As Ethereum Price Continues to Cool Off, Mid-Cap Alternatives Are Drawing Fresh Investor Interest

The Ethereum price recently slipped toward the $3,000 region, closing November with more than 20% monthly losses as United States Ethereum ETFs saw over $1.2 billion in outflows before a late bounce in inflows.

With large holders now cautious, many traders are asking where the next strong trend may appear. One name that keeps coming up among mid-cap alternatives is Remittix, a payments-focused DeFi project that some see as a way to capture growth while Ethereum pauses.

Ethereum Cool Off Resets Expectations

Ethereum began December with a constructive rebound after November’s pullback, stabilizing near the $3,050 support area following a retest of a descending trendline and the short-term EMA cluster. Analysts note that holding this zone could set the stage for tests of $3,400–$3,500, though market liquidity and participation remain key variables. Recent price action has also approached a supply region between $3,500 and $3,700, where sellers have historically outweighed buyers, while deeper support remains in the $2,400–$2,550 band highlighted during Ethereum’s earlier rally.

Short-term bullish momentum has emerged as ETH attempts to hold above $3,000–$3,050. Market analyst CyrilXBT suggests that maintaining this area during dips could drive a move toward $3,300–$3,400, while losing it risks another sweep of lower demand zones. According to commentator Jainam Mehta, emerging higher-low structures on both the 4-hour and daily charts underscore this constructive shift, with the 20-day and 50-day EMAs near $2,964 and $2,957 acting as initial support.

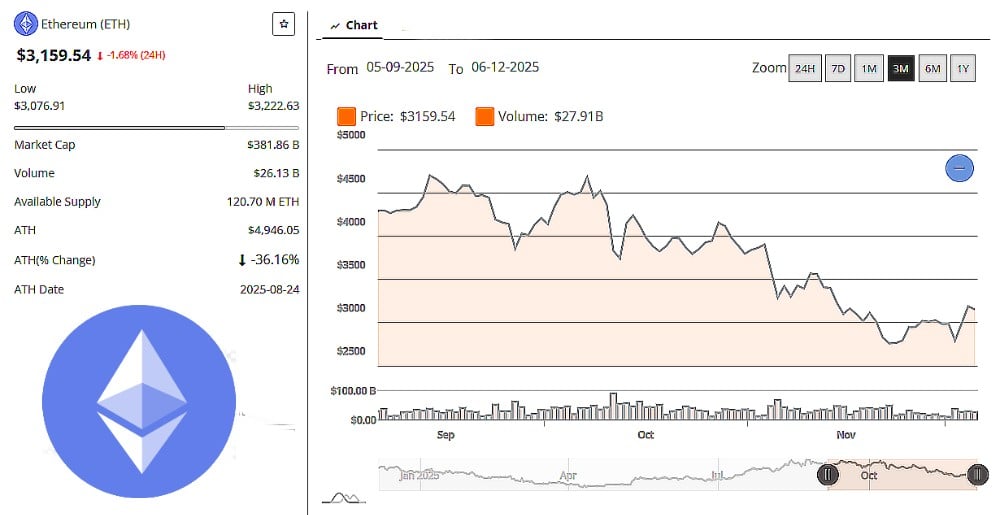

The Ethereum price has declined steadily for the last 90 days. Ethereum price source. Brave New Coin ETH market data.

Key resistance levels sit at the 100-day and 200-day EMAs at roughly $3,013 and $3,206. Clearing these may invite targets near $3,360–$3,477 and potentially the broader pivot around $3,566, but rejection could send ETH back toward $2,900 or even $2,800–$2,720.

Looking ahead, Ethereum’s ability to defend $3,050 while navigating dense resistance zones will shape the near-term trend. Analysts caution that corrective rallies can produce misleading signals, and volatility driven by liquidity sweeps or leverage unwinds may obscure true directional bias. US ETH ETFs recorded about $1.28 billion in net outflows between November 11 and November 20, a clear sign that many institutional holders reduced risk as worries grew. The recent bounce, with roughly $368 million of inflows, helped stabilize the Ethereum price but did not erase the earlier damage.

Ethereum currently trades at $3,159 with a market cap of around $381 billion and a daily volume of $26 billion. That is a powerful position, yet Ethereum still ended November with a loss of about 22% for the month. Derivatives data still leans bullish for December, yet the cool-off has reminded traders that upside may be slower from current Ethereum levels. Many are keeping Ethereum as a core position while moving fresh capital toward mid-cap projects that may offer stronger percentage growth if the market rotates again.

Remittix Gains Momentum As Ethereum Slows

That search for higher growth is where Remittix enters the conversation. Unlike Ethereum, which already dominates layer-one smart contracts, Remittix focuses on one clear problem: turning crypto into real payments and remittances across a $19 trillion global market.

The project aims to become a crypto-to-fiat payment hub with a wallet, web app, fiat rails, and API integrations for merchants and payment providers. Remittix has already sold more than 692 million tokens at a price of $0.119, raising over $28.4 million, which signals notable early-stage interest.

The Remittix team is fully verified by CertiK, and the project holds the number-one spot for pre-launch tokens on CertiK Skynet with a Skynet Score of 80.09 and more than 24,000 community ratings.

The Remittix wallet is already live on the Apple App Store as a full crypto wallet that lets users store, send, and manage assets. The team plans to integrate crypto-to-fiat functionality directly into this app, with a high-profile December announcement expected to give the Remittix DeFi project a clear PayFi roadmap.

Some practical reasons traders now group Remittix among the best cryptos to buy are:

-

Focus on real-world payments and global remittance

-

Direct crypto-to-bank transfers are planned in more than 30 countries

-

Utility-first token that aims to support real transaction volume

-

Audited by CertiK with public Skynet monitoring and an A-grade security score

-

Built for adoption and daily use rather than short-term speculation

Cooling Ethereum Trend And The Remittix Shift

Ethereum still anchors the smart-contract sector, yet the 90-day price cool-off and November drawdown show that even leaders need periods of reset. ETF outflows, heavy derivatives positioning, and tight resistance around $3,100 all point toward a more measured Ethereum path in the near term.

That shift helps explain why more traders now screen mid-cap projects for the next major move rather than focusing solely on Ethereum. Remittix stands out in that search, with a live wallet on the Apple App Store and a December PayFi announcement on the way.

For investors who see Ethereum as mature but still want growth exposure, Remittix looks increasingly like the mid-cap alternative drawing fresh attention.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Frequently Asked Questions

-

Why is investor interest moving away from Ethereum right now?

Ethereum dropped more than 20% in November and saw over $1.2 billion in ETF outflows, signaling reduced risk appetite from larger holders. While the ecosystem remains strong, many traders expect slower upside from these levels and are rotating into mid-cap projects with higher growth potential.

-

What makes Remittix stand out among mid-cap alternatives?

Remittix focuses on real-world payments and remittances, a sector that spans roughly $19 trillion globally. Its live App Store wallet, upcoming crypto-to-fiat tools, and strong CertiK verification give it practical utility that many mid-caps do not offer.

-

How does Remittix differ from Ethereum in terms of use cases?

Ethereum anchors smart contracts and decentralized applications, serving as a broad layer-one ecosystem. Remittix instead targets crypto-to-bank payments, merchant settlement, and cross-border transfers, making it a more specialized PayFi project.

-

Why is Remittix considered a potential high-growth candidate?

The project has already raised more than $28.4 million, sold over 692 million tokens, and secured top rankings on CertiK Skynet. Combined with a live wallet and a major December announcement, it sits early in its growth curve compared to mature assets like Ethereum.

-

What upcoming developments could boost Remittix further?

A high-profile December update will integrate crypto-to-fiat functionality into the live wallet and outline the next steps in the project’s PayFi roadmap. This, along with upcoming exchange listings after the $30 million milestone, is drawing fresh investor attention.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Tom Lee Predicts Major Bitcoin Adoption Surge