Ripple CTO Shares Three Reasons Behind His Fresh XRP Ledger Push

- Ripple CTO has publicly displayed a hub running on the XRP Ledger (XRPL) and calls on the community to connect.

- One of the objectives for starting this was to reduce network latency and increase reliability.

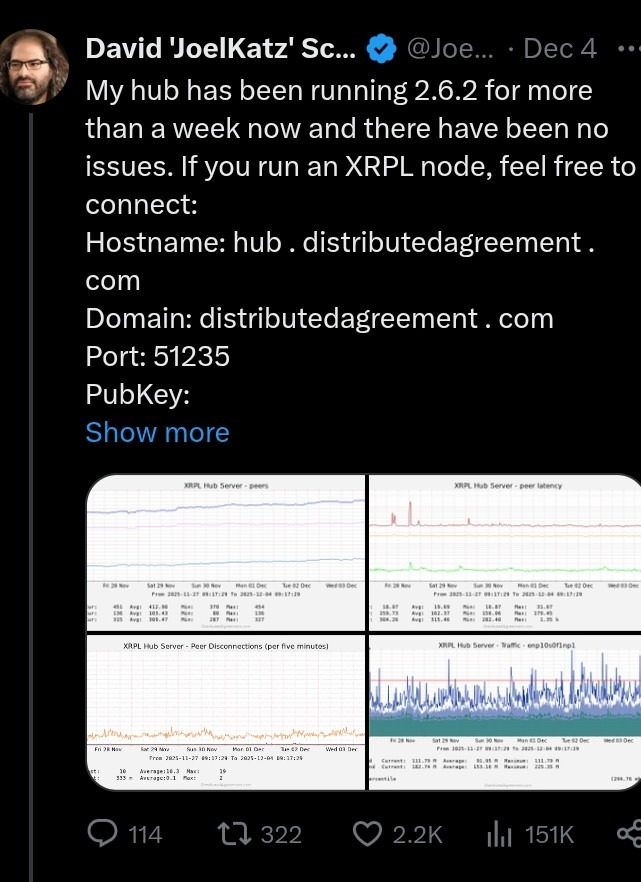

On December 4, Ripple Chief Technology Officer (CTO) David Schwartz publicly unveiled an XRPL hub to support the ecosystem. In his post, Schwartz called on the community to connect since it has successfully run for more than a week without issues.

Source: David Schwartz on X

Source: David Schwartz on X

As featured in our earlier coverage, the hub runs on version 2.6.2 and currently provides live operational information. Some of this information includes traffic throughput, peer connection, uptime statistics, and latency levels.

Why the XRPL Hub?

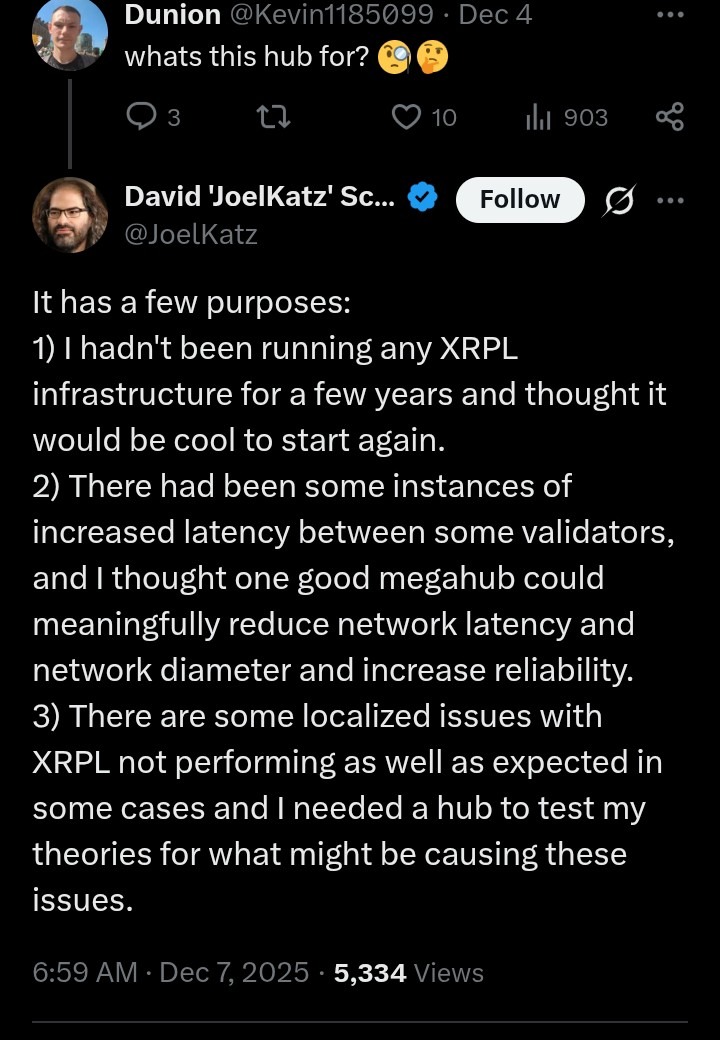

Schwartz’s call to open access to the broader community led to several comments, including the one from a user known as Dunion, who asked the reasons for starting this hub.

In response, the Ripple CTO provided three reasons. Firstly, he disclosed that he had not run any XRPL infrastructure for a few years; hence, he “thought it would be cool to start a new one.” Apart from this, Schwartz disclosed that there were some instances of increased latency between validators. In a bid to reduce this network latency and network diameter and also increase reliability, he decided to start a megahub.

Source: David Schwartz on X

Source: David Schwartz on X

Adding to this, Schwartz also highlighted some previous localized issues affecting the performance of XRPL. According to him, he started the hub to test some of his theories to find the possible cause.

This clarification comes after Schwartz announced his step down from the role of CTO, taking effect by the end of 2025.

Source: David Schwartz on X

Source: David Schwartz on X

As detailed in our earlier post, he is not taking a complete exit from the company, as he would still “be in and out” of the Ripple office as a “CTO Emeritus.” Also, he disclosed that he would join the board of directors to support the long-term vision of the company at the request of Ripple co-founder Chris Larsen.

Fascinatingly, he made a sudden comeback in August as an independent operator to unveil a custom server he built to support XRPL. At that time, he stated that the intention is not to experiment but to provide real connectivity. According to him, the data obtained from this could be crucial in the network’s understanding of how traffic behaves across different workloads.

Amid the backdrop of this, Anodos Wallet has simplified XRPL onboarding for new users with the launch of a passkey-secured XRPL wallet, as indicated in our previous publication. Additionally, XRPL smart contracts have gone live on AlphaNet to enable developers to explore and test, as mentioned in our earlier news brief.

]]>You May Also Like

Community Banks, Crypto Industry ‘Are Allies’ In CLARITY Act Clash: Exec

Liquidity shock? LIT drops 16% after Justin Sun pulls funds from Lighter