Aave DAO Governance Process Questioned After Disputed Proposal Submission

- Aave DAO governance proposal is still in contention despite moving to Snapshot voting.

- Aave founder Stani Kulechov defends the proposal, Snapshot voting, stating it follows all governance requirements.

Aave community members have raised questions about the legitimacy of the Aave DAO governance process. Their comments are in response to a disputed proposal announced by Aave founder Stani Kulechov.

Controversy About Aave DAO Proposal

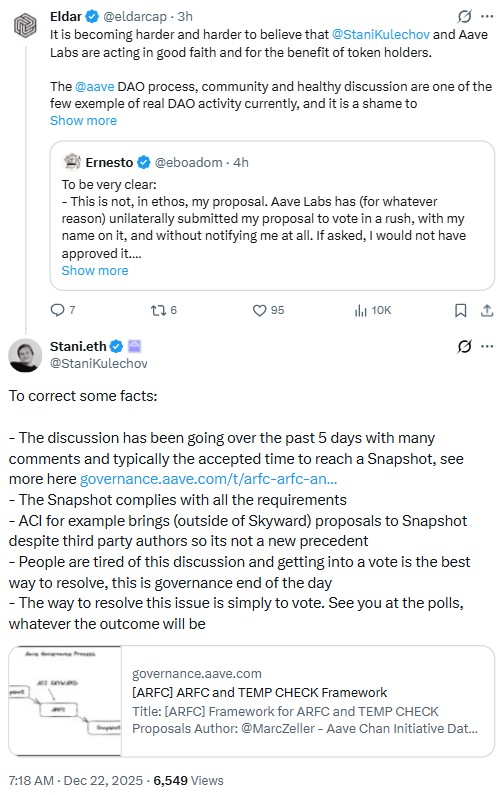

In an X post, community member Eldar stated that it is difficult to believe Kulechov and Aave Labs are acting in the best interest of token holders.

Eldar further noted that it is shameful to tarnish the DAO process. As Eldar noted, Aave practices true democracy as it fosters community discussions and voting.

Eldar has responded to the dispute that stemmed from ongoing tensions between the Aave DAO and Aave Labs.

Backtrackking, former Aave Labs CTO, Ernesto Boado, recently posted a governance proposal titled “AAVE token alignment. Phase 1 – Ownership.”

In his proposal, Ernesto calls for transferring control of Aave’s core brand assets from Aave Labs to a DAO-controlled vehicle. Note that the Aave core brand assets include domains, social media accounts, and naming rights.

The goal is to prevent private entities from monetizing the brand without Decentralized Autonomous Organization (DAO) input. The proposal also aims to bring clarity on what AAVE token holders actually own.

On December 22, Kulechov announced on X that the proposal had been moved to a Snapshot vote after extensive discussion.

Aave DAO Governance Debate | Source: Stani Kulechov on X

Aave DAO Governance Debate | Source: Stani Kulechov on X

Ernesto immediately responded with the comments. He clarified that he did not authorize or intend for the proposal to be rushed to a vote. According to Ernesto, Aave Labs bypassed ongoing healthy community discussion and violated trust codes in public governance.

Aave Founder Defends Snapshot Voting

Aave’s Kulechov has responded to the claims from Ernesto. He said the community has been discussing the matter over the past 5 days. According to him, this is the time needed for the community to move forward with any given proposal.

Kulechov asserts that submitting the proposal to Snapshot follows all governance requirements. He cited an example that the Aave Chan Initiative (ACI) submits proposals to Snapshot despite third-party authors.

The Aave founder further argued that people are tired of the prolonged debate. He, therefore, sees the Snapshot vote as the best way to resolve the delay. Whatever the outcome, Kuchelov believes voting will settle the issue democratically.

His comments align with his broader plans and strategy for the Aave ecosystem. In a recent study we reported on, Kuchelov revealed Aave would prioritize Horizon, Aave V4, and Aave App in 2026.

He also disclosed that Aave V4 launched the Hub-and-Spoke liquidity model to boost DeFi growth, as we discussed earlier. Furthermore, Aave collaborated with ByBit and Mantle to enhance the accessibility of Decentralized Finance (DeFi).

Aave remains the largest decentralized finance lender, with annualized revenue of around $112 million. However, its native token, AAVE, declined nearly 10.9% in the last 24 hours.

]]>You May Also Like

Quick Tips for Passing Your MyCPR NOW Final Exam

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!