In conversation with Joshua Nwogodo on how ZuniQ is rebuilding cross-border payments for the overlooked mid-sized businesses powering emerging market trade

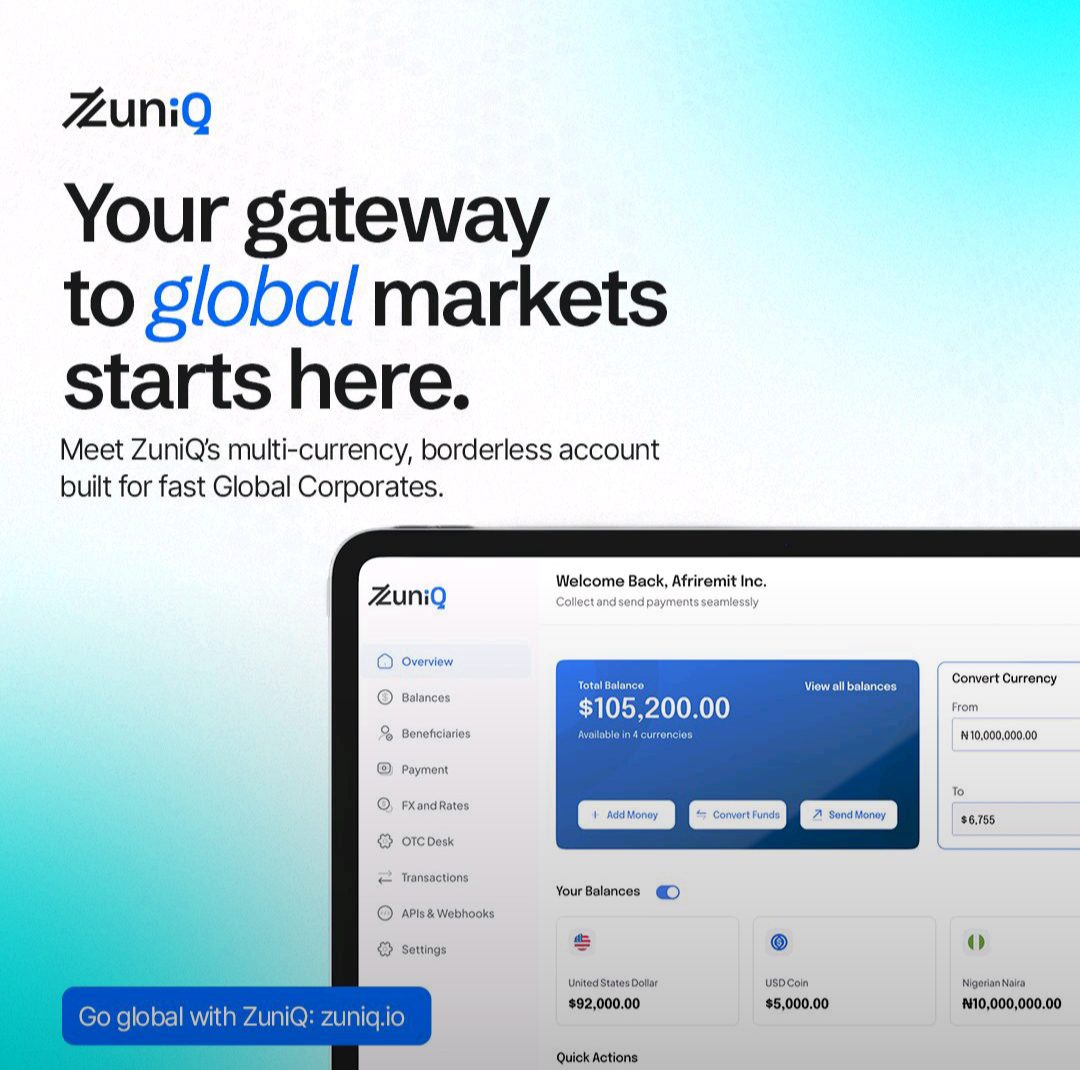

ZuniQ, a Nigerian fintech company providing instant, borderless access for businesses to transact globally, was born from a simple but uncomfortable truth: the businesses that keep trade moving across Africa are the ones most punished by the financial system built to serve them.

The company was founded by Joshua Nwogodo in early 2025 and in his conversation with Technext, he does not dress the challenge up. The ZuniQ founder returns to the same point throughout our conversation: mid-sized African businesses moving goods across borders wait too long, pay too much, and get ignored too often. His thesis is blunt. The big players built payment rails that work for themselves. The real economy was left to fend for itself.

Ask Nwogodo what pushed him to build ZuniQ, and he leans into his experience advising fintech and digital asset companies. He had seen the failures of traditional cross-border rails close-up. He had also seen entrepreneurs and importers trying to operate in markets where dollars were scarce, compliance rules shifted by geography, and payments routinely vanished into banking limbo.

He describes the current system with the tone of someone who has grown tired of polite euphemisms. “Swift is slow because your money has to pass through many hands,” Nwogodo says. “We remove those middle steps.” The point is not speed for its own sake. It is about operational survival. For a logistics company, a three-day delay can mean goods stuck at the port with charges piling up.

ZuniQ

ZuniQ

The pain is structural. African payments are routed through correspondent banks in the United States before moving on to Asia or other African markets. A payment from Lagos to Guangzhou often takes a detour through New York. That detour adds days. It also adds risk.

ZuniQ’s pitch is not flashy but logistical. Cut out the detour. Build direct corridors. Pre-fund float where it matters. Work with institutions willing to touch markets others avoid. And create enough liquidity pathways that no single bottleneck can block a transaction.

The liquidity question everyone pretends is away

Every fintech selling cross-border dreams eventually collides with the same wall: dollar scarcity. Nigeria, Ghana, Kenya, and others have lived through cycles of FX droughts that cripple importers. Nwogodo refuses to soften the language. “FX scarcity is a real-life problem. Every operator knows it. Every importer feels it,” he says.

ZuniQ relies on a blend of its treasury positions and institutional liquidity partners across Africa, Europe, and Asia. The model is not glamorous. It is a network of pre-funded accounts, local partners, and balance sheets positioned where trade actually flows. If one corridor tightens, another picks up the slack.

The point is flexibility. ZuniQ does not depend on a single rail, a single partner, or a single currency. It routes payments through whatever corridor is open at that moment. That redundancy is what banks, by design, do not build for mid-sized firms.

This is where Nwogodo’s frustration becomes more personal. “We are built for businesses the system ignores,” he says. “The mid-sized importer in Malawi or Alaba. They carry the continent’s trade on their back, but they get ignored.”

ZuniQ is building for the missing middle

‘The missing middle’ is his favourite phrase. These are firms too big for retail fintech apps but too small to get the attention of global banks. They deal in real volume, hire real workers, and keep supply chains alive. Yet they operate in the dead zones of financial infrastructure where speed, transparency, and service break down most.

Joshua Nwogodo, founder and CEO of ZuniQ

Joshua Nwogodo, founder and CEO of ZuniQ

For this segment, ZuniQ says the non-negotiable is visibility and control. Instant settlement. Multi-currency wallets. Real-time tracking. A support team that does not vanish once the onboarding is done.

Nwogodo does not frame this as innovation. He frames it as overdue fairness. “If you’re moving money globally, you don’t have to beg a traditional bank to confirm if your payment got to your supplier,” he says. “That era is getting over.”

The subtext is clear. If banks were going to fix it, they would have done so already.

Compliance as a local craft

Any company promising instant settlement in emerging markets faces a harsh reality because speed without compliance is suicide in cross-border payments. The scrutiny on African flows is heavier than ever, and regulators move at their own pace. The compliance burden is not just heavy. It varies dramatically across regions. KYC in Nigeria is nothing like AML in the UK. Kenya’s monitoring requirements bear little resemblance to those of the UAE.

ZuniQ’s answer is granular rather than centralised. Each market gets its own compliance stack, built with local rules and local partners. “We build our compliance layer country by country,” Nwogodo says. Local KYC partners handle automated checks. Real-time monitoring tools detect anomalies before regulators do. Where ZuniQ lacks a licence, it works through licensed local partners.

This approach slows expansion but prevents the blowback that has killed many early-stage payment firms. “Instant payment, but the right controls behind the scenes,” Nwogodo says. It is one of his most measured statements, and it highlights how thin the line is between ambition and regulatory disaster.

ZuniQ

ZuniQ

The longer we speak, the clearer it becomes that ZuniQ is not trying to rebuild SWIFT. It is trying to bypass it.

The company is already processing millions monthly across Nigeria, Ghana, the US dollar and British pound corridors. The next phase is Asia. Not as a secondary hub, but as a peer. Direct Nigeria–Vietnam flows. Direct Kenya–Brazil. Direct Africa–UAE. All without touching the dollar.

“Not everything has to pass through USD,” Nwogodo says. For him, the future is a mesh of direct corridors linking emerging markets to each other. The big banks never prioritised this because the commercial incentives were weak. For ZuniQ, that gap is the business model.

On the quiet role of blockchain in cross-border payments, Nwogodo might not pass for a regular crypto evangelist, but he is pragmatic about where the industry is heading. He notes that stablecoins already power parts of ZuniQ’s settlement layers. Not as a marketing stunt, but as a practical way to gain speed, transparency, and traceability.

He points to JP Morgan Coin, Citi’s experiments, Stripe’s acquisition of Bridge, and SWIFT’s own blockchain pilots. The incumbents are not resisting the shift; they are preparing for it. ZuniQ is positioning itself in that same direction.

For him, blockchain is simply a more efficient ledger. “All the old wait time and lack of transparency will go away,” he says. Real-time, trackable settlement is the promised benefit, not the slogan.

ZuniQ

ZuniQ

Although ZuniQ is just under a year old, it moves millions monthly across multiple currencies. Yet the company keeps a low public profile. Nwogodo prefers to grow quietly rather than trumpet milestones.

The focus for the coming months: broader liquidity access, smarter automation, and smoothing the fragmented rails within Africa. New products are scheduled before year-end. New markets will follow, with licensing pursued where required.

He returns, one last time, to reaffirm his company’s core mission: “We are here to make cross-border payments simple, fast and fair for businesses that have been struggling in silence for too long.”

If ZuniQ succeeds, it will not be because it reinvented payments. It will be because it paid attention to the companies no one else bothered to build for.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

Star: In the future, 50% of global economic activity will run on the blockchain.