets created in a single day. This jump in demand and fresh user growth is giving Ethereum a solid boost after a slow week. Analysts say continued wallet accumulation could help support the price in the coming days.

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

![Crypto Market News Today [LIVE] Updates 4th Dec: Ethereum Fusaka Upgrade, ETH ETF inflows, ETH Price Today](https://image.coinpedia.org/wp-content/uploads/2025/12/04161105/Crypto-Market-News-Today-LIVE-Updates-4th-Dec-Ethereum-Fusaka-Upgrade-ETH-ETF-inflows-ETH-Price-Today-1024x536.webp)