Pi Network Price Under Pressure as OKX & Gate.io Consider Possible Delisting

The post Pi Network Price Under Pressure as OKX & Gate.io Consider Possible Delisting appeared first on Coinpedia Fintech News

Pi Network’s native token Pi coin is under new pressure after China’s top financial groups warned against illegal crypto activities and directly named Pi Coin as a risky asset. This has also increased fears that exchanges may delist Pi and that a future Binance listing is unlikely.

Meanwhile, Pi price dropped another 7% this week to around $0.22, now down 92% from its all-time high.

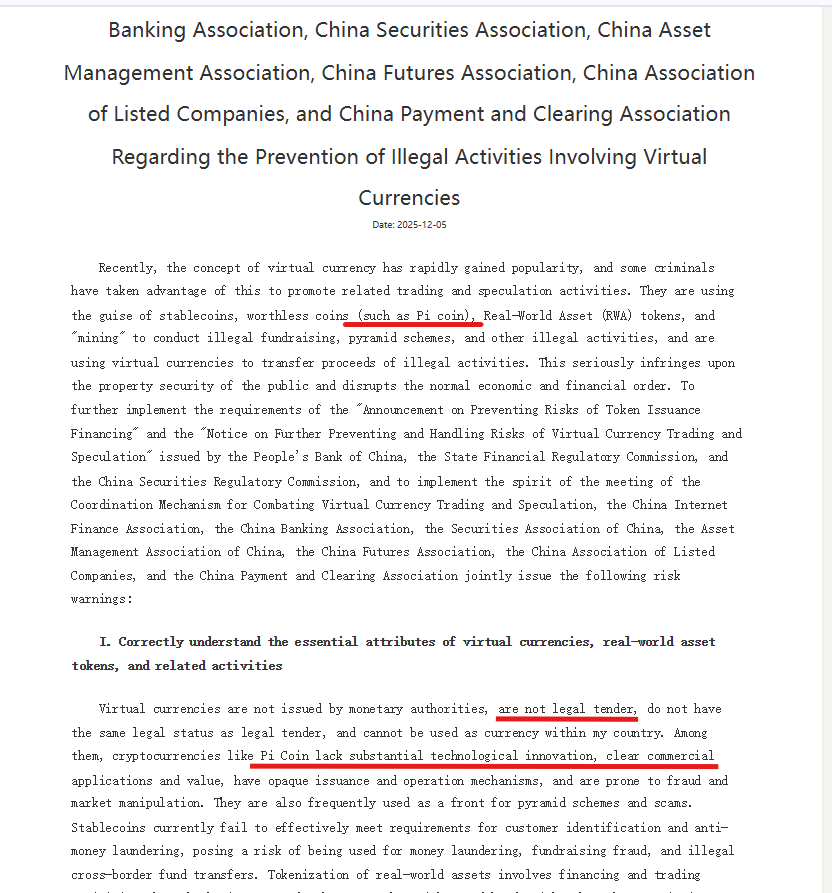

Pi Network: China Labels Pi Coin a High-Risk Asset

According to a joint notice issued by seven national associations, including the China Internet Finance Association, regulators warned the public about projects that promote virtual currencies without real value or technology.

The statement clearly mentioned Pi Coin, calling it an “air coin,” a term China uses for tokens that lack transparency, utility, or proven backing.

According to the regulatory notice, projects like Pi Network have been associated with frequent scam activities, raising concerns about investor protection and financial stability.

However, authorities also reminded everyone that virtual currencies do not have legal tender status in China, as they cannot be used inside the country, and are not allowed for payments or investments.

- Also Read :

- China Issues Major Public Warning Against RWA Tokenization and Crypto Activities

- ,

Binance Listing Fades, Even Pi Could Delist From Listed Exchange

The new warning from China is already causing problems for Pi Coin on exchanges. Some platforms that allow people to trade Pi are now thinking about removing it, because they don’t want to get into trouble with regulators.

Market experts say a strong regulatory backlash in China makes it impossible for major exchanges like Binance, one of the world’s largest exchanges, to consider listing Pi Coin.

Right now, Pi is listed on places like Gate.io, OKX, Bitget, CoinUp.io, and a few smaller exchanges. But after the new warning, these listings may also be at risk.

Pi Coin Price Drops Again, More Downside Ahead?

In the past week, Pi coin price dropped 7% and is currently trading around $0.22, continuing its month-long decline. The token is also down 92% from its all-time high, as confidence continues to weaken due to repeated delays and new regulatory warnings.

Recently, a Coinpedia analyst reported that Pi is showing early warning signs as it falls below an $0.29 important trading range after getting several.

If Pi fails to hold its rising trendline around $0.223–$0.225, the drop may speed up because liquidity is weak below this zone. In that case, Pi could slide toward $0.20 next, and even a fall to $0.18 is possible.

Unless Pi Network delivers clear communication on the open mainnet, the token may continue facing downward pressure.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

China called Pi Coin a high-risk “air coin,” hurting investor confidence and pushing its price lower this week.

Yes, some exchanges may delist Pi because China’s warning increases regulatory risk and reduces trading support.

A Binance listing is very unlikely right now due to strong regulatory pressure and concerns around Pi’s compliance.

You May Also Like

Why is YZi Labs trying to change the board of CEA Industries?

TRX holds near $0.28 as Tron Inc. ramps up accumulation strategy