Best Cryptos to Buy Now as BlackRock moves into AI & Stablecoins: Why Digitap ($TAP) Ranks Number One

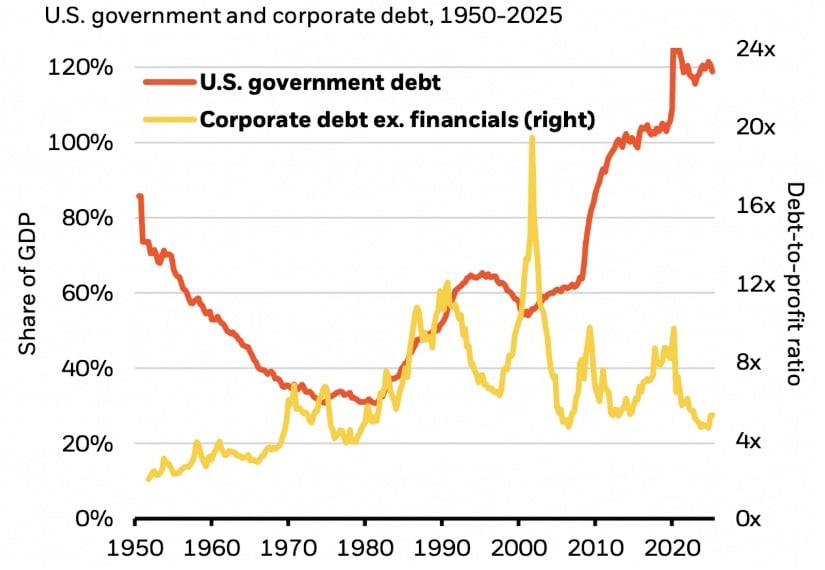

BlackRock’s 2026 outlook highlights several pressures on the economy. U.S. debt is expected to rise above $38 trillion, bonds are weakening, and tokenization is accelerating across the financial sector. With that backdrop, investors searching for the best crypto to buy now are turning toward platforms built for the next phase of digital finance.

While institutional capital concentrates on established assets like Bitcoin, early-stage projects such as Digitap ($TAP) are emerging as the clearest asymmetric opportunities.

Source: BlackRock 2026 Global Outlook

BlackRock Outlook Signals Early Rotation Into Altcoins

BlackRock’s latest AI-driven macro report signals a turning point in how institutional money will interact with digital assets over the coming year. The firm highlights an emerging disconnect between traditional financial instruments and the expanding digital economy, noting that AI-driven leverage and fiscal uncertainty are reshaping risk models across Wall Street.

As institutions reassess exposure to aging financial infrastructure, the role of digital assets becomes increasingly central to long-term portfolio strategy.

Source: Altcoin Season Index – CoinMarketCap

The Altcoin Season Index chart reflects this shift in real time. Over the past 90 days, the altcoin market cap fluctuated near the upper band of 1.8 trillion dollars before sliding toward 1.5 trillion dollars, while the index itself fell toward the low twenties.

This pattern indicates that capital is consolidating in preparation for new market leadership rather than exiting the space entirely, which aligns with BlackRock’s view that tokenization and stablecoins are forming the next major financial rails.

USE THE CODE “TAPPER20” FOR 20% OFF FIRST-TIME PURCHASES

How Digitap Bridges Fiat And Crypto in One Banking System

Before comparing Digitap to trending market tokens, it’s important to understand its foundational appeal. Digitap is building an omni-banking platform designed for a world where AI, tokenization, and digital payments converge.

Unlike traditional banks that restrict crypto access, Digitap integrates fiat and digital currencies into one unified account, enabling users to hold, send, and exchange more than 20 fiat currencies and over 100 cryptocurrencies.

Digitap’s global payment freedom supports SEPA, SWIFT, and blockchain transfers, solving the fragmentation and slow settlement times that legacy banks struggle with. This ties directly into BlackRock’s narrative: as financial systems become strained, users will migrate toward platforms offering lower fees, faster transfers, borderless access, and complete control over their funds.

The $TAP token powers this ecosystem by delivering lower fees, enhanced access, and cashback rewards. As computing demand surges and crypto adoption rises, Digitap’s position as a compliant, hybrid banking solution becomes increasingly relevant. This establishes the foundation for why Digitap is entering conversations about the best crypto to buy now.

$TAP Presale Growth Shows Strong Early Demand and Traction

Digitap’s $TAP presale continues to show strong traction. Since launch, the token has advanced through several predetermined tiers—from $0.0125 at announcement to $0.0361 in the current stage. This progression provides participants with a clear sense of how early allocations compare to later phases, which is often a key consideration in structured presales

With over 95% of its current allocation filled, demand appears steady, and the next programmed price step is already in place. For participants, this means each stage offers a transparent reference point: earlier entry simply provides access to a lower presale band, while later stages naturally come at higher preset levels.

This is where presale mechanics can create asymmetric potential as a token that advances through ascending presale tiers enters the public markets with a defined pricing history. If $TAP were to debut near its upper presale range, early supporters would have participated at structurally lower price points than those available closer to launch.

With over 138 million tokens sold and more than $2.2 million raised, Digitap’s traction mirrors patterns seen in previous best crypto presales that later became category leaders. The current first-purchase bonus of +499 $TAP is active for new buyers, adding an additional incentive window during the final presale phase.

Why $TAP Appeals to Buyers Seeking Practical Crypto Utility

Retail investors searching for the best cryptos to buy now increasingly focus on projects that deliver real utility and early-stage pricing with meaningful upside potential. Digitap stands out by directly addressing core financial pain points such as fragmented accounts, high transfer fees, blocked transactions, and limited crypto-fiat interoperability. Its product is already live, placing it ahead of many emerging competitors that rely on unproven concepts.

As the presale nears completion, rising demand, steady price growth, and a clear development roadmap strengthen the case for Digitap as a compelling altcoin to buy.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

You May Also Like

SUI Ecosystem Sees Strong Revival as TVL Surpasses $1 Billion Again

CME Group to launch Solana and XRP futures options in October