Why Is Crypto Up Today With Solana Back At $142 And XRP Above $2 – Are Analysts Right To Call Digitap ($TAP) The Best Crypto Presale 2026?

The crypto market gained ground on December 10th, coinciding with the Federal Reserve’s meeting. The odds of a Fed rate cut sharply rebounded in the prior weeks. A rate cut is generally viewed as supportive for risk-on assets, especially crypto.

Just hours before the meeting was scheduled to start, the CME FedWatch placed a 89.9% probability of a rate cut being announced. Altcoins that looked poised to retest lows bounced higher amid expectations of the upcoming catalyst. Solana looked poised to retest the $100 level just weeks ago, but it bounced back to $142. Similarly, Ripple’s XRP token solidly reclaimed the $2 level.

However, tokens such as Solana and XRP remain well below their all-time highs. It will take much more than a rate cut to recoup lost ground. By contrast, Digitap ($TAP), the maker of the world’s first “omni-bank,” has been named the best crypto presale project for 2026.

Digitap is a top altcoin to buy for next year, as it surpassed key funding milestones despite a major crypto selloff and has even earned a reputation as a safe haven while crypto prices fall.

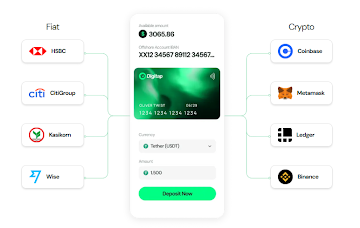

Source: Digitap

Digitap’s Live Bank App Attracts Investors Seeking Best Crypto To Buy

Digitap is a one-part fintech, one-part crypto startup aiming to bridge the gap between traditional banking and crypto finance. The project has already launched a global money and banking app that lets users send, receive, store, save, invest, and spend both fiat and crypto in one place.

Digitap’s platform also enables instant cross-border transfers and low-cost currency exchange capabilities. A recent partnership with Visa introduced the card brand’s network to power Digitap’s prepaid debit card.

Digitap users are offered a physical and virtual Visa card that is linked to their account. The card can even be loaded with crypto as the app automatically swaps between crypto and fiat at the time of purchase.

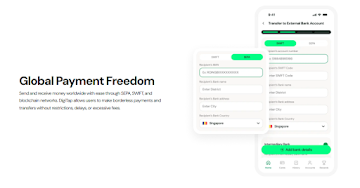

Source: Digitap

How Digitap’s Real Utility Helped Win Over Early Analysts

This real utility has helped Digitap build trust among early adopters and win over crypto analysts who declare Digitap a top crypto to buy for 2026. Indeed, Digitap has delivered on early development goals, including a live app and spending card during its presale phase.

Its focus on unifying crypto and fiat taps into a large global market. An optional no-KYC signup process even opens the door to the more than 1 billion underbanked and unbanked adults.

Many of these adults live in countries where access to ID is restricted or impossible. They finally have an option to join the global financial community and enjoy basic services that many people in Western countries take for granted.

Source: Digitap

3 Takeaways From $TAP’s 200% Presale Gain and Next Stage

Digitap’s presale of its native $TAP token kicked off in late summer. As part of a tiered offering, the price of $TAP slightly increases once each round concludes. $TAP was first for sale at $0.0125, and the price has gradually risen to $0.0361. The next round will see $TAP rise to $0.0371.

Early investors are sitting on a nearly 200% paper profit. What’s encouraging is that $TAP proved to be a solid altcoin to buy during the market selloff that started in October. In fact, analysts note that Digitap provided a refuge against falling crypto prices. Many note that a small allocation to Digitap would have hedged against losses elsewhere.

The Digitap team recently confirmed its token will graduate from presale to trade on major exchanges. Although a timeline has not been confirmed, the team announced an expected listing price of $0.14.

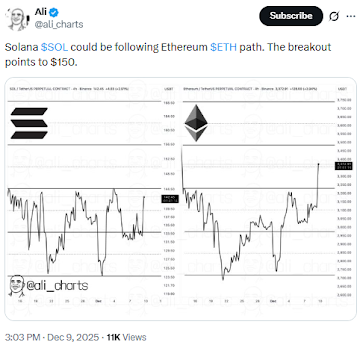

How Solana’s Break Above $140 Resets Key Price Levels

Solana traded at around $120 at the start of December, and technical analysis pointed to a possibility of retesting the $100 level. However, the overall crypto market sentiment rebounded ahead of the Fed decision. Solana is a major blue-chip token, meaning its near-term direction is mostly impacted by major macro events.

Solana’s on-chain key metrics remain encouraging. For example, total value locked in DeFi of $8.98 billion remains solidly above April’s low of $6.1 billion. Inflows to SOL ETFs have also remained positive over the past few days, implying equity investors consider SOL a solid crypto to buy.

A rally to $142 is encouraging, as $140 was seen as a former resistance level. By clearing this hurdle, SOL could have a clear path toward $150. The next major hurdle would be near the $175 level. If SOL manages to maintain its current momentum, a retest of the $200 level could be possible next year.

Source: @ali_charts

XRP’s Move Back Above $2 Could Shift Its 2025 Scorecard

XRP broke above the psychologically important $2 level. This is notable for the struggling XRP as it creates the possibility of the token ending 2025 in the positive. XRP traded as high as $2.34 on January 1st, and a continued move could erase a red yearly candle.

Granted, XRP traded as high as $3.65 after a very favorable court win against the U.S. Securities and Exchange Commission in July. Since then, it has fallen out of favor with investors. A series of major acquisitions saw Ripple spend $4 billion on M&A deals, and investors continue to question how these purchases will lift XRP higher.

Technically, XRP remains above a multi-month support zone near $1.94, so trading above $2 is a bullish sign. Investors may want to wait for further confirmation before adding XRP to their list of crypto to buy. XRP would need to gain ground above the next resistance level near $2.30–$2.50 before adding it to their portfolio.

Source: @bitgu_ru

XRP & SOL vs. $TAP: Which is the Best Crypto to Buy Now Before 2026?

Established coins like SOL and XRP are appreciating in value, but they have a lot of ground to catch up before trading at new highs. Digitap, on the other hand, is a startup project whose presale performance and unique value proposition have led some analysts to call it the best crypto presale altcoin to buy for next year.

Digitap’s presale status means investors have the opportunity to accumulate Digitap at its very early stages. All crypto projects start at the bottom, and investors shouldn’t equate a low price with a poor project. In fact, Solana’s early seed sales in 2018 saw the token offered at $0.04.

Digitap is in the very early stages of its lifecycle, and it has yet to even fully market its product. The project plans on using part of the proceeds from its raise to launch a global marketing campaign. While the growth seen so far is impressive, it could pale in comparison to the next chapter of Digitap’s evolution.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Why Is Crypto Up Today With Solana Back At $142 And XRP Above $2 – Are Analysts Right To Call Digitap ($TAP) The Best Crypto Presale 2026? appeared first on Live Bitcoin News.

You May Also Like

And the Big Day Has Arrived: The Anticipated News for XRP and Dogecoin Tomorrow

Luxembourg adds Bitcoin to its wealth fund, but what does that mean for Europe?