PIPPIN Price Rally Hits 150%, Will It Continue?

PIPPIN has emerged as one of the strongest performers in the AI Agent token market, rallying sharply over the past few days.

The impressive surge has pushed the token into the spotlight, with investors now questioning whether PIPPIN can extend this momentum.

PIPPIN Investors Are Showing Skepticism

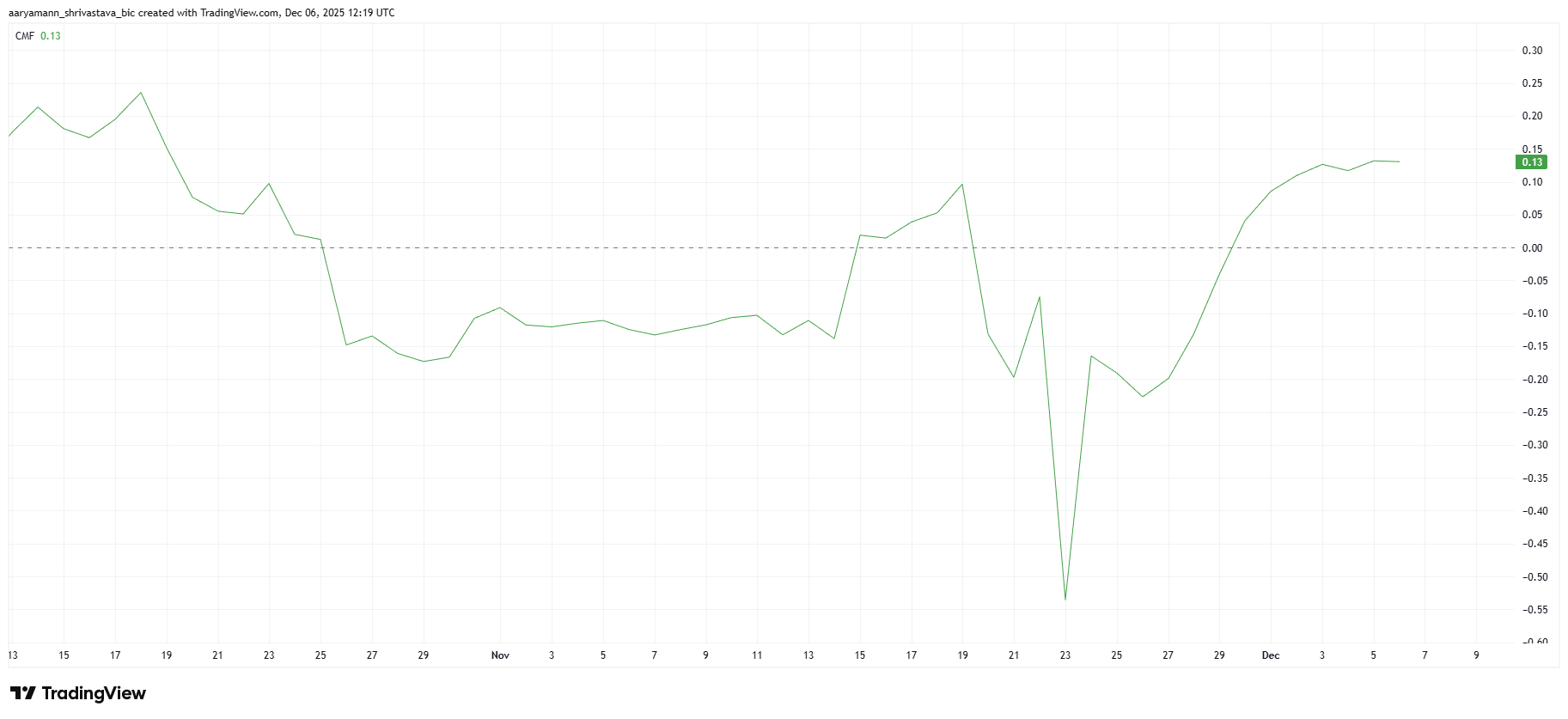

The Chaikin Money Flow (CMF) shows that PIPPIN recently enjoyed a period of strong inflows. This signaled rising confidence and capital entering the market.

Yet the indicator is now flattening, pointing to slowing inflows. A decline in fresh capital could limit PIPPIN’s ability to sustain its rally, making upward movement more difficult.

This shift suggests that investors are becoming more cautious. Without consistent inflow support, PIPPIN may struggle to maintain its current momentum.

The AI Agent token depends heavily on sentiment-driven surges, and the diminishing strength of the CMF could keep the token from climbing further in the near term.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

PIPPIN CMF. Source: TradingView

PIPPIN CMF. Source: TradingView

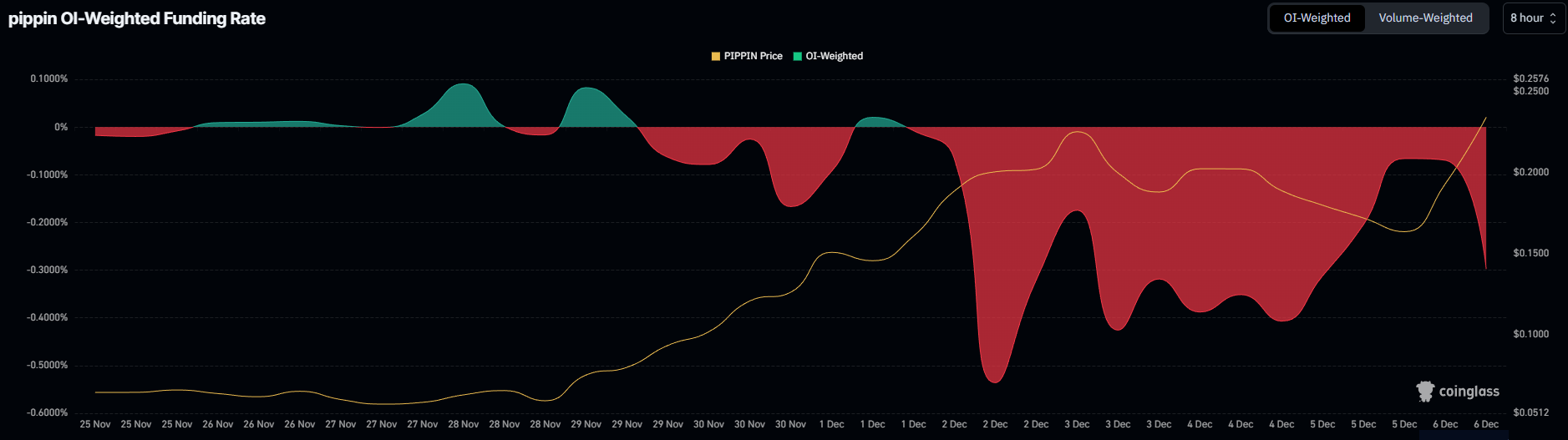

The broader outlook is complicated by the funding rate, which shows a heavily bearish structure. A negative funding rate means that most traders are opening short positions, expecting PIPPIN to fall. This widespread bearish positioning reflects low confidence among derivatives traders.

Such sentiment can weigh down price action, as short sellers often accelerate downward pressure. Unless market conditions flip, this pessimistic stance may become a significant hurdle for PIPPIN and stall any attempt at a long-term rally.

PIPPIN Funding Rate. Source: Coinglass

PIPPIN Funding Rate. Source: Coinglass

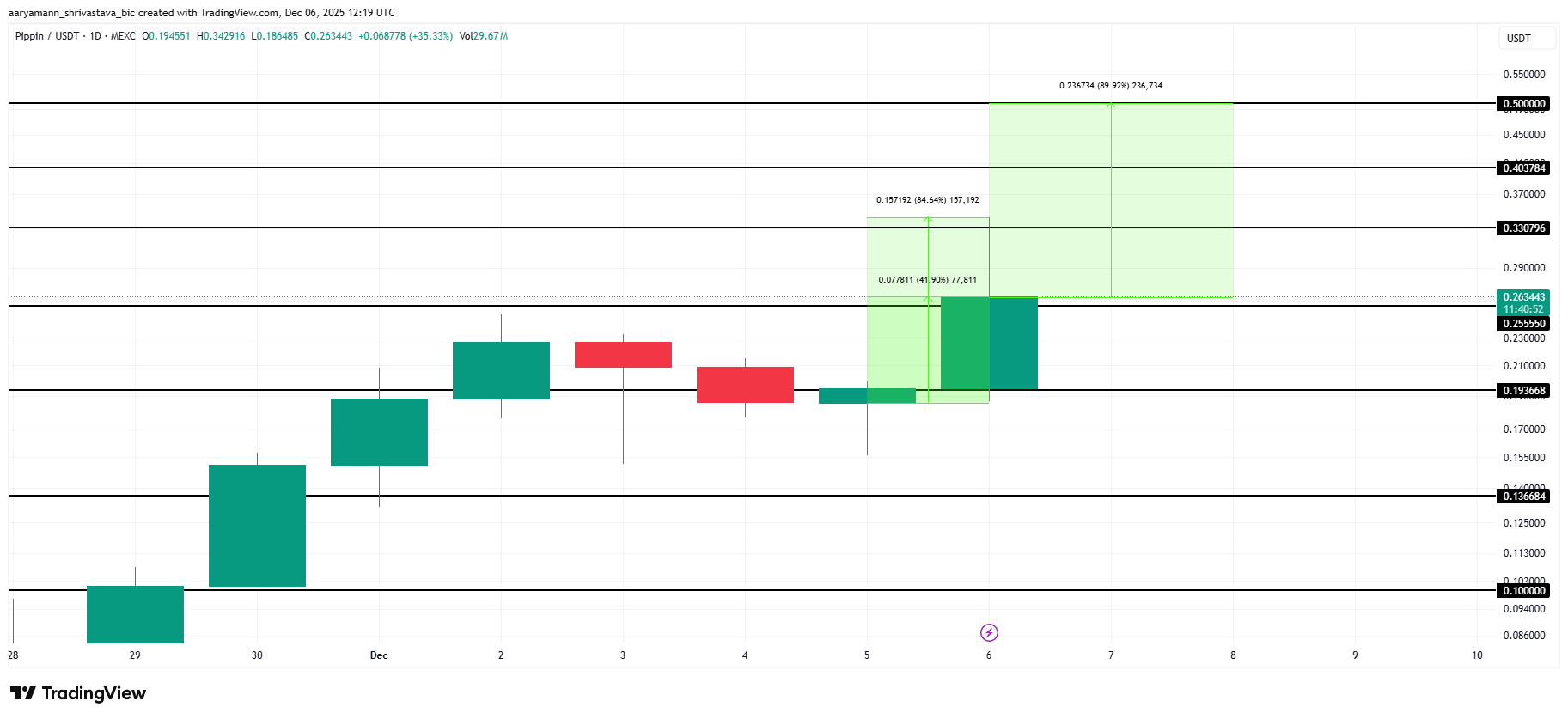

PIPPIN Price Has Some Barriers To Breach

PIPPIN is trading at $0.263, holding just above the $0.255 support level. The AI Agent token is still up nearly 42% today and briefly noted an 84% intra-day rise, reflecting strong volatility. However, breaking higher will require strong conviction from investors.

Reaching $0.500 demands a near 90% rally from present levels. Given slowing inflows and a negative funding rate, this target may be difficult. Instead, PIPPIN could remain closer to the $0.193 support, with a fall toward $0.136 possible if holders begin securing profits.

PIPPIN Price Analysis. Source: TradingView

PIPPIN Price Analysis. Source: TradingView

But if bullish sentiment returns and fresh capital flows back into the market, PIPPIN could break past the $0.330 and $0.403 resistance levels. Surpassing these barriers would open the path toward $0.500, invalidating the bearish outlook.

You May Also Like

Tropical Depression Wilma weakens into LPA

JPMorgan CEO warns that a weak Europe threatens US economic stability