Trading time: BNB chain pays attention to CZ's avatar change, institutions wait and see mainstream currencies

1. Market observation

Keywords: BNB, ETH, BTC

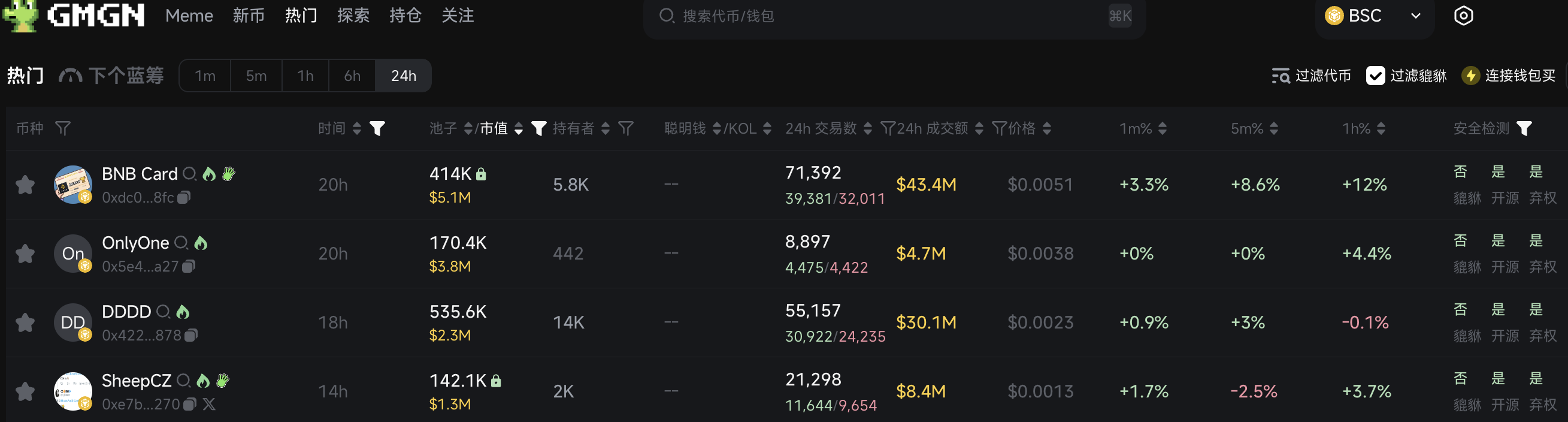

The BNB chain Meme market is in full swing. The on-chain market is closely related to the words and deeds of CZ and He Yi, and the market focus is on CZ's upcoming profile picture. In the past 24 hours, 4 new Meme projects on the BNB chain have exceeded $1 million in market value. However, institutional investors are more cautious about Meme coins. In a recent interview with Bloomberg TV, Cathie Wood, founder of ARK Investment, warned that most Memecoins in the $2.6 trillion crypto market may eventually be "worthless." She pointed out that although the combination of blockchain and AI has spawned "millions" of Memecoins, these tokens have limited actual value, and ARK's private funds will not invest in such assets.

In contrast, Wood is positive about mainstream crypto assets. She is optimistic about the development prospects of assets such as Bitcoin, Ethereum and Solana, and predicts that Bitcoin may exceed $1 million by 2030. However, CryptoQuant CEO Ki Young Ju said that although the market has been bullish for the past two years, the current data has clearly weakened and the market may have entered a bear market. For Ethereum, the MVRV ratio is about 0.9, which is at a historical low, and this level usually coincides with a good entry opportunity.

At the macro level, QCP Capital analysis believes that although the Fed is unlikely to cut interest rates this week, any dovish signal from Powell may become a catalyst for Bitcoin's rise. The overall market volatility has eased, with the VIX index falling back to around 20. In terms of institutional participation, Coinbase's latest survey shows that 83% of institutional investors plan to expand their cryptocurrency allocation this year, reflecting that as the regulatory environment becomes clearer, institutions' confidence in digital assets is increasing.

2. Key data (as of 13:30 HKT on March 19)

-

Bitcoin: $83,173.19 (-10.99% year-to-date), daily spot volume $19.375 billion

-

Ethereum: $1,939.26 (-41.89% year-to-date), with a daily spot volume of $11.716 billion

-

Fear of corruption index: 23 (fear)

-

Average GAS: BTC 2 sat/vB, ETH 0.46 Gwei

-

Market share: BTC 60.6%, ETH 8.6%

-

Upbit 24-hour trading volume ranking: XRP, AUCTION, LOOM, BTC, UXLINK

-

24-hour BTC long-short ratio: 0.9701

-

Sector gains and losses: SocialFi sector rose 3.25%, RWA sector rose 2.48%

-

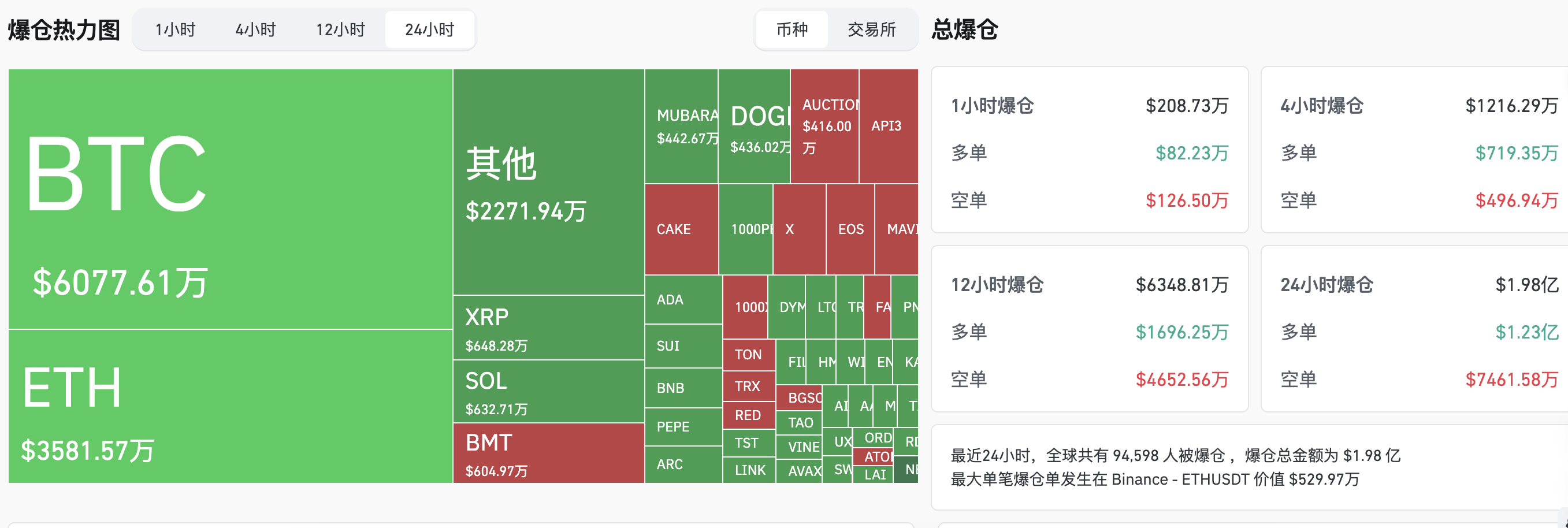

24-hour liquidation data: A total of 94,598 people were liquidated worldwide, with a total liquidation amount of US$198 million, including BTC liquidation of US$60.07 million and ETH liquidation of US$35.81 million

3. ETF flows (as of March 18 EST)

-

Bitcoin ETF: $209 million

-

Ethereum ETF: -$52,815,600

4. Today’s Outlook

U.S. EIA crude oil inventory for the week ending March 14 (10,000 barrels) (March 19, 22:30)

-

Actual: Not announced / Previous: 144.8 / Expected: Not announced

The Federal Reserve FOMC announced its interest rate decision and a summary of economic expectations. (March 20, 02:00)

US Federal Reserve interest rate decision (upper limit) until March 19 (March 20, 02:00)

-

Actual: Not announced / Previous: 4.50% / Expected: 4.5%

Federal Reserve Chairman Powell held a monetary policy press conference. (March 20, 02:30)

-

Binance to List StraitsX USD (XUSD)

-

Babylon will extend the airdrop registration deadline to 4:00 pm on March 19

-

WazirX: Voting period for proposed restructuring plan set for March 19 to March 28

-

Polyhedra Network (ZKJ) will unlock approximately 15.53 million tokens at 8:00 am Beijing time on March 19, accounting for 25.72% of the current circulation, with a value of approximately US$31.8 million;

The biggest gainers in the top 500 by market value today: RSS3 up 101.57% in 24 hours, Dohrnii (DHN) up 44.07%, EOS up 27.28%, AUCTION up 25.94%, LOOM up 25.74%

5. Hot News

- A smart money address accumulated 1.136 million BMT in 15 hours, becoming the top 4 holding address on the chain

- North Carolina Bitcoin Reserve Bill Would Authorize 10% of Public Funds to Purchase Bitcoin

- Nvidia launches GR00T N1, a universal base model for robots

- MyShell Launches Shell Launchpad, AI Agent Launch and Tokenization Platform

- Suspected Sun Yuchen's address pledged 60,000 ETH to Lido yesterday, worth over $100 million

- Coinbase survey: Institutional investors remain optimistic about cryptocurrencies, 83% of institutions plan to expand their allocation this year

- Bo Hines says US stablecoin bill could reach Trump within two months

- Raydium is developing LaunchLab, a Meme coin issuance platform, to compete with Pump.fun

- Cathie Wood: Plans to tokenize the company's funds if US regulations allow

- EOS transforms into a "web3 bank" and changes its name to Vaulta, plans to launch a new token

- Filecoin Ecosystem DeFi Protocol Glif Launches GLF Governance Token and Airdrops 94 Million Tokens

- BlackRock, Superstate, Centrifuge receive $1 billion in RWA tokenized asset investment from Sky

- Nasdaq submits rule change application to list 21Shares Polkadot ETF

- Strategy announced that it would issue 5 million additional preferred shares to raise funds, which it plans to use to increase its holdings of Bitcoin

- Binance HODLer Airdrop Launches Bubblemaps (BMT)

- CryptoQuant CEO: The market may have entered a bear market and will not short BTC

You May Also Like

The Manchester City Donnarumma Doubters Have Missed Something Huge

“We Cannot in Good Conscience Agree”: Anthropic Defies Pentagon Over AI Weapons